Updated: July 4, 2024

Published: March 19, 2024

Section 174 now formally defines software development as R&D expenses. How does this major alteration influence software companies? What should be discussed under section 174 software development? Check the blog post to find your answers and build your company’s strategy based on all the recent updates.

List of the content

- What is the recent section 174 news in 2024?

- Will the current tax bills revert to pre-2022 rules?

- How does section 174 impact the US tech market?

- What are the side effects of section 174 software development amortization?

- How does section 174 influence software companies and startups?

- Will changes to section 174 software development weaken the US tech market’s position?

- How can software companies prepare for section 174 changes?

- Conclusion

WHAT IS THE RECENT SECTION 174 NEWS IN 2024?

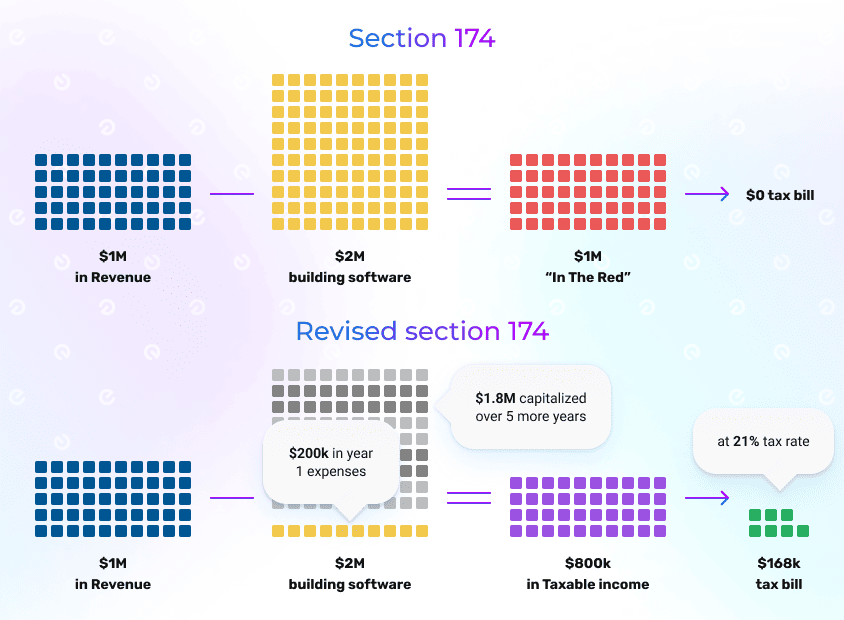

The revised section 174 has become a matter of growing concern to many businesses. For the first time in decades, they aren’t allowed to deduct R&D expenditures as an expense. Instead, they must capitalize these costs and amortize them over five years for domestic R&D and fifteen years for foreign R&D.

The amended section 174 has brought a number of sweeping changes. The main thing is that companies weren’t prepared to see such drastic increases in their tax bills. A large number of taxpayers have discovered that they have research and development activities scattered throughout their trial balance.

They might not initially consider software development since they aren’t strictly software developers, but in reality, they do engage in software development activities that qualify as R&D. These activities could involve creating a mobile app, implementing website features to boost sales, or developing supply chain management systems for managing business operations.

But what about software companies? They tend to be the first ones to feel the huge impact of the updated tax code legislation. There is no indication that Congress intended to alter the definition of R&D expenses, though they also included software development costs. Besides, all the research and development costs are no longer subject to deduction after December 31, 2021. That significant tax benefit helped so many software companies invest more intensively in research and development.

Looking for more specific details on section 174 changes?

We suggest checking our latest post on tax code 174 updates and what key aspects taxpayers, including software companies, should consider.

Even with the recent section 174 changes, the situation still seems unclear. Large and small companies keep a close watch on new guidance and eagerly anticipate further adjustments. For instance, everyone is waiting for the proposed bill HR 7024, which might postpone the requirement to capitalize on domestic R&D expenditures until tax years start after December 31, 2025. However, foreign expenditures remain without changes and need to be capitalized and recovered over a 15-year period.

Of course, more updates might be coming soon, but the fact remains that businesses need to be prepared to pay undeniably higher tax bills. Regardless of their size and specification, many feel the pressing need to review their financial and business strategies. Software companies were the ones taken by surprise when they realized the size of their taxable income in the upcoming years.

