Updated: May 10, 2024

Published: January 27, 2023

The financial services industry is one of the most heavily regulated and complex sectors, and software development is critical in driving innovation and growth within it. The software is at the heart of nearly every financial service, from online banking to mobile payments to investment management. In this article, we will explore the current state of software development in the financial services industry, the sector’s challenges, and the key trends shaping the future.

List of the Content

- Trends and challenges in software development for financial services

- Types of financial software

- Regulations in software development for financial services

- Programming languages, frameworks, and other technologies

- Role of open-source technologies in fintech software development

- Security standards in software development for financial services

- Conclusion

TRENDS AND CHALLENGES IN SOFTWARE DEVELOPMENT FOR FINANCIAL SERVICES

First, let’s look at the current state of software development in the financial services industry. The sector is undergoing a significant transformation driven by technology, with fintech startups and established financial institutions investing heavily in new software and systems. This is driven by the need to meet the changing demands of customers, who are increasingly looking for fast, convenient, and secure financial services.

One of the key trends driving innovation in the financial services industry is using technology to drive growth. For example, many financial institutions are now using artificial intelligence and machine learning to analyze customer data and identify new opportunities for growth. Similarly, blockchain technology powers new financial products and services, such as digital currencies and smart contracts.

Despite these opportunities, there are also significant challenges for the software development community in the financial services industry. One of the biggest challenges is regulatory compliance. Financial services companies must comply with a wide range of regulations, such as the General Data Protection Regulation (GDPR) and the Payment Services Directive (PSD2), which can make software development more complex and costly.

Another challenge is data security. Financial services companies handle sensitive customer data, and a data breach can have severe consequences for the company and its customers. As a result, software developers must ensure that the systems they create are secure and can protect against cyberattacks.

Scalability is also a significant challenge for financial services software development. Financial services companies must be able to handle large amounts of data and transactions, and software must scale to meet these demands. This task can be difficult, time-consuming, and requires careful planning and testing.

When it comes to programming languages, frameworks, and tools, the financial services industry tends to favor mature and robust technologies. Java, C#, and C++ are popular languages for developing financial services software, while frameworks such as Spring and .NET are commonly used. Tools such as Git, JIRA, and Jenkins are also widely used to manage the software development process.

Emerging technologies such as blockchain, AI, and machine learning are also becoming increasingly important in financial services software development. Blockchain technology is up-and-coming, as it has the potential to revolutionize financial transactions. AI and machine learning, on the other hand, can be used to analyze customer data and identify new opportunities for growth.

User experience design is also crucial in financial services software development. Financial services software must be user-friendly and easy to navigate, as customers will quickly lose interest in software that is difficult to use. Best practices for creating user-friendly and effective software include user research, prototyping, and testing. A discussion of the role of technology in driving innovation and growth in the financial services industry, including examples of successful tech-driven initiatives.

Another trend expected to shape software development in the financial services industry is the increasing use of open-source software. Open-source software offers several benefits, such as lower costs, a wider pool of developers, and greater flexibility. However, there are also some drawbacks, such as a lack of support and potential security risks.

Mobile and web-based technologies are also expected to grow in the financial services industry, as customers increasingly use their mobile devices to access financial services. This will require developers to create mobile-friendly and responsive software that can be accessed from a wide range of devices.

TYPES OF FINANCIAL SOFTWARE

First of all, software developed for financial services institutions can be divided into two major categories – for internal use and available to the customers.

Customer-facing applications

The financial services and fintech industries rely heavily on various applications to help them manage and process financial transactions, analyze data, and make informed decisions. These applications can be broadly classified into several categories, each with unique features and capabilities.

How to build your own fintech application, and how much it would cost?

Want to know more about financial services application development?

Mobile banking applications are the most commonly used in the financial services and fintech industries. These apps allow customers to access their bank accounts, view transactions, and make payments with mobile devices. They are used for account management, money transfer, and other banking transactions. Consumers may access account balances, view statements, and manage account settings as a standard.

