Updated: July 4, 2024

Published: June 20, 2022

How can digital services offer better alternatives to regular banking? What is Revolut, and how it’s revolutionizing the financial market? Finding answers to these and other related questions explains the popularity of building an app like Revolut and how to implement it regarding your business needs.

List of the Content

- What is Revolut and what does it do?

- Features that are important to apps like Revolut

- How to build an app like Revolut

- Business models: how to monetize an application like Revolut

- In conclusion

WHAT IS REVOLUT AND WHAT DOES IT DO?

It’s quite interesting to discover how digital services have introduced opportunities to transform regular services across different industries. The wide adoption of technology supports the fast advancement of the software market. Moreover, some tech solutions can easily become the absolute game-changer within the industry.

Revolut, often referred to as a financial super app, is a great example to consider in the fintech industry. Launched in 2015, the application aimed at supporting such functionality as money transfer and exchange. It became a solution that has definitely revolutionized the financial market and keeps on introducing innovative products. So let’s find out more about Revolut and why it’s so popular on the market.

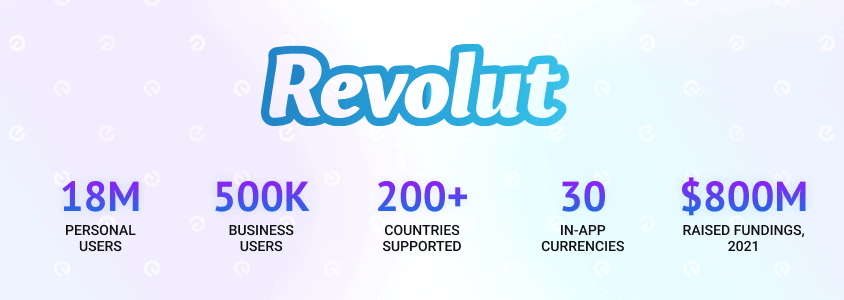

The increasing demand for banking beyond traditional institutions explains the popularity of an app like Revolut. Besides, the founders’ main objective was simplifying payments worldwide. It allowed customers to make transactions in a few taps and considerably eased the global transfers. Over the first year, the startup reached a number of 100k users with a fundraising of $15M. These were impressive numbers for an application that had just entered the market. However, the more interesting thing remains its continuous growth from year to year. They delivered a great set of features to manage spending, savings and investments in one place to attract more and more users. Once started as a digital payments service, Revolut turned into an e-money institution that also attained an EU banking licence. At present, it has grown to 18M personal customers, and 500k business users and its revenues are estimated at $800M.

The distinctive advantage of Revolut is that it offers international transfers and global spending at real exchange rates. Over the years, they have been pursuing the same objective – to present accessible banking and financial services worldwide. The customers can spend in over 140 currencies across more than 200 countries. The multi-currency accounts support 28 in-app currencies to receive, save and exchange money within mobile and web applications. Also, they’ve presented many options to ease financial operations between individuals and manage business resources.

There is another compelling reason why Revolut has gained its considerable market share. The company continuously works on extending the functionality with innovative products and services. For example, the app covers a number of services to make investments easier. It’s really amazing that customers can find everything with one app – stock tradings, company shares, cryptocurrencies, saving vaults, etc. Also, they keep adding new services to advance user experience and bring cutting-edge services. Budget management, on-demand pay, reward programs, medical insurance, and Revolut Shopper are other great functionalities to advance financial operations online.

As for the business models, they cover the needs of both individuals and businesses. For personal usage, customers can choose among several plans. It’s worth saying that the standard plan is free of charge and offers great features and services. Of course, it has some limitations, but it’s definitely enough to start experiencing digital services. The same way is for business solutions. They can start with the free plan and get it upgraded according to rising needs. Revolut is a perfect solution for covering basic needs and fulfilling the requirements of large enterprises. So what are the functionalities that make it so attractive, and what advantages can teams gain when building an app like Revolut?

Interested in other types of applications for the fintech industry?

We recommend reading the latest article about fintech software development to learn about app categories, required features and development process details.

