Updated: July 4, 2024

Published: April 19, 2024

How do businesses process online payments? Why would they like to start the development of custom payment gateways? How do they benefit from implementing their own solutions? Read the post on building a payment gateway and its efficiency for your business.

List of the content

- What is a payment gateway?

- How do payment gateways work?

- What is a payment processor?

- How do payment gateways and payment processors function?

- How to create a payment gateway?

- Custom gateway advantages and disadvantages

- Build a payment gateway: alternative options

- Conclusion

WHAT IS A PAYMENT GATEWAY?

Online payments have surged in popularity due to their transformative impact on commerce and financial transactions. The key factor is the convenience they offer. Customers can shop and pay for goods or services from anywhere, anytime, using their smartphones, tablets, or computers. This convenience also extends to businesses, enabling them to accept payments without the need for physical infrastructure or in-person transactions.

This seamless integration of financial activities into everyday life has made online payments indispensable for millions worldwide. Based on recent research, the worldwide payment processing market is projected to grow to $234k million by 2032.

But have you thought about what happens under the hood when users can make payments within just a few seconds? What tech solutions do businesses leverage to process fast and secure payments? Let’s learn about payment gateways and how they enable efficient payment processing.

What is a payment gateway?

That is a technology utilized by businesses to process card and digital wallet payments from customers. This term encompasses both the physical card readers in brick-and-mortar stores and the online equivalents that handle payments for eCommerce, in-app purchases, and other card-not-present transactions.

Payment gateways play an essential role in enabling online transactions by providing a secure way to process payments. They facilitate communication between different transaction components, transmitting information from a business’s app to the payment processor to confirm and settle the payment.

This tech solution helps protect sensitive financial information, like credit card details, by encrypting data to prevent unauthorized access. Payment gateways also help streamline the checkout process, making it easier and faster for customers to make purchases online.

In addition to processing payments, payment gateways often offer other features, such as recurring billing for subscription services, support for multiple currencies and new payment methods, and fraud detection tools to identify and prevent fraudulent transactions. Payment gateways are commonly integrated into mobile and web applications like eCommerce platforms, making them a vital component of online businesses.

HOW DO PAYMENT GATEWAYS WORK?

In the light of discussing how to make a payment gateway, it is vital to understand its functionality and use purposes. Besides, everything starts with discovering all the essential details of the payment processing workflow. The transaction’s success relies on the smooth interaction between customers, merchants, banks, and other service providers.

Gateways, along with payment processors, serve as intermediaries between merchants and customers, ensuring that all transactions are conducted properly and securely. Let’s start by explaining how a payment gateway works and its specifications.

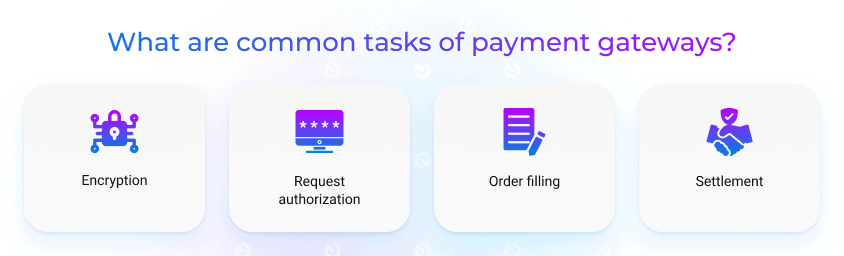

From the moment the customer submits an order to when the merchant receives the payment, a chain of required operations is handled under the hood. In order to complete the transaction, the gateways exercise responsibility to address the following tasks:

Encryption

A payment gateway handles encryption by using secure protocols to protect customers’ sensitive information, such as credit card numbers, during transmission. This involves encrypting the data on the customer’s device before it is sent to the gateway server, where it is decrypted for processing. The gateway then uses encryption to protect the transaction response before sending it back to the customer. The process helps to ensure the security and integrity of online transactions.