Investment management applications help to manage investment portfolios, track performance, and make informed investment decisions. Additionally, customers can get analysis of the market trends, generate reports, and track portfolio performance. Investment management applications can also be used to set up alerts and notifications, such as when a stock reaches a specific price or a portfolio reaches a certain level of risk.

Personal finance applications are another type of application commonly used in finances. These applications are designed to help individuals manage their money, track expenses, create budgets, create financial goals, track spending, and manage account balances. Often those apps are linked to bank accounts and credit cards, making it easy to track transactions and stay on top of account balances.

Digital wallets are electronic versions of physical wallets to store credit card information, debit card information, and other sensitive data. They provide a convenient way to make payments without physical credit cards. Digital wallets also have additional features such as loyalty card storage, gift card management, and cashless payments. Some fintech companies like Revolut provide cards that can be used solely through digital wallets like Apple Pay without plastic cards.

Online lending platforms are another type of application commonly used in the financial services and fintech industries. These platforms connect borrowers with lenders, allowing borrowers to apply for loans and lenders to invest in loans. They use advanced algorithms and data analysis to assess the creditworthiness of borrowers and match them with suitable lenders. Those platforms also help to manage loan accounts, track payments, and generate reports.

Enterprise software for financial services

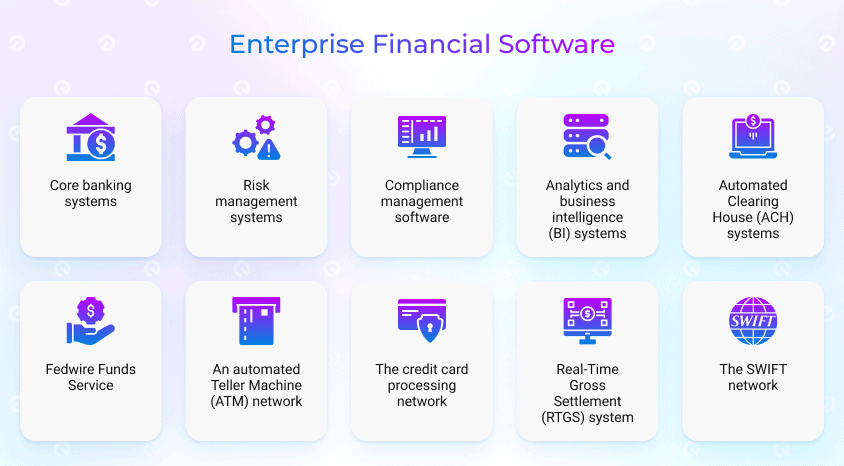

There are a wide variety of different types of enterprise software used in the financial services industry, each with its own unique set of features and capabilities.

Some of those applications are obligatory to use by banks and other financial institutions worldwide or for local market operations. Here we will mention some of the solutions used globally or in the US market.

Core banking systems are one of the most commonly used types of enterprise software in the financial services industry. These systems manage a bank’s core operations, including account management, money transfers, loan management, and general ledger management.

Risk management systems are a second type of enterprise software commonly used in the financial services industry. These systems are used to identify, assess, and manage risks associated with financial transactions, such as credit and market risks. Companies leverage risk management systems to generate reports and alerts, such as when a risk threshold is exceeded.

Compliance management software is another type of enterprise application commonly used in the financial services industry. These systems are used to ensure that financial institutions comply with a wide range of regulatory requirements, such as the General Data Protection Regulation (GDPR) and the Payment Services Directive (PSD2).

Analytics and business intelligence (BI) systems are commonly used in the financial services industry to analyze large amounts of data and generate insights for informed business decisions. BI systems can be used to create reports and visualizations, such as charts and graphs, that make it easy to understand complex data. They can also be integrated with other enterprise software systems, such as core banking and ERP systems, to provide a holistic view of the financial institution’s operations.

Automated Clearing House (ACH) systems are designed to process electronic transactions, such as direct deposit of payroll and electronic payments. The ACH system is operated by the National Automated Clearing House Association (NACHA) and provided to financial institutions to clear and settle transactions.

