Updated: May 10, 2024

Published: August 10, 2020

You won’t be surprised that 60.9 percent of the U.S. population is mobile buyers, especially if you’ll take into account how people are tightly engaged with activities on mobile phones and tablets. Everyone has quickly settled into the routine of acquiring services and products online. Fast and secure payment checkout is a must to achieve your customer satisfaction and build a long-lasting connection with them. It’s high time every business thought about how to add a payment gateway for mobile apps and provide the exceptional user experience with completing transactions. Mobile app payment gateway integration can become one of the easiest solutions to make, receive, and process payments within PCI compliance. Addressing the frequently asked questions, we’ll give responses on what is a payment gateway, how to add a payment gateway in an app to meet requirements for iOS and Android.

List of the Content

- What is a payment gateway for mobile apps

- Mobile payment gateways: main features and advantages

- How does a payment gateway work

- How to add a payment gateway for mobile apps

- How to integrate a payment gateway for an iOS app

- How to add payment gateways in an Android app

- Mobile payment gateway for a hybrid app

- How to choose a payment gateway for mobile apps?

- Conclusion

WHAT IS A PAYMENT GATEWAY FOR MOBILE APPS?

So-called payment gateways are services provided by the third party companies that are authorized by the banking system to store and process the electronic payment data as well as actually perform the transaction. Those companies, like PayPal and Stripe, offer their services to various merchants to be integrated with their shops or services and process the payments on their behalf for a fee or percent of each transaction.

Online payments take only a few seconds for end users, whereas the process goes through the complex sequence of operations and follows a number of regulations. It is important to understand that not everyone is allowed to carry the finances as well as gather the billing information.

What is a payment gateway?

It is the authorized service that uses its own infrastructure to perform electronic transactions on behalf of various vendors.

Therefore, the closest comparison is the terminals applied for payment authorization. Mobile payment gateways accept full responsibility for sending data to the financial institutions, tracking the transaction status, and ensuring safety for both customers and merchants. Clients provide billing information to the online payment system instead of individual businesses whereas merchants don’t worry about storing and processing credit card data. All the data is contained and handled by a reliable system that covers the needs of each involved party.

Ready-made gateways are considered the best options so far. It is worth noting that they are quite simple for integrating into the mobile application. As a rule, they offer free and open-source Software Development Kits (SDKs) while giving clear guidance, code samples, and all the necessary development tools. Following simple instructions, developers find out how to add a specific payment gateway as a part of the app in a few steps commonly just by inserting several lines of code. It allows the development team to meet both client-side and server-side specifications. Those manuals are given separately for the chosen operating system (Android or iOS) as well as the applied development approach (native or hybrid). Let’s address this part in detail in the following paragraphs of this article.

The great thing is that businesses are offered a variety of services and can choose the right provider to meet needs to the fullest. Such well-known providers as PayPal, Stripe, Braintree have been on the market for more than a decade and have become de facto industry standards.

PayPal is a leading provider that has more than 240 million active users in 200 countries. In order to begin accepting payments, you need to start with a free sign up for PayPal account and then just add a purchasing button with a piece of code. The sales can be completed between multiple currencies like USD, EUR, GBR, and most payments are available within minutes of making a sale.

Stripe is an often choice for eCommerce businesses. It supports purchase processing in more than 135 currencies. Remaining developer-focused, they provide full access to SDKs, APIs, and code samples in numerous languages. Moreover, Stripe integrates social media payments and supports recurring billing, Android Pay, Apple Pay, Bitcoin, etc.

Braintree is a popular provider of digital financial solutions. It was bought in 2013 and became a subdivision of Paypal. Its services are delivered in more than 40 different countries around the world. They are commonly chosen for quick, secure, and easy transaction processing. The interesting fact is that now Braintree and Paypal are both integrated into mobile apps applying the Braintree SDKs. We’ll touch on this subject in the next paragraphs as well as provide a detailed guide on how to add a payment gateway for mobile apps.