FEATURES THAT ARE IMPORTANT TO APPS LIKE REVOLUT

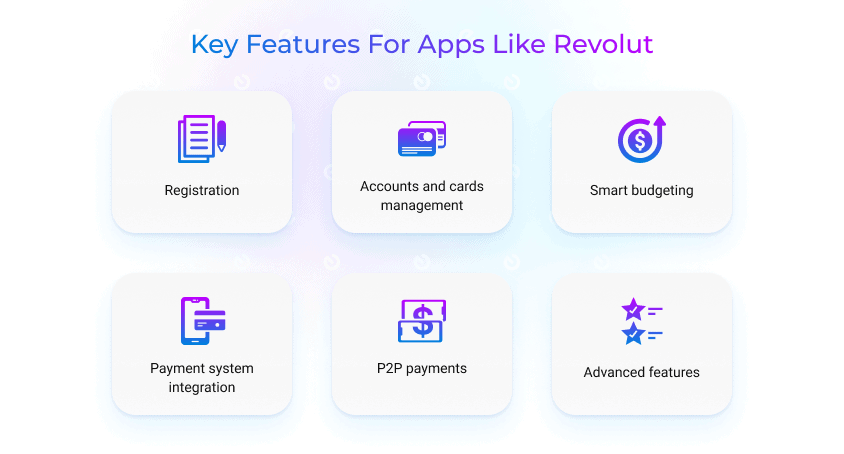

The development process always starts with a comprehensive requirement analysis to define the app’s functionality. Following the best market practices and well-outlined requirements, the team is able to present an excellent set of features. Revolut is a good example for companies that have decided to provide digital financial services. As a result, it’s worth focusing attention on the following features when the team starts to build an app like Revolut:

- Registration

That’s a basic feature included in every app. However, the difference is that it isn’t just a registration; it’s about opening an account within your app. The team has to deliver end-to-end security with the simplicity of registration and usage. The Revolut registration takes up to a few minutes, whereas the verification is completed just by providing a selfie and a passport image for personal accounts. As for business users, the account approval can take from a few hours up to a week after filling the application form with business details.

- Payment system integration

An application like Revolut needs to settle funds, accept payments, send local and international payouts, etc. The distinct advantage remains that it can be completed regardless of the country the company operates. Therefore, payment integration is a must-have feature for any app like Revolut. Some efficient options are referred to both the usage of BaaS platforms and the introduction of financial services from scratch. The main thing is careful planning and smooth integration.

- Accounts and cards management

Account and card management are considerably simplified through digital services. The planned features have to deliver the best user experience and options to manage spending, saving and payouts on the go. Apps like Revolut should focus on an extensive set of innovative features. It involves account and card security, instant payments, excellent exchange rates, Apple and Google Pay integration, etc. Even though Revolut users have virtual cards, they are also offered physical debit cards for additional convenience.

- Smart budgeting

Digital services have always aimed at advancing user opportunities. As we discover the financial aspects, today’s users are in need of efficient and innovative solutions to manage budgets. Revolut can be easily considered a game-changer as it presents many advantageous features. Weekly insights, spending limitations and predictions, cashback, online deals and reward programs will be really favoured by users. Moreover, your team can always go further and introduce new options when building an app like Revolut.

- P2P payments

It remains one of the core functionalities for many apps that provide digital financial services. Peer-to-peer payments are way faster and easier than traditional bank transfers. Revolut offers instant transfers with no hidden fees. Also, there are many great options to settle payments like splitting bills, requesting payback or sending the gift card. Even users that don’t have a Revolut account can use payment links and instantly generated QR codes to complete transactions. When the team builds an app like Revolut, they can also consider the option to handle payments by just obtaining the user’s phone number or email.

- Advanced features

Innovative functionality aims at bringing additional value to your customers. It’s wise to approach it as something that can differentiate your product in the market. Along with sharing experiences of the apps like Revolut, the team can always come up with some new ideas. Revolut aims to bring together various operations within one app. Also, they focused on delivering the highest quality of security in compliance with the latest regulations. For instance, it’s worth noting the fact that Saving Vaults support FDCI-insured deposits.