Fedwire Funds Service is operated by the Federal Reserve and is used to facilitate funds transfer between financial institutions. The Fedwire Funds Service is widely used for time-sensitive transactions, such as government securities transactions and large-value money transfers.

An automated Teller Machine (ATM) network is something we all access almost every day. Various financial institutions operate this network to give customers access to their bank accounts through ATMs. The ATM network is widely used for cash withdrawals, account balance inquiries, and other transactions.

The credit card processing network is operated by various financial institutions and is used to process transactions made with credit and debit cards. The credit card processing network is widely used for point-of-sale transactions, online payments, and other transactions.

Real-Time Gross Settlement (RTGS) system is another software commonly used in the US financial and banking system. This system facilitates the real-time transfer of large-value funds between financial institutions. The RTGS system is widely used for time-sensitive transactions, such as government securities transactions and large-value money transfers.

The SWIFT network is the standard way to operate any financial transaction. The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a global financial messaging network that enables financial institutions to exchange electronic messages and financial transactions securely. This network is used to facilitate cross-border transactions, including foreign exchange and international money transfers. SWIFT is crucial for international transfers, and the inability to use it may significantly impact the economics of entire countries, like the recent example of the sanctions against Russia and Belarus.

Check processing network is still a thing in some countries like the US. This network processes paper checks and converts them into electronic transactions for check deposits, check payments, and other transactions.

REGULATIONS IN SOFTWARE DEVELOPMENT FOR FINANCIAL SERVICES

The financial and fintech industries are heavily regulated globally, with many laws and regulations to protect consumers, ensure the financial system’s stability, and prevent money laundering and other financial crimes. These regulations are necessary to ensure that financial and fintech institutions and companies operate safely and transparently, and to protect consumers from financial fraud and other risks.

The Basel III Capital Accord is among the most critical global regulations for financial and fintech institutions and companies. This set of regulations, developed by the Basel Committee on Banking Supervision, sets out the minimum capital and liquidity requirements for banks and other financial institutions. The Basel III regulations are intended to ensure that financial institutions have sufficient capital to absorb losses in times of economic stress and to maintain stability in the financial system. While this is not directly applicable to software development, it is a requirement that fintech companies still need to match.

Anti-Money Laundering (AML) regulations is another important global regulation for financial and fintech institutions and companies. These regulations, developed by the Financial Action Task Force (FATF), are intended to prevent money laundering and other financial crimes. AML regulations require financial institutions and companies to implement procedures to identify, monitor, and report suspicious transactions. They also require financial institutions and companies to maintain records of their transactions and to implement measures to prevent money laundering and other financial crimes.

General Data Protection Regulation (GDPR) is a third crucial global regulation for financial and fintech institutions. This regulation, developed by the European Union, protects individuals’ privacy and personal data. GDPR regulates the collection, storage, and use of personal data, and gives individuals the right to access, correct, and delete their data. It also requires organizations to appoint a data protection officer and report data breaches.

The Payment Services Directive (PSD2) is probably the most well-known regulation for financial software companies. This standard, developed by the European Union, is intended to increase competition in the payment services market and to provide consumers with more choices and better services. PSD2 requires financial institutions and companies to provide access to customer account data to authorized third parties, such as fintech companies, and to implement strong customer authentication methods.

Explore PSD2 regulations in detail

Want to know more about PSD2 regulations in financial services?

Know Your Customer (KYC) regulations are another universally applicable regulation for financial and fintech institutions and companies. These regulations, developed by the Financial Action Task Force (FATF), require financial institutions and companies to verify the identity of their customers, assess the risks of money laundering and other financial crimes, and implement measures to manage those risks.

Task Force (FATF) is intended to prevent the financing of terrorism and to disrupt the activities of terrorist organizations. CFT regulations require financial institutions and companies to implement measures to identify and report suspicious transactions that may be related to terrorist financing. They also need financial institutions and companies to maintain records of their transactions and to implement measures to prevent the funding of terrorism.