Request authorization

They also authorize requests by securely communicating with the issuing bank to verify the payment details and assure that the customer has sufficient funds or credit available for the transaction. This process typically involves sending encrypted information back and forth between the gateway, the merchant, and the bank to authenticate the transaction. Once the authorization is confirmed, it’s time to process the transaction, deduct any fees, and transfer the funds to the merchant’s account.

Order filling

As long as a transaction is confirmed, the funds can be transferred to the merchant’s account. The process ensures that payments are processed quickly, securely, and accurately, allowing merchants to fulfill orders and customers to receive their purchases promptly. Some payment gateways offer integrations or APIs that enable merchants to automate parts of the fulfillment process, such as updating order status or sending tracking information to customers.

Settlement

Besides, gateways reconcile the transactions to ensure that the correct funds were transferred and that there are no discrepancies. This reconciliation process helps maintain the integrity of the secure payment system and ensures that both customers and merchants can trust the gateway to handle their transactions securely.

The main thing to remember when building a custom payment gateway project is that your team needs to create a facilitating intermediate to ensure smooth, secure, and quick online transactions. It is related to providing a safe pathway between customers, merchants, and the payment processor.

WHAT IS A PAYMENT PROCESSOR?

Since the payment gateway always works in tandem with the payment processor, we’ll need to discover more about this component. First, these are not interchangeable terms, and they are responsible for different aspects of the payment processing workflow. Some may confuse these components as they are offered by the same providers. For example, such representatives as PayPal and Stripe provide these services, including payment gateway integration.

What are payment processors?

These are services that enable electronic transactions between customers and merchants by processing and approving credit/debit cards or some other digital payment methods. They serve as a go-between for the customer’s bank and the merchant’s bank, ensuring the secure transferring of funds from one account to another.

A payment processor simplifies the payment process, improves security, and streamlines financial transactions for merchants and customers alike, making it an essential element of today’s digital economy. Various processors may provide different features, accept multiple payment methods, and serve numerous regions, meeting the varied requirements of businesses and consumers.

In light of discussing how to build a payment gateway, it becomes clear that both components play crucial roles in the electronic payment ecosystem. Though, the functions of payment processors and payment gateways differ. Let’s discover these key distinctions.

Role in processing transactions

- Payment gateways act as intermediaries responsible for streamlining communication and securely transmitting payment data among the customer, the merchant, and the payment processor.

- Payment processors oversee the transaction process by managing and authorizing payments while also guaranteeing the secure fund transfer between the customer’s bank and the merchant’s bank.

Range of services

- Payment gateways primarily concentrate on the secure transition of sensitive payment data.

- Payment processors offer an additional range of services, including chargeback management, compliance with payment regulations, fraud detection, and more.

Integration

- Payment gateways provide businesses with simplified integration options, such as APIs, prebuilt modules, and plugins, to enable them to begin accepting payments.

- Payment processors embrace more complex setup procedures as businesses have to acquire a status of payment service providers to process transactions or find a third-party service provider to process and authorize transactions on their behalf.

Payment processors provide broader services for handling entire transaction processing. They manage the transaction from the moment customers submit their payment information until the funds are deposited into the merchant’s account. They communicate with both the issuing bank and the acquiring bank to authorize and settle transactions.

Besides, payment processors are commonly considered essential partners for businesses looking to operate smoothly in today’s digital economy. They help manage chargebacks and refunds, providing support to both merchants and customers throughout the payment process. Some payment processors offer such additional services as recurring billing and subscription management to support businesses in their operations. Additionally, they can integrate with other business systems, such as accounting software, to streamline financial processes and improve overall efficiency.

HOW DO PAYMENT GATEWAYS AND PAYMENT PROCESSORS FUNCTION TOGETHER?