PAYMENT GATEWAY FOR MOBILE APPS: MAIN FEATURES AND ADVANTAGES

According to the statistics, Google Play has offered 3.55 million apps for Android users whereas Apple Store presented 1.6 million apps for iOS devices in the third quarter of 2022. Besides selling goods and services they can apply additional ways for monetization like charges for the use of the mobile app, premium features, paid advertisement, in-app purchases, etc. On a case-by-case basis, every company still has to come up with good solutions to accept payments in the app as well as figure out how to add a payment gateway in an app. You need to focus on not only practical but simple and speedy results. Considering major reasons why and how to add a payment gateway for mobile apps, we’d like to mention the following aspects.

- Risk control – In addition to secure transaction delivery and compliant data protection, it is a great solution for fraud management. It simplifies reconciliation of accounts and protects merchants from expired credit/debit cards, closed bank accounts, insufficient funds, exceeding card limits.

- Convenience for the clients – Mobile payment gateway integration helps to make the buying process easier and more adaptive to the needs of the users. For example, the option of recurring billing allows customers to authorize merchants to deduct charges on a regularly scheduled basis. It lets the purchase happen automatically which is rather convenient for both receiving and providing the agreed-upon services and goods.

- Faster transactions – Automated process management will make transactions not only convenient but quicker. With PCI compliance for payment gateway, returning clients are able to save the credit card details so that there is no need to fill in the data each time they make a purchase. All they need to do is to confirm the transaction with a few clicks.

- Business expansion – Choosing the right gateway ensures completing international transactions. It helps to accept payments around the globe as well as deal with currency conversions, local regulations, supplementary cross-border fees, and foreign exchange charges.

- Savings – There is a possibility to reduce costs since operating expenses are covered by service providers. Moreover, the company can save time and resources. As they don’t look for their own development solutions but consider how to add a payment gateway for mobile apps.

- Variety of additional tools – Service providers often offer personal dashboards with the visualization of income, income sources, taxation, gains overtime period, etc, which help small businesses start getting structured financial data at the very start. Also, gateways usually include built-in analytics tools that have been extremely helpful in optimizing purchasing processes. For instance, reports on handled transactions or customer interaction give a single view of your business performance and encourage the necessary improvements.

HOW DOES A PAYMENT GATEWAY WORK?