In addition to these global regulations, many countries have specific regulations for the financial and fintech industries. For example, the United States has the Bank Secrecy Act (BSA), which requires financial institutions to implement measures to prevent money laundering and other financial crimes. The United Kingdom has the Financial Conduct Authority (FCA), which regulates financial institutions and companies and ensures that they operate safely and transparently.

In conclusion, the financial and fintech industries are heavily regulated globally, with many laws and regulations to protect consumers, ensure the financial system’s stability, and prevent money laundering and other financial crimes. These regulations include the Basel III Capital Accord, the Anti-Money Laundering (AML) regulations, the General Data Protection Regulation (GDPR), the Payment Services Directive (PSD2), Know Your Customer (KYC) regulations, and the Countering the Financing of Terrorism (CFT) regulations. These regulations are necessary to ensure that financial and fintech institutions and companies operate safely and transparently, and to protect consumers from financial fraud and other risks. Financial institutions and fintech companies must comply with these regulations and continuously monitor their compliance to avoid penalties.

PROGRAMMING LANGUAGES, FRAMEWORKS, AND OTHER TECHNOLOGIES IN SOFTWARE DEVELOPMENT FOR FINANCIAL SERVICES

The financial services, banks, and fintech industries rely heavily on software development to manage their operations and provide customer services. As such, a wide variety of frameworks, programming languages, and other technology tools are commonly used in software development for these industries.

Languages, frameworks, and cloud computing

One of the most commonly used frameworks in software development for financial services, banks, and fintech is the Spring Framework. Spring is a popular open-source framework for building Java applications. It provides a comprehensive set of features for building enterprise applications and is widely used for creating web applications, RESTful web services, and microservices.

Another commonly used framework in software development for financial services, banks, and fintech is the .NET Framework. It is a popular framework for building Windows-based applications and is widely used for creating enterprise applications, web applications, and services. It provides a wide range of features for robust and scalable applications and is supported by a large community of developers.

The Angular Framework is the second most commonly used framework in software development for financial services, banks, and fintech. Angular is a popular open-source framework for building web applications widely used in single-page applications (SPAs). It provides a comprehensive set of features for making dynamic and interactive user interfaces and is supported by many developers.

Another commonly used technology in software development for financial services, banks, and fintech is Microservices. Microservices is a software architecture pattern that structures an application as a collection of small, loosely-coupled services. Each service runs in its own process and communicates with other services through a lightweight mechanism, such as an HTTP API. Microservices enable development teams to work independently and deploy their changes more frequently and easily, which can be an advantage for financial services, banks, and fintech companies as they can respond quickly to changing market conditions.

Node.js, Java, and C# are the most popular backend technologies for fintech services. Enterprise companies widely adopted these technologies. They embed solutions for the majority of financial challenges out of the box. For example, Java has a Java EE version, a brunch specifically designed for enterprise applications and supported by Oracle Corporation.

Another commonly used technology in software development for financial services, banks, and fintech is Cloud Computing. Cloud computing enables financial institutions to access IT resources, such as servers, storage, and software, over the internet. This enables them to reduce their IT costs and increase their operational flexibility. Cloud computing services, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), are widely used by financial institutions to host their applications and data.

DevOps is another trend becoming increasingly popular in financial services software development. DevOps is a set of practices and tools that enable development teams to build, test, and deploy software faster and more reliably. DevOps practices include continuous integration, delivery, and deployment, enabling development teams to deliver software more frequently and with fewer errors. This can help financial institutions to respond more quickly to changing market conditions and to improve their overall competitiveness.

Other technology trends in software development for financial services

Other commonly used technology in software development for financial services, banks, and fintech is Artificial Intelligence (AI) and Machine Learning (ML). AI and ML technologies enable financial institutions to analyze large amounts of data, identify patterns, and make predictions. This can help them improve their decision-making, reduce costs, and increase competitiveness. AI and ML technologies can be used in various applications, such as fraud detection, customer service, and risk management.