The requirement for mandatory amortization might be challenging for US taxpayers. Key industries such as technology, manufacturing, engineering, product development, and others are more than likely to have R&D expenses. The expenses deductible in previous years started to fall under the revised section 174. Software companies have to be prepared for the IRS to review returns and ensure that R&D expenses are properly amortized.

WILL THE CURRENT TAX BILLS REVERT TO PRE-2022 RULES?

That question comes up frequently, and some might even hope for a yes in response. On the other hand, to be objective, there is little chance of reverting to pre-2022 regulations.

Returning to the recent updates, only a few believed that tax change could become law. However, the Congressional negotiations to repeal the changes failed in December 2022, resulting in its enactment into law. The IRS continues to provide further guidance, including the part on section 174 software development.

Businesses have to realize that section 174 now applies to any taxpayer engaged in R&D activities. The IRS will look for compliance with the latest tax code updates for the tax years starting after December 31, 2021. In the immediate term, taxpayers have to account for the introduced changes and run the business in compliance with all the regulations. Eventually, there is little chance to expect a change in these rules.

Even though the recently proposed legislation HR 7024 could modify section 174, it would only postpone the mandatory capitalization of domestic R&D until after December 31, 2025. Foreign R&D expenses remain subject to capitalization over the 15-year period. In other words, the revised section 174 doesn’t fall under some new guidance; only the new terms can be expected. As a result, software companies feel the urgent need to get ready for the amended tax code. It’s always better to be aware of decisive aspects and prepare for the different outcomes.

Businesses should not underestimate the importance of discovering rigid specifications in section 174. It definitely streamlines the smooth and faster adaption of your business to the revised tax code regulations. Considering the current situation, they have no other choice than to follow the newly introduced rules. Moreover, most concerns are raised over the amortization of R&D expenses and the difference between domestic and foreign expenditures.

| Year | R&D expenses | Percentage use | Deduction |

| 2021 | $150 000 | 100% | $150 000 |

The main change refers to the point where businesses can no longer deduct the R&D expenses in the year they incurred them. That was a great opportunity widely used among businesses in various domains. Moreover, it was supported by the fundamental concept to encourage them to focus more on research and development. The results have always been positive since the US market is in a strong position to lead the technological advancements and innovations.

But how does new section 174 impact R&D expenses? When it comes to revised tax code treatment, there are specific rules regarding the capitalization and amortization of these expenses. For R&D expenses incurred within the United States, the general rule is to capitalize and amortize these expenses over a five-year period.

Amortization of domestic R&D expenses

| Year | Domestic R&D expenses | Percentage use | Amortization |

| 1 year | $150 000 | 10% | $15 000 |

| 2-5 years | 20% per year | $30 000 per year | |

| 6 year | 10% | $15 000 |

However, for R&D expenses incurred for research and development conducted outside the United States, the amortization period is extended to 15 years.

Amortization of foreign R&D expenses

| Year | Foreign R&D expenses | Percentage use | Amortization |

| 1 year | $150 000 | 3.3% | $5 000 |

| 2-15 years | 6.7% per year | $10 000 per year | |

| 16 year | 3.3% | $5 000 |

The concerns expressed by taxpayers refer not only to higher tax bills but also to a limited opportunity for business investments in development and research. Software companies might be experiencing both financial and business difficulties. At the same time, the workable solution is mainly related to the ability to adapt to the new section 174 and find the right ways to overcome rising difficulties.

HOW DOES NEW SECTION 174 IMPACT THE US TECH MARKET?

Section 174 plays a significant role in shaping the behavior of US tech companies regarding their investment in R&D and how they account for these expenses, ultimately influencing their competitiveness and innovation in the market.

Over 70 years, businesses undoubtedly relied on this regulation as it supported such distinctive aspects as tax incentives. The former sec.174 provided tax incentives for companies to invest in R&D activities by allowing them to deduct these expenses from their taxable income. This deduction helped reduce the after-tax cost of innovation, encouraging businesses to invest more in R&D. Besides, it impacted the competitiveness of US tech companies. The provision encouraged innovation and helped US tech companies compete globally.

If the new sec. 174 rules stay, businesses will increasingly question why the basic rules seem abandoned. The revised tax code regulation brought so many things into the discussion. Moreover