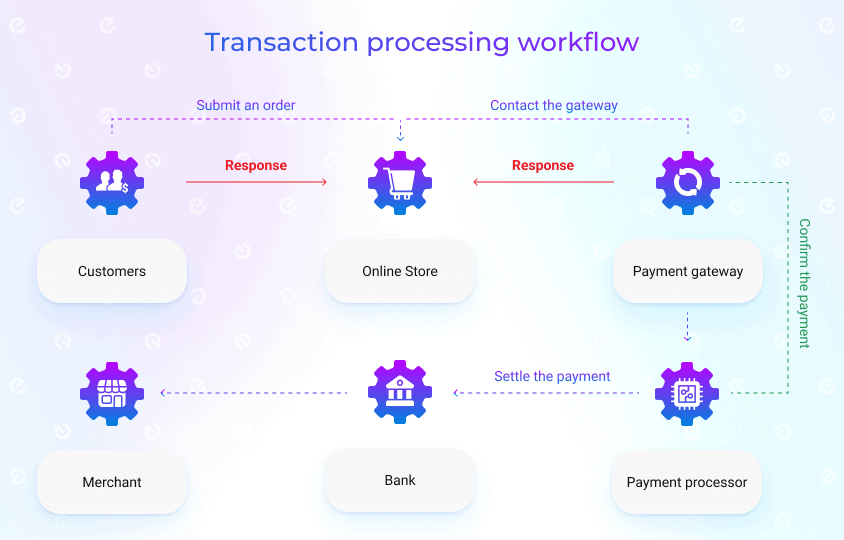

So, figuring out how to create a payment gateway requires understanding how these components work together to be complete. The key point is that businesses need both to conduct online transactions. They become essential elements that collaborate to facilitate secure online payments effectively.

The payment gateway, acting as the entry and exit point for transactions, plays a pivotal role in the security and control of online payments. It’s where customers input their credit card information, which is then forwarded to the payment processor for validation. This process ensures that the transaction data exchange between customers and merchants’ banks is managed securely and efficiently.

It’s important to recognize that each online transaction relies on both a payment gateway and a payment processor. These components are interlinked and collaborate to guarantee the seamless processing of payments. They perform distinct yet interrelated functions, enabling secure and efficient electronic transactions for businesses and customers. Their combined efforts form the backbone of electronic transactions, fostering trust and convenience in the digital economy.

Let’s take a look at the collaborative process between these two components during an online transaction.

- The transaction is initiated by the customers

As clients are prepared to purchase, they input details of credit cards or some other payment methods into the company’s application or website.

- The role of the payment gateway

It has to encrypt the customers’ payment information securely before transmitting it to the payment processor.

- The role of the payment processor

It takes responsibility for sending the received encrypted payment information to the issuing bank for transaction authorization.

- The response of the issuing bank

It approves or rejects transactions through the evaluation of payment details and available funds and then sends its response to the payment processor.

- The processor connects the gateway

It communicates the issuing bank’s response to the payment gateway.

- The gateway connects the business

In its turn, the payment gateway forwards this response to the company’s application or website to inform customers about the transaction status (declined or approved).

- The funds’ settlement

After the approved transaction, the payment processor manages the funds transfer from the customer’s bank account to the merchant’s bank account.

As a result, the efficiency of the transaction greatly depends on both of these components.

Smooth communication and interaction between payment gateways and processors can reduce transaction times and ensure a fast payment processing system.

Businesses can choose among a wide variety of third-party service providers or create their own custom payment gateways. This allows for greater flexibility and customization in payment processing.

Teams can tailor their solutions to specific needs, integrate seamlessly with existing systems, and ensure that they meet security standards. Additionally, having your own gateway can reduce costs compared to using third-party services, especially as your transaction volume grows.

So, let’s proceed with additional details on making a payment gateway and making it an efficient tool for handling payment transactions.

HOW TO BUILD A PAYMENT GATEWAY?

It’s common practice that custom software development provides better perspectives on introducing solutions tailored to business-specific needs. Therefore, businesses often look for flexibility in creating a payment gateway themselves. It can provide better transaction processing, faster troubleshooting and support, and enhance the overall user experience by tailoring the payment process to their specific requirements. The custom payment gateway development process covers the following stages:

Research and planning

Everything starts from the precisely outlined business needs. The primary task of all the involved parties is to establish the project goals and impose essential requirements. It can be related to such aspects as the project capacity, applied technologies, security solutions, compliance, and development expertise of your chosen team. The important point is that all these details should be appropriately documented and agreed upon by the involved parties.