Another commonly used technology in software development for financial services, banks, and fintech is Blockchain. Blockchain technology is a decentralized, distributed ledger technology used to track and verify transactions. Blockchain-based systems can be applied for various applications, such as payments, digital identities, and supply chain management. This technology can improve the transparency and security of financial transactions and reduce the need for intermediaries in financial transactions.

Big Data is another trend that is having a significant impact on financial services software development. Financial institutions generate and collect large amounts of data daily, including data on customer transactions, market movements, and more. By using big data technologies, such as Hadoop and Spark, financial institutions can analyze this data in real time and gain insights that can help them to improve decision-making, reduce costs, and increase their competitiveness.

ROLE OF OPEN-SOURCE TECHNOLOGIES IN FINTECH SOFTWARE DEVELOPMENT

Some of the programming languages and frameworks mentioned above are open-source. This means they have some advantages, like a very high talent supply and exceptional community support. At the same time, software development for financial services requires specific security and compliance requirements which may raise some concerns regarding open-source technologies.

Open-source software (OSS) has become increasingly popular in recent years, and its use is spreading to various industries, including financial services. OSS refers to software whose source code is available for anyone to use, modify, and distribute.

One of the main benefits of using open-source software in financial services software development is cost savings. OSS is typically free to use, which can significantly reduce the cost of software development for financial services companies. This can be especially beneficial for smaller companies that may not have the same resources as larger companies.

Another benefit of using OSS in financial services software development is the vast pool of developers. OSS is developed by a community of developers, and this community can provide valuable support and contributions to the development process. This can also speed up the development process and reduce its time and costs.

OSS also promotes transparency and security. As the source code is available for anyone to examine, it is easier to identify and fix any security vulnerabilities. Additionally, OSS is typically more transparent than proprietary software, which can increase customer trust and confidence.

However, some things could be improved in using OSS in financial services software development. One of the main drawbacks is the need for more support. OSS is developed by a community of developers, and while this community can provide valuable support, it may not be as extensive as the support provided by proprietary software vendors.

Another drawback is the potential security risks. As the source code is available for anyone to examine, it may be easier for hackers to identify and exploit security vulnerabilities. Additionally, OSS may not have the same security features as proprietary software, which can increase the risk of data breaches.

It’s also worth mentioning that using OSS in financial services software development requires compliance with open-source licenses. Financial services companies must ensure that they comply with the terms of the open-source licenses, which can be time-consuming and complex.

Another important aspect of using OSS in financial services software development is the ability to customize and adapt the software to the company’s specific needs. OSS allows developers to modify and adjust the software to the company’s unique requirements, which can be beneficial for financial services companies that need to meet specific regulatory requirements or comply with industry standards.

Furthermore, OSS can also lead to innovation and collaboration. As the source code is available for anyone to use and modify, it can encourage developers to share their modifications and improvements with the community, which can lead to the development of new and improved features. This can also foster collaboration between different financial services companies, which can lead to the development of new and innovative solutions.

Another trend becoming more relevant in the financial services industry is using open-source technologies for distributed ledger and blockchain solutions. OSS blockchain platforms like Ethereum, Hyperledger, and EOS provide a transparent, secure, and decentralized infrastructure for financial services companies to build their solutions on. This can help financial services companies to reduce costs and increase security and transparency.

Need assistance with choosing the ideal technology stack for your financial application?

The Existek team has vast experience in creating robust and scalable solutions for fintech. Contact us to get a free consultation.

SECURITY STANDARDS IN SOFTWARE DEVELOPMENT FOR FINANCIAL SERVICES

Security is a critical aspect of software development for financial services, as even minor errors or vulnerabilities can have severe consequences for the financial institution and its customers. From a technology and software development standpoint, there are several standards and best practices that financial institutions should follow to ensure the security of their software systems.

One of the most important standards for software security in financial services is the ISO/IEC 27001:2013 standard. This standard provides an information security management system (ISMS) framework and outlines the best practices for managing and protecting sensitive information. It covers various security controls, including access, incident, and risk management. Financial institutions should ensure that their software development processes comply with the ISO/IEC 27001 standard to ensure the security of their systems.