Need additional assistance in defining functionality for your app?

Existek’s team will gladly share our experience and help select the right features to meet your user and business needs.

HOW TO BUILD AN APP LIKE REVOLUT

That’s a common question to ask when the team decides to create an app to enter the fintech market. Revolut has become a great example of sharing extensive product experience. At the same time, the team has to put considerable effort into defining its own strategy to not only launch the app but withstand the strong market competition.

Therefore, we suggest going through essential aspects to streamline the development process and receive the desired results. The first thing to remember is that apps like Revolut have one distinct difference. Digital financial services embrace a number of banking and regulatory aspects. If the team has decided to create an app like Revolut, they have to comply with numerous regulatory measures like PSD2, PCI-DSS, security regulations such as GDPR, AML and others. Dealing with a banking and regulatory part of the business is quite essential as the team won’t be able to deliver the product without it. And it goes without saying that following regulations play an important role in the overall efficiency of the development process.

Development approaches

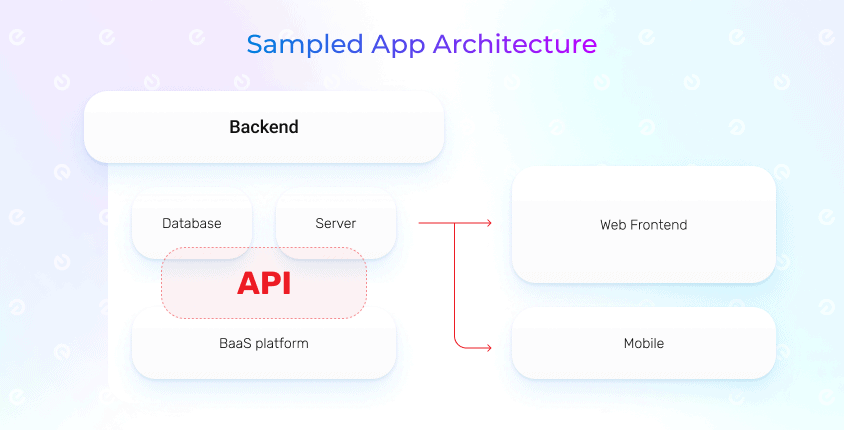

Every team has to choose between two available options in the beginning. Some teams prefer to use BaaS platforms, whereas others develop their financial services from scratch. Let’s focus on both approaches to find out how they differ.