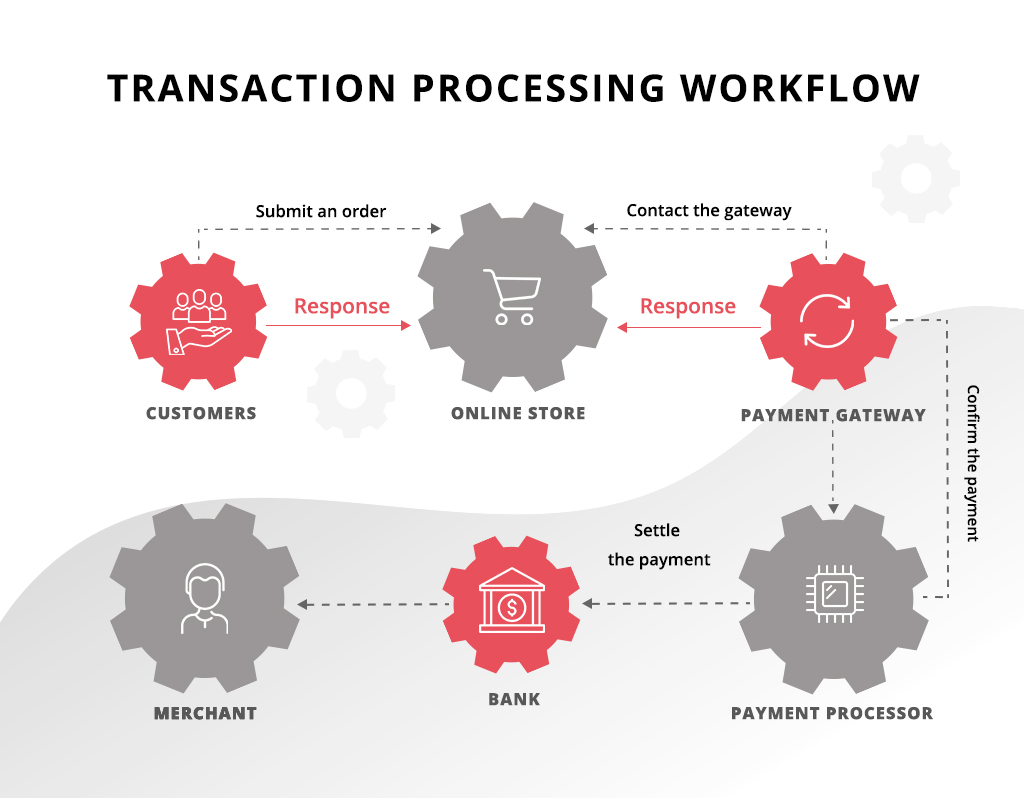

Before we proceed to the question of “how to add a payment gateway for a mobile app”, it is important to understand the transaction process itself and how it is carried out between the involved parties. Several essential steps take place during the purchasing process whereas it lasts only for a few seconds. The transaction success depends on how well the interaction between customers, merchants, banks, and service providers is maintained. The gateways are responsible for establishing the connection and completing the outlined process steps.

- The customer places an order by clicking the “Buy” button and inputs the required data.

- Encrypted transaction data is sent to the payment gateway.

- The gateway forwards information to the payment processor used by the merchant’s acquiring bank.

- The payment processor sends data to the card association where the operation can be approved or declined.

- After request verification, the payment processor sends a response to the gateway.

- Finally, the gateways forward it to the merchant that will fulfill the order as the financial operation is being completed.

Integrating a payment gateway for an Android app or an iOS app ensures that businesses are able to accept payments simply and quickly. However, there are several aspects to emphasize like payment gateway compliance and cost. They often become the determining factors while figuring out how to implement a payment gateway for mobile apps as well as choosing the right service provider.

Payment gateway compliance

Any business that carries out financial transactions is obliged to PCI DSS (Payment Card Industry Data Security Standard). These security regulations focus on the protection of credit card data and maintenance of the secure environment while accepting, processing, storing, and transmitting such data. Following the mobile payment acceptance guidelines, developers can apply the best practices thus allow merchants to accept and process payments within their mobile application. Payment gateway compliance requires that no account data can be accepted whether customers enter the data into a device or when it is processed and stored. Both merchants and service providers are in charge of:

- Building and maintaining a secure network

- Cardholder data protection

- Ensuring strong access control

- Vulnerability management

- Regular testing of security systems

- Development of information security policies

Therefore, it is essential to choose a reliable provider that is capable of meeting your needs as well as standard security requirements. Merchants are regularly assessed how compliant their infrastructures are to the current standards. Thus, the service providers have to be committed to protecting not only the customers but also merchants. Besides high risks, PCI non-compliance results in penalties. The fines are set starting from $5 000 and reaching up to $200 000. They usually vary depending on a number of clients, transaction volume, times of violation, etc.

Payment gateway integration cost

Making the correct estimate for payment gateway integration cost is another essential step. It is obvious that you should cover the salary of developers who work on integration as well as be aware of service fees charged by the chosen provider. The developers’ price might differ depending on the project complexity, included features, applied technologies, etc. It is worth mentioning that payment gateway integration cost charged by developers remains only a part of the project budget. Commonly, service providers don’t charge any fees for settling accounts or getting access to necessary SDKs. Most of them offer open-source libraries and tools to complete mobile app payment gateway integration since their main source of income is the transaction fees. So what are the additional expenses you need to cover?

Payment processing companies usually make revenues by adding the standard commission for financial operations. As a rule, they charge a few percent of every transaction amount. For example, PayPay establishes the standard fee of 3.4% of the operation, whereas Stripe and Braintree charge 2.9%. Besides this, merchants are charged supplementary 30 cents for each financial operation. The good thing is that companies can often negotiate plans based on incomes, offered discounts, and lower commissions for loyal customers.

HOW TO ADD A PAYMENT GATEWAY FOR MOBILE APPS?