Another vital standard for software security in financial services is the Payment Card Industry Data Security Standard (PCI DSS). This standard is specifically designed for organizations that handle credit card transactions, and it outlines a set of security controls that must be implemented to protect cardholder data. Financial institutions that handle credit card transactions should ensure that their software development processes comply with the PCI DSS standard to ensure cardholder data security.

Another key aspect of software security in financial services is encryption. Encryption is converting plain text into code to protect the data from unauthorized access. Financial institutions should ensure that their software systems use encryption to protect sensitive information such as customer data, financial transactions, and other confidential information. This includes using secure protocols such as HTTPS and SSL to encrypt data in transit and encryption algorithms such as AES and RSA to encrypt data at rest.

Another aspect of software security in financial services is using secure coding practices. This includes following best practices for writing secure code, such as input validation, error handling, and access controls. Developers should also be trained on the OWASP Top 10, a list of the most common web application security risks. They should be familiar with common vulnerabilities like SQL injection and cross-site scripting (XSS). Additionally, software must be tested for vulnerabilities before deployment to ensure any issues are identified and addressed.

Another important aspect of software security in financial services is threat modeling. This process identifies potential threats to a software system and assesses their likelihood and impact. By identifying potential hazards, financial institutions can take proactive measures to prevent or mitigate them, such as implementing security controls or conducting penetration testing.

Continuous monitoring and incident response can’t be overestimated. This includes implementing systems and processes for monitoring and detecting security incidents in real time and having a plan in place for responding to incidents quickly and effectively. This includes having a team to handle the incident response and regularly testing incident response plans to ensure they are effective.

Financial institutions should also implement a comprehensive security strategy that includes people, processes, and technology. This includes providing security training to employees, implementing security controls and processes, and investing in security technology. This will help to ensure that all aspects of security are addressed and all employees are aware of the risks and how to respond to them.

Additionally, financial institutions should consider partnering with third-party security providers, such as security consultants and managed security service providers, to assist with implementing and maintaining security controls and processes. These providers can provide expertise and resources that may be difficult or expensive for an organization to acquire independently.

In conclusion, financial institutions should ensure that their software development processes comply with relevant standards, such as ISO/IEC 27001 and PCI DSS. They should use encryption, secure coding practices, and threat modeling to protect their systems and customer data. By following these best practices, financial institutions can help ensure their software systems’ security and the safety of their customers’ information. Additionally, implementing a comprehensive security strategy, continuous monitoring and incident response, and partnering with third-party providers can help further strengthen financial institutions’ security posture.

CONCLUSION

In conclusion, software development for financial services and fintech companies is constantly evolving and shaped by new trends and technologies. Some of the key trends we have observed include artificial intelligence and machine learning, blockchain technology, cloud computing, and open-source software. These technologies can revolutionize financial services companies’ operations and provide new growth opportunities. However, many challenges come with creating software for financial institutions, such as complying with a wide range of laws and regulations and ensuring customer data’s security and privacy. Additionally, financial institutions need to be aware of the new trends and technologies emerging in the software development field, and they need to adapt to these changes to remain competitive and continue to provide the best services to their customers.

Need help with building a new financial application or customization the existing solution?

We’re here to help. Existek is a software development company with rich experience in the integration, customization, and development of fintech apps. Describe your need and get a free consultation.

Frequently asked questions

What software is used in financial services?

Software is used in every aspect of financial services. Some of the best examples are personal banking applications where users can access their account details, statements, funds, and manage accounts in general. Additionally, companies use accounting software for everyday operations.

How is the technology used in financial services?

In financial services, technology is used to ease interactions between organizations and B2C operations. The technology addresses automatization challenges, security, and reduces human interaction for better and more efficient services.

What is an example of financial application software?

Some of the most well know applications are personal banking apps like Revolut or client applications that almost every bank has. Enterprise companies use accounting applications like QuickBooks.

Which programming language is best for fintech?

Fintech widely adopts programming languages like Java, .NET, C#, and Node.js because those are mature technologies with the necessary security levels and suit of tools required for compliance and an efficient development process.