- Using the BaaS platforms

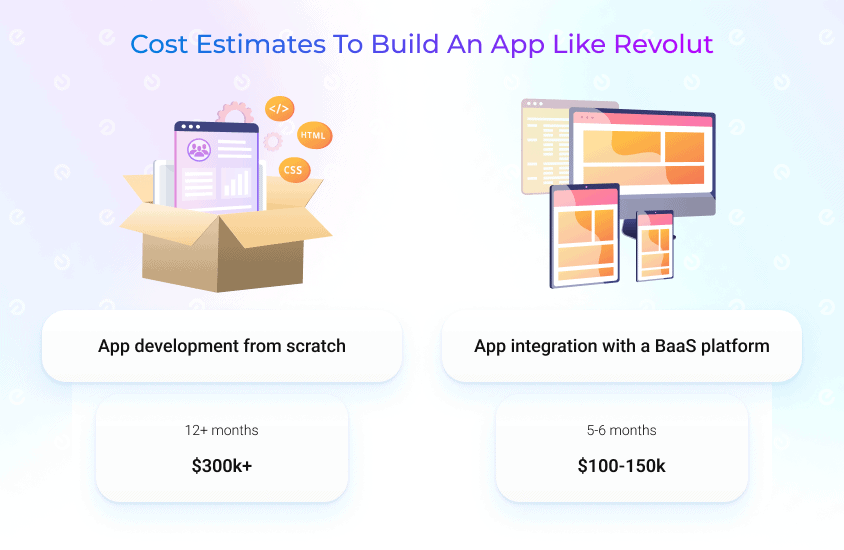

The easier and faster way to create an app like Revolut is to consider a partnership with third-party providers. It means that the team remains responsible for the application development, whereas the financial and legal aspects can be shared with the chosen provider. In this case, the business has to apply for the services of BaaS platforms. BaaS is the advanced solution that allows non-bank organizations to embed financial services into their digital products. They take responsibility for a number of financial and regulatory aspects as well as deliver the required functionality set. BaaS can be considered a backbone for financial application development. Moreover, BaaS platforms bring advantageous solutions to streamline the development process. Out-of-the-box API and detailed documentation support smooth integration. BaaS often includes UI designs, various financial products, risk assessment and management tools, account management, etc. That’s a great option to accelerate time to market, streamline compliance and obtain powerful financial features. The usage of BaaS platforms allows the team to embed payments, banking and compliance within the shortest period. Among the popular market providers, we can mention such representatives as Synctera, Unit and Finzly. These mature market players offer a wide set of features and services to support digital financial services on the highest level. The company’s choice should be supported by a number of decisive criteria like available functionality, partnership terms, processing fee, etc. Well-outlined requirements are quite helpful in choosing a suitable BaaS provider. Developing an app like Revolut and its integration with the BaaS platform could take up to 5-6 months with an average budget of $100-150k.

- Building an application from scratch

The other option embraces use cases, where businesses take full responsibility for delivering and supporting apps like Revolut. At first sight, it could seem quite reasonable to start from scratch and focus on something new for digital financial services. However, you shouldn’t forget the fact that the team has to develop a full-fledged and compliant product. Building this type of application requires obtaining your own financial services and following all the latest regulations. Moreover, it’s worth mentioning that banking licences and security measures usually differ from country to country. So it needs to be addressed separately in every country or region you want to operate. The financial services are really vulnerable, and the products have to pass numerous tests to meet the standards. Therefore, the development timeline and budget definitely increase compared to the first option. It could take more than a year to launch an app like Revolut with expenses, starting from $300k.

Functionality consideration

Also, development efficiency greatly depends on the ability to prioritize the needs through well-defined functionality. If we talk about creating an app like Revolut, it foresees a complex project with a number of advanced features. At the same time, it doesn’t mean that everything should be implemented with the first version.

It’s usually recommended to go with a gradual approach where prioritizing needs and requirements can make a big difference to the overall process. The team has to remain quite specific with defining the required functionality. One of the common challenges is the desire to add as many features as possible. Though it never guarantees the best outcomes. Instead, it’s better to focus on a shorter list of features but get the most out of it. The obligatory features for an app like Revolut include

- Highly secure login

- User accounts

- P2P payments

- Virtual and physical debit cards

- Direct deposits

- Budget and saving tracking

- Integrations like Apple Pay and Google Pay

The good market practice is to start with MVP development to cover basic functionality. It considerably shortens the development time and allows the team to test the product vision in the market. It also provides valuable insights on how to finalize the product and what features to add next.