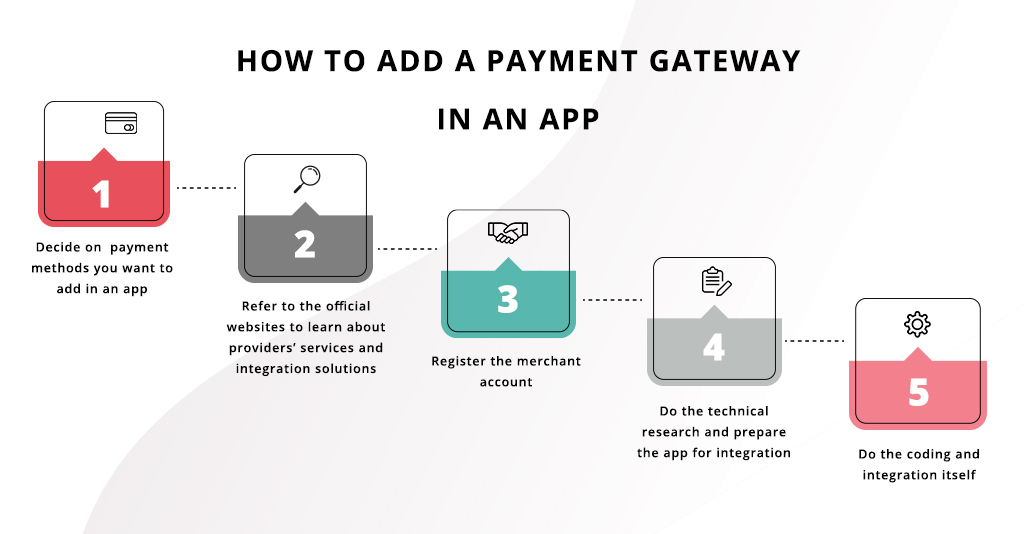

The best way to answer the question of how to add a mobile app payment gateway is focusing on both technical and business needs. Whereas the professional development team takes the technical part, you’ll be responsible for addressing business aspects. With mobile payment gateway integration, there are a number of steps before developers start integrating payment gateway in the Android app or/and the iOS app. Careful planning and detailed research outlines the business strategy and helps come up with suitable development solutions.

- Decide on purchasing methods you would like to offer for your clients. Besides accepting credit cards, you’ll definitely consider Google Pay for Android apps and Apple Pay for iOS applications. Moreover, you can diversify the clients’ choice by such options as PayPal, Samsung Pay, Venmo, Weepay, local purchasing methods, etc. The main goal relies on providing an excellent in-app purchasing experience as well as giving your customer a great purchasing choice.

- Find out how to add a payment gateway in an app by referring to the official websites of different service providers. For example, you can visit paypal.com or braintreepayments.com. Learn in detail about offered services, previous experience, clients’ feedback. Make sure to draw a comparison between the chosen companies. The pros and cons of partnering with the particular provider have to cover the variety of purchasing methods, maintained security regulations, service plans, the availability of developers’ documentation, the number of implemented projects, etc.

- Get your developers acquainted with provided SDKs to make sure it is suitable for the tech needs of the project. Development requirements differ not only by platform specifications but also by applied frameworks. Following the detailed guidance from developer.paypal.com or developers.braintreepayments.com, the team can handle the mobile payment gateway integration in several steps. There they will find the code samples, clear guidance, and comprehensive libraries to implement both client-side and server-side within payment gateway compliance.

- Get in touch with the chosen provider, discuss the possible partnership, feel free to ask as many questions as you are interested in. It is always a good idea to set a team of business analysts and developers that would be involved in the process and help with the final choice.

- Finally, the execution of the legal part is the most important step that precedes the development stage. The companies have to draw a comprehensive agreement covering overall conditions, agreed plans, fees, term durations, etc. If required the service provider will help to set your merchant accounts and explain the necessary details.

Completing the mentioned above steps allows the development team to start the payment gateway integration process itself. We suggest taking the example of Braintree SDK and checking in detail how to use the payment gateway for mobile apps in Android, iOS, and hybrid development.

Have additional questions on app payment gateways?

Get professional consultation with our team. Existek has a decade-long experience in mobile app development and knows how to advance your solutions to increase users’ engagement and satisfaction.

HOW TO INTEGRATE A PAYMENT GATEWAY IN AN IOS APP?