Architecture design

Once the team carefully considers interaction flows, project scalability, and time to market, the subsequent step involves detailing your payment gateway. That entails establishing a solid system for the payment gateway’s infrastructure. It is vital to introduce a resilient and scalable architecture for the payment gateway solution that aligns with the anticipated transaction volume. The clearly defined interactions among various components help to ensure smooth and secure data flow.

Building relationships with financial institutions

Dealing with digital payment transactions requires not only software development but also establishing partnerships with financial institutions like payment processor providers, banks, etc. This process entails engaging in lengthy negotiations and navigating complex contractual agreements. Also, it requires adhering to stringent industry regulations and compliance standards to guarantee seamless transactions. The team is commonly provided with API documentation of payment processors and acquirers to follow the implementation guidelines. Besides, they will need to create an external API to transfer client payment information.

Compliance and security

It’s crucial to remember that payment gateway development assumes responsibility for handling data due to the latest requirements. The team has an obligation to obtain the required licenses and certifications, including PCI DSS compliance, to lawfully and securely manage payment data. They incorporate all of the necessary security measures to follow the latest updates and reduce the risks of data breaches.

Software development

The next step embraces the software development process itself. The skilled payment gateway developers focus on creating the core functionalities, which include payment processing, error management, transaction authorization, and compatibility with diverse payment modes like credit cards, bank transfers, and digital wallets. The payment gateway landscape is incredibly diverse and ever-changing, so your team always needs to look for new features and payment methods to integrate.

Testing

The payment gateway development goes in parallel with rigorous testing to detect and resolve bugs, security vulnerabilities, or performance bottlenecks. It includes running comprehensive unit tests, integration tests, and security tests. The team has to enhance the overall reliability, security, and performance of your software to ensure a seamless user experience.

Deployment and maintenance

Once your payment gateway is finalized and tested, it’s time to deploy it in a production environment. That involves integrating real-time monitoring and error-tracking tools to promptly identify and resolve rising issues. The team also has to develop a plan for continuous maintenance, support, and updates.

Developing your own payment gateway is neither simple nor straightforward. It involves intricate processes like acquiring proper licenses, ensuring regulation compliance, integrating various financial systems, and implementing stringent security measures. The development also demands meticulous planning, expertise, and resources. However, the potential advantages, including greater control, customization, and lower transaction fees, can make the effort worthwhile for businesses seeking to enhance their payment processing capabilities.

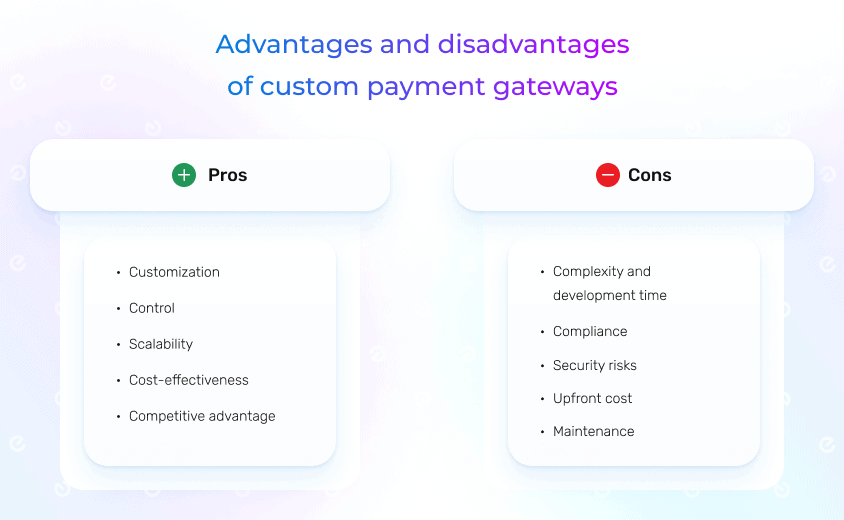

ADVANTAGES AND DISADVANTAGES OF CREATING A CUSTOM PAYMENT GATEWAY

Every business realizes the importance of carefully planned solutions when answering the question of “how to make my own payment gateway?” As long as the team knows its goals and requirements, it’ll be easy to introduce custom gateway solutions and deal with rising challenges. Let’s discuss the common advantages and disadvantages of getting custom payment getaways and how to use them for your business’s benefit.