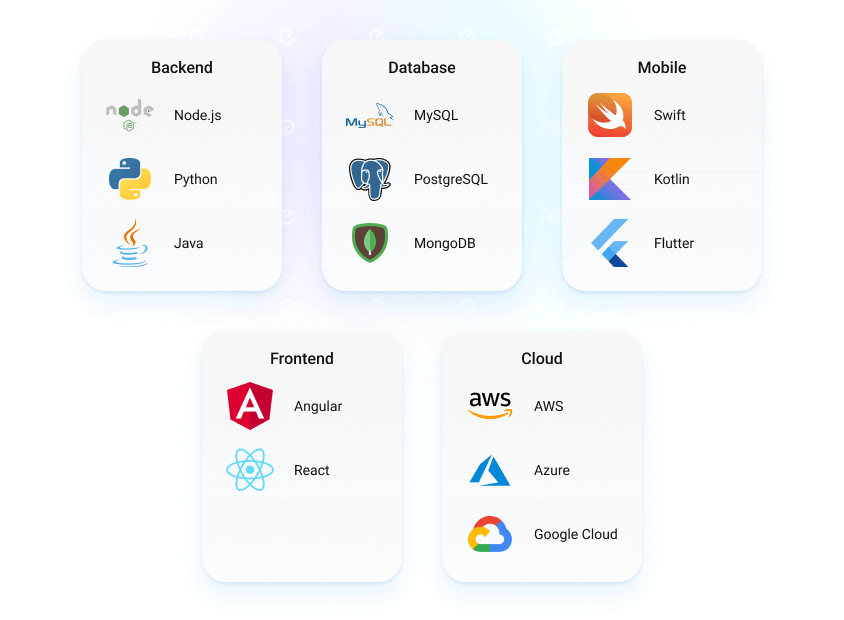

Technology stack

The other decisive aspect in application development is the technology stack. It requires special attention as it considerably influences product implementation. The team aims to combine the best set of technologies and tools to deliver a full-fledged application. Their task is to make a choice regarding project-specific needs along with following the best market practices.

It’s really important to make reasonable and up-to-date tech choices. The software market develops at a rapid pace, so the team has to keep pace with its tendencies. As long as the team decides to build an app like Revolut, they need to support product presence across different channels, including mobile and web. Therefore, developers work on several solutions in parallel and commonly create both web and mobile applications.

The good characteristic of a great tech stack is to support smooth interaction between all product parts. Besides, the chosen technologies have to be compatible and work together for the best performance of the application. The other thing that can influence the choice is technology share in the market as well as its popularity among developers. It could be easier to find developers of the required expertise.

Analyzing the latest market tendencies, teams commonly choose among the following technologies:

Backend – Node.js, Python, Java, C++

Database – MySQL, PostgreSQL, MongoDB

Web frontend – Angular, React

Mobile – Swift, Objective-C (native iOS development), Kotlin, Java (native Android development), Flutter, React Native (hybrid development)

Cloud providers – AWS, Azure, Google Cloud

Need professional assistance with choosing the tech stack for your project?

Existek’s team is at your service. We’ll gladly share our experience in software development to select the best technologies and tools for your needs.

Cost estimates

When starting custom software development, the company also needs to answer how much it costs to create an app like Revolut. That’s essential to both understand needs and manage resources wisely. In many cases, businesses might have limited or tight budgets and try to keep within them.

Therefore, cost estimates are an inevitable aspect of the overall process. It commonly requires special attention from the involved parties. The development team has to provide the product owner with all the details regarding the project budget before the actual development starts. The accurate cost estimates can be provided after reviewing the project scope, estimating the timeline, finding developers’ rates, checking out the competition, and choosing engagement models. It’s worth saying that teams have to be very specific and consider so many cost details. For example, development rates could vary depending on the specialists’ expertise, experience, availability, and of course, locations.

Covering the basic functionality of the app like Revolut, we’ve received the following calculations. Take into account that estimates are done using the Eastern European rates that could be twice lower than in North America or Western Europe.

The development cost to present web and mobile applications from scratch could cost more than $300k and take more than a year to deliver. Besides, many teams prefer to integrate their apps with BaaS platforms. It allows them to decrease the development timeline to about six months, and development expenses will fluctuate between $100k and $150k for both mobile and web solutions.

BUSINESS MODELS: HOW TO MONETIZE AN APP LIKE REVOLUT

There are always some purposes behind the product implementation. And it’s fair to say that driving revenue remains among business goals. Spending time and resources on the app delivery should definitely be paid back. Teams take responsibility for evolving an efficient monetization strategy involving different business models to earn money within the app.

According to the latest statistics, the total transaction value has reached $8,502 billion in 2022. That’s explained by the fact that cutting-edge innovations and digital services continuously introduce new options for doing business. Revolut is a good sample of how to succeed in the market and gain your market share. Continuing on the question of how to create an app like Revolut, let’s discover some business models for making revenue.