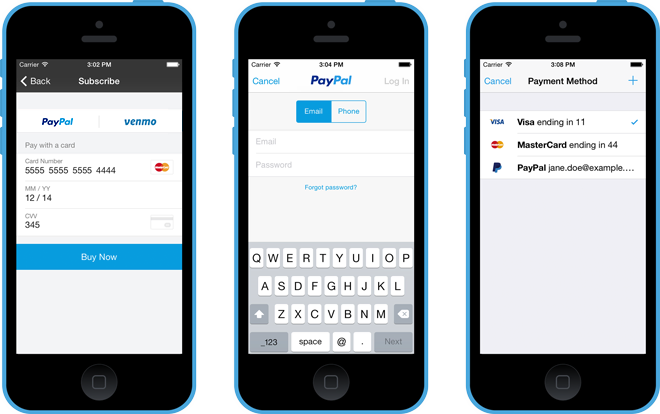

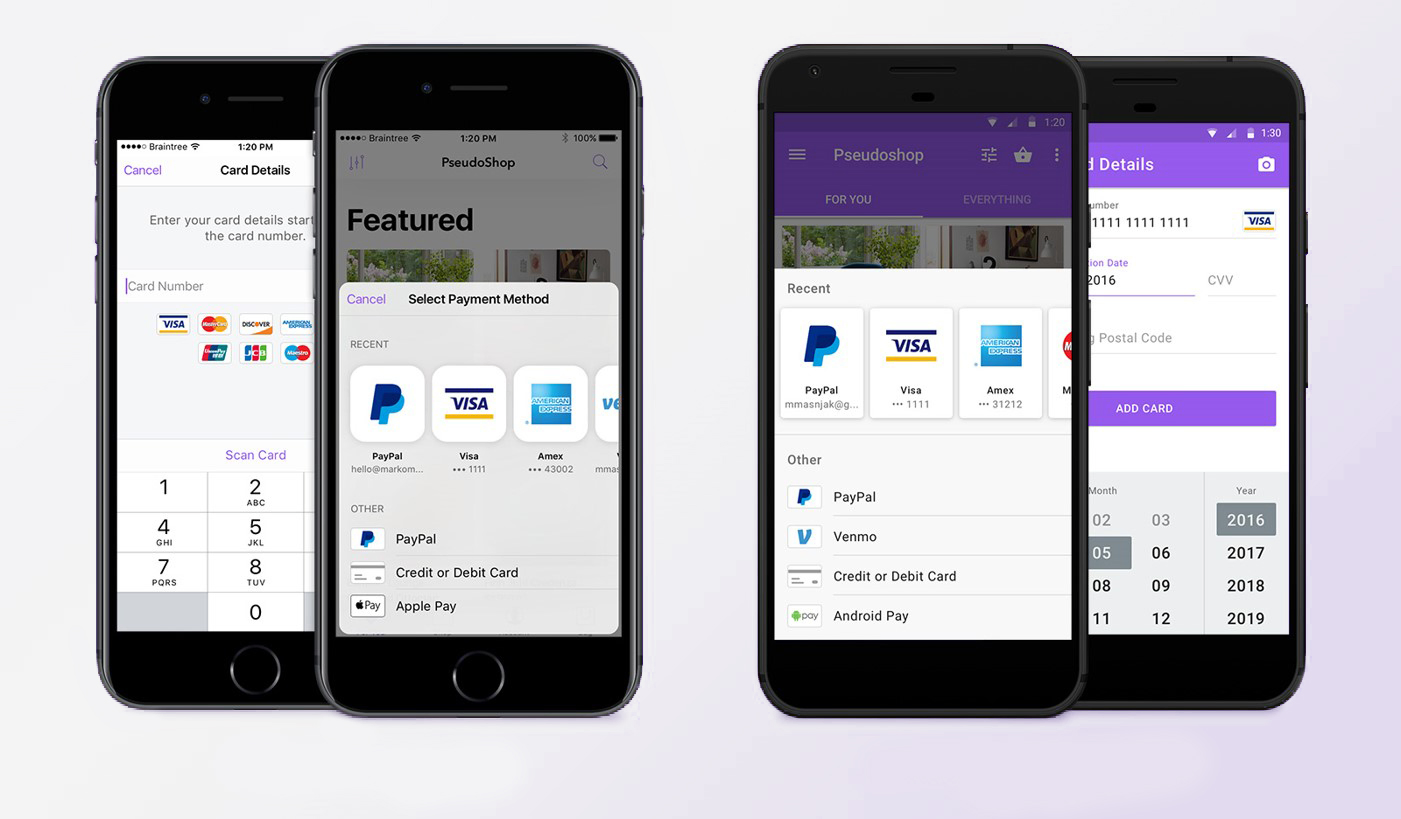

As a good example of integrating mobile payment gateways in iOS, we consider the Braintree iOS SDK. Braintree is a PayPal service that presents developers’ tools and resources to build efficient purchasing solutions. Applying the Braintree iOS SDK, the mobile app will be able to support not only credit cards but other methods like PayPal, Apple Pay, etc. Let’s go through the short instructions on how to integrate a payment gateway in an iOS app.

- Get started. There are several ways how to create a payment gateway for mobile apps whereas CocoaPods and Carthage are common to build systems to work with Braintree iOS SDK.

- Introduce Drop-in UI. It is considered one of the simplest ways to begin accepting payments. Just a few lines of code can deliver a fully-featured purchasing experience. Moreover, the development team has the ability to customize UI and later tokenize the data straightforwardly. That means that there is no need to generate a new key for every session. Tokenization keys allow clients to tokenize purchasing data directly.

- Add client tokens. This step is optional as long as you use tokenization keys. In another case, your server would need to generate client tokens as often as the application restarts. Client tokens contain all the configuration and authorization details to allow the client to initialize the SDK.

- Run testing. In order to test the iOS payment gateway for mobile apps, you need to use Sandbox API credentials. They can be easily obtained within Braintree sandbox accounts with the help of public and private keys and Sandbox merchant ID.

- Sending the purchasing method nonce to the server. At this point, the server will apply the purchasing method nonce to make a transaction.

The mentioned instructions are provided for the latest version of iOS SDK where Drop-in UI supports iOS 9 and later that has introduced new security requirements.