Custom payment gateway advantages

Customization

The first and most obvious advantage is related to the business opportunities to tailor the payment gateway to fit specific needs, including functionality, user interface, branding, etc.

Control

This benefit embraces additional control over the payment process, allowing the team to optimize for speed, security, and user experience.

Scalability

The own payment solution is designed to scale with your business, accommodating increased transaction volumes and new functionalities as your business grows.

Cost-effectiveness

Even though it requires upfront investment, it is often more cost-effective in the long run than using third-party solutions that charge transaction fees.

Competitive advantage

The custom gateway can differentiate your business from competitors by offering unique features or an exceptional user experience. Besides, you can always generate extra revenue by offering your payment gateway services to other companies.

Custom payment gateway disadvantages

Complexity and development time

Payment gateway implementation has always been more complex and time-consuming than choosing out-of-the-box solutions. It necessitates a deep understanding and expertise in software development, payment processing, security, and other related fields.

Compliance

Payment processing is subject to strict regulations and standards, such as PCI DSS. It’s a continuous effort that demands resources to ensure compliance with the latest regulations.

Security risks

Creating a custom payment gateway requires strict security measures to protect sensitive payment information. If not handled correctly, it could lead to data breaches and legal issues.

Upfront cost

Custom software development saves money in the long run, although initial development costs can be high. Additionally, ongoing maintenance and updates will incur some expenses.

Maintenance

Custom gateways require ongoing maintenance, updates, and support. That can be resource-intensive and may require dedicated staff or external service providers.

Сustom payment gateways provide businesses with a competitive edge and enhance customer experience. They can use this opportunity to tailor the payment process to align with their unique requirements and branding, leading to increased customer satisfaction and loyalty. While creating a custom payment gateway can offer advantages, businesses should carefully weigh the disadvantages and consider whether the benefits outweigh the challenges.

In today’s digital economy, where online transactions are increasingly common, a custom solution can set businesses apart from competitors. They also demonstrate a commitment to innovation and user satisfaction, helping to build credibility and trust with clients. Custom gateways often become a valuable investment for teams looking to optimize payment processes and drive business success.

BUILDING A PAYMENT GATEWAY: ALTERNATIVE OPTIONS

Proceeding with the topic of payment gateway developing, we can’t leave out details on an alternative to choosing an existing solution. Why would some companies prefer implementing a payment gateway from scratch rather than using ready-to-use products?

It’s well-known that the market is full of a wide range of off-the-shelf products and services from third-party providers. Many businesses find it convenient to integrate an existing payment gateway. This option offers a faster and more straightforward process than traditional full-cycle development. The team is equipped with well-documented APIs and SDKs, enabling them to accept digital payments within their application or website seamlessly. Additionally, the chosen service provider is responsible for security and compliance, ensuring adherence to all necessary regulations.

Of course, ready-to-use gateways typically offer such features as support for multiple payment methods, recurring billing, fraud detection, and other functionalities. They are often chosen for their convenience, extensive feature sets, and the ability to quickly integrate them into existing systems.

How to add payment gateways to mobile applications?

Find the detailed guide on integrating ready-to-use solutions to your mobile products.