Fixed commissions

That is the first business model to consider when following the example of the Revolut app. The main advantage is that this model supports customer choice. As long as the team offers several pricing plans, users can find suitable ones. Moreover, many teams introduce a free plan. Even though it has certain limitations, it helps to get engaged with customers. At the same time, you can target the different user groups and even specify them by category. For instance, Revolut has introduced two separate categories of plans – for both personal users and businesses.

Operation fees

That’s a straightforward option to monetize applications like Revolut. This model will charge users when they actually use a certain service or make some transaction. The team has to specify the fee rates depending on the type of financial operation, recipient country, number of transactions, etc. Also, teams can consider flat fees or charge based on the percentage model. Revolut applies this model when customers overuse the limit within their plans and want to complete additional transactions.

In-app advertising and referrals

The most popular business model for app monetization can also be applied to apps like Revolut. Of course, that won’t be the regular advertisements that we’re used to seeing in other apps. Digital financial services capitalize on the products and services by gaining users’ attention through native advertisements like recommendations or referral programs. Businesses often get compensation for promotions but remember that the reward programs can also encourage many new customers to increase revenue. For example, Revolut offers a welcome reward of $50 for using a registration code or link provided by affiliated partners.

Business collaboration

To deliver digital financial services, the business has to collaborate with a number of partners. It involves both traditional banking institutions and neighbouring providers. Successful collaboration allows the team to introduce the extended user experience and a wider range of services. Revolut has introduced the services like online shopping offers, airport lounge passes, integrations with other apps, etc. Therefore, there isn’t any limitation for partnership ideas if the team can transform them to the advantage of a business and users.

Business API and tools

If we talk about such a successful market player as Revolut, it’s worth mentioning that they went further to provide services to other businesses. They offer a set of business APIs to support payments and transactions for other teams. Also, Revolut introduces so many separate tools for a variety of needs like management of expenses, invoices, payrolls, etc. It means that the team never knows where they can get with their initial idea. Constant advancement allowed Revolut to go beyond the financial app and become the market aggregator of digital financial services.

When you start developing an app like Revolut, it’s important to consider different business models. The team doesn’t need to adopt everything simultaneously, but they can choose the gradual approach. Along with the app advancing, the company will be able to introduce new ways of monetizing its services and products.

IN CONCLUSION

Starting app development isn’t a simple task. Every team understands the importance of introducing a valuable market product and making it attractive to users. And sometimes, the presence of other similar applications could pose difficulties for some teams. It might seem complicated to overcome the popularity of already presented products. However, open competition often becomes a driving force for many companies. Following the best practices and adding unique goals allows them to bring successful products.

Therefore, building an app like Revolut can be attractive to numerous businesses. They have all the necessary tools and technologies to extend user expectations and continue introducing innovative financial products and services. Besides, there is no problem with entering the market as the team carefully plans to advance the digital services to a target audience.

Want to develop an app like Revolut?

Existek is a software development company with a decade-long experience in delivering custom solutions. We know how to implement your ideas through digital services and withstand the intense market competition.

Frequently asked questions

What is Revolut and why is this app so popular?

Revolut is a well-known app that provides a wide range of digital financial services worldwide. They manage to cover such fintech operations as payments, money transfers, currency exchange, saving vaults, investments, etc. Besides, they keep on introducing unconventional financial services and become a trendsetter in the fintech industry.

How to build an app like Revolut?

Like with any other project, you need to undergo the full-cycle development process. It involves setting the cross-functional team, defining project requirements, choosing the tech stack, designing and building the application and continuing its advancement.

What are the must-have features of the apps like Revolut?

One of the primary tasks in app development is to deliver great functionality. It has to meet the needs of every involved party and present workable solutions to them. In order to provide digital financial services like Revolut, the team has to implement the following features:

Registration

Accounts and cards management

Payment system integration

P2P payments

Smart budgeting

Advanced features

How much does it cost to create applications like Revolut?

Costs vary depending on many aspects like app complexity, chosen tech stack and development approaches, developers’ rates, engagement models, etc. The project expenses start from $100k to cover the basic functionality for an app like Revolut.