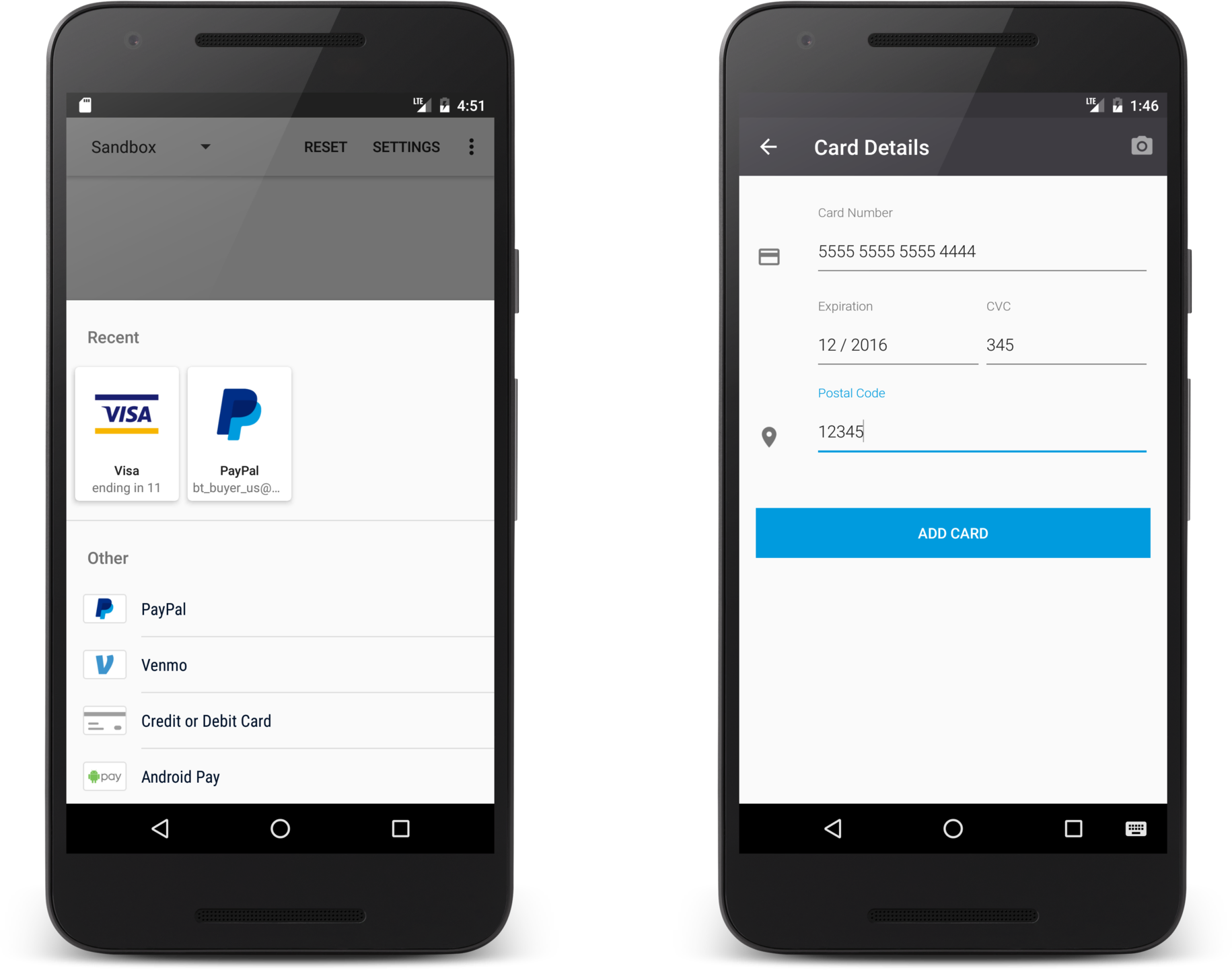

HOW TO USE A PAYMENT GATEWAY IN AN ANDROID APP?

If we compile a guide on how to add payment gateways in an Android app, the steps will be quite similar. The first difference is that developers will use the separate Braintree library created for the Android SDK setup. Along with Google Pay purchasing, Android apps similarly to iOS applications are enabled to support credit cards, and such methods as PayPal or Venmo. So integrating a payment gateway for an Android app with Braintree Android SDK includes the following steps:

- Get started. The developers have to include Braintree to the project using one of the build systems like Gradle or Maven here.

- Introduce Drop-in UI. This is completely the same procedure on how to add a payment gateway in the Android app as in the iOS app. It presents all the necessary functionalities to get the checkout with credit cards and customize it by adding buttons for additional purchasing methods. Concerning tokenization, the development team can choose between the tokenization keys or getting the client tokens from the server.

- Add client tokens. As mentioned previously, it remains still optional. We always suggest checking tutorials on how integration server behaves and ensuring adaption applying your own backend API.

- Run testing. Again you’ll use the Braintree sandbox account that is free for signing up and where you obtain sandbox API credentials for development and testing. As for the production environment, developers have to switch for production API credentials that are different from the first ones.

- Sending the purchasing method nonce to the server. The final step to receive the working checkout flow to initialize the transaction by the server.