However, there are some other essential aspects to draw attention to. The company has to carry out a detailed analysis of its business-specific needs and take into consideration such factors as budget, timeline, required features, and scalability. They need to choose the solution that suits their requirements and offers the necessary set of features. Good practice also involves checking the selected service providers’ rates and fees so they can be included within the company’s budget. It’s often no exception that a custom payment getaway can become a more reasonable solution to balance the budget and save in the long run. As an example, we suggest checking some of the fees of such known providers as PayPal and Stripe.

| Stripe | PayPal | Own payment gateway | |

| Monthly fee | no | $30.00 Payments Pro | no |

| Standard credit and debit card payments | 2.90% + $0.30 | 2.99% + fixed fee | no |

| International commercial transactions | +1.50% | +1.50% | no |

| Setup fee | no | no | no |

| Chargeback protection | 0.40% per transaction | 0.40% per transaction | no |

| Instant payouts | 1% of instant payout volume *1.5% effective June 1, 2024 | 2% of the total transaction amount | no |

The decision between custom and off-the-shelf solutions should be based on a thorough evaluation, including the company’s potential for growth, available resources, and the specific requirements of its industry. Additional factors include cost-effectiveness and the ability to meet evolving business demands over time.

Many companies favor the flexibility of integrating ready-to-use payment gateway solutions. However, there are types of organizations with specific requirements or unique business models that cannot be accommodated by off-the-shelf products or services. So, what businesses look for a custom payment gateway?

Large enterprises

Companies with complex payment processing needs require custom solutions to handle high transaction volumes, multiple currencies, and intricate payment workflows. A tailored payment system can simplify internal transfers, manage various currencies, integrate with other business software, and ensure compliance with different regional financial laws.

eCommerce companies and marketplaces

As they facilitate transactions between multiple parties like buyers, sellers, and service providers, they need to manage complex payment flows, split payments, and handle disputes. A bespoke payment system guarantees a seamless checkout process, provides various payment choices, seamlessly integrates with inventory and supply chain systems, and has the potential to lower transaction costs.

Subscription-based services

Companies offering subscription-based products or services need the advanced solution to manage recurring payments, billing cycles, and subscription changes efficiently. A bespoke gateway can automate recurring digital payments, manage international transactions, and seamlessly integrate with project management tools.

Fintech companies

It’s obvious that organizations operating in this industry possess complex and often distinct transactional requirements. The adoption of tailored products is a common practice as they allow them to simplify internal financial operations, provide cutting-edge services to customers, integrate seamlessly with other banking systems, and comply with stringent financial regulations and security protocols.

In a fast-paced business environment, teams need to be agile and adaptable in making the right decisions based on their needs. The off-the-shelf solution is quicker to implement and often meets immediate needs. On the other hand, the company’s own payment gateway helps to meet business-specific needs and differentiate brands in the market.

CONCLUSION

It’s a good practice to introduce own payment gateway to provide your users with a seamless and secure online payment experience. Businesses have the opportunity to customize the payment gateway process to align with outlined needs and user experience goals.

A custom payment gateway can be integrated into the business’s existing systems, like mobile apps, a website, or other solutions, providing a seamless payment experience for customers.

In addition to providing a secure and customized payment experience, it also helps businesses reduce costs in the long run. While there are third-party payment gateways available, having a custom solution can be more cost-effective, especially for businesses with high transaction volumes.

Looking for a professional team to help you create your own payment gateway?

Existek is a professional software development company with a proven track record of addressing innovative projects. We are committed to exceeding your expectations and introducing successful market solutions.

Frequently asked questions

Can a business build its own payment gateway from scratch?

Yes, a business can create a payment gateway on its own, though it requires a deep understanding of payment processing, software development, and security best practices.

How much does it cost to create a payment gateway?

Like any other software development, the cost greatly depends on the applied technologies, implemented payment gateway functionality, development approaches, team composition, etc. The average payment gateway development cost with core features could start from $200k.

How hard is it to build a payment gateway?

Creating a payment gateway is commonly considered to be challenging. Due to the complexity of regulatory requirements, expertise in compliant payment processing is required in addition to software development.

Why do businesses need their payment gateway?

Businesses choose to implement their payment gateways to process online transactions securely, provide a customized payment experience, integrate with their existing systems, reinforce their brand identity, and potentially reduce costs compared to third-party gateways.