Take into account that it is always recommended to apply the latest version of SDKs. The current version Android v3 SDK requires Android API>=21.

PAYMENT GATEWAY INTEGRATION IN A HYBRID APP

With reference to hybrid app development, developers have to consider specific details on how to add a payment gateway for mobile apps there. Let’s take an example of Ionic applications on iOS and Android. The fact that Ionic Native Community presents and maintains a collection of different plugins enables adding native functionality to every Ionic application. For instance, in the case of mobile payment gateway integration for the hybrid app, they offer the plugin that also enables the Braintree Drop-in Payments UI. The implementation relies upon the need to use native Drop-in UI for each platform separately.

- Getting started adding the payment gateway for the hybrid app developed with Ionic, developers need to install Cordova/Ionic native plugins that are supported on both platforms.

- Introduce Drop-in UI for both iOS and Android. It is the essential step to link each platforms’ SDK and follow the mentioned above instructions along with meeting the necessary requirements.

- Complete gateway integration and testing within dedicated native plugins and security patches.

- Sending the purchasing method nonce to the server. Following the same procedure, Braintree client-side UI is capable of generating the payment nonce and later processed in your server to finish the purchase.

As a result, we can see that approaches on how to create a payment gateway in an app differ but still focus on delivering the same functionality. Depending on the complexity of your app and purchasing methods, developers can always work on advancing the gateway implementation with additional options or even choose between other ways how to add a mobile app payment gateway.

WHAT TO CONSIDER WHEN CHOOSING A PAYMENT GATEWAY FOR MOBILE APPS

When choosing a payment gateway for a mobile app, there are several factors you should consider to ensure that your customers have a seamless and secure payment experience. Here are some of the most important considerations:

- Compliance: Security is a crucial factor to consider when adding a payment gateway for your mobile app. Look for a solution that offers robust security measures like encryption, tokenization, fraud detection, etc. Payment gateways that are PCI-DSS compliant are a must-have choice since they have met strict security standards for handling credit card information.

- Integration: It should be easy to integrate into your mobile app and work seamlessly with your existing technology stack. Choose a payment gateway that provides comprehensive documentation, sample code, and SDKs to facilitate integration. Ensure that it supports the programming languages and platforms used in your app.

- User experience: The checkout process should be smooth and user-friendly. It has to offer a responsive user interface that is optimized for mobile devices. The chosen solution should also provide features such as autofill and auto-detection of card types to make the checkout process more convenient for users.

- Fees: The fees charged by the service providers are an important consideration. Transaction fees, setup fees, and monthly fees can all add up, affecting your profit margins. Consider a representative that offers competitive rates for the services you require. Some of them often offer tiered pricing plans that can help you save money as your transaction volume increases.

- Payment methods: Choose payment gateways for mobile apps that support the payment methods that your app’s users prefer. Credit cards and debit cards are the most commonly used payment methods, but e-wallets and bank transfers are also becoming increasingly popular. It’s great when it supports multiple payment methods and currencies, depending on the regions where your app is popular.

- Availability: The chosen option should be available in the regions where your app is popular, and it should support the currencies your target audience uses. If your app caters to a global audience, add a payment gateway that supports multiple languages and currencies.

- Customer support: The solution should provide excellent customer support, including 24/7 support, email, and phone support. A payment gateway with responsive customer support can help you quickly resolve any issues that arise during payment processing.

- Reputation: A payment gateway with a good reputation is a reliable choice. Check reviews and ratings to ensure the service provider has a good track record of securely and efficiently processing payments. Look for a solution that has been in business for a while and has a solid reputation in the industry.

In summary, choosing the right payment gateway for mobile apps can help you provide a smooth and secure payment experience for your app’s users and boost your revenue.

CONCLUSION

Finding out how to add a payment gateway for mobile apps might seem simple in certain respects. Though we’ll recommend going deeper in outlining the smallest details. Besides technology implementation, companies have to take into account business intents. Forward planning, defined needs, and security compliance would help define the technical choices. We hope that this article has answered your questions and given you some ideas on how to create a payment gateway for a mobile app.

Want to build your own mobile app or add new features to the existing one to win the competition?

Reach out to Existek, and we’ll be happy to help you. We are a software development company that has provided a range of services, including mobile app development, for US and European customers since 2012. We’ve completed a number of successful mobile app projects and will be glad to share this experience with you.

Frequently asked questions

What is a payment gateway for mobile apps?

Payment gateways are third-party services authorized by the banking system to perform payment transactions within an app. The main task is to authorize payments and handle the process end-to-end. Businesses that want to accept payments look for the authorized service to carry out operations, process, and store financial data. The easiest way to create a payment gateway for mobile apps is to sign up with payment service providers like PayPal, Braintree, and Stripe.

What are the main reasons to add a payment gateway for mobile apps?

Adding a payment gateway has become a reasonable solution to accept payments within mobile apps. It commonly supports such important aspects as:

Faster transactions

Risk control

Convenience for the clients

Business expansions

Additional tools

Cost savings

How does a payment gateway work?

When the purchasing process in an app is completed within a few seconds, the payment gateway is responsible for handling the transition processing under the hood. It helps to establish the connection between all the involved parties and support compliance. That allows teams to maintain a secure network, protect data, ensure access control and handle transition workflows efficiently and fast.

How to create a payment gateway for mobile apps?

Detailed planning helps to outline the suitable business strategy:

Define the purchasing methods you would like to use within the app

Learn more about available payment gateway providers’ services and integration solutions

Choose the provider and register the merchant account

Do the technical research and prepare the app for integration

Execute the legal part

Do the coding and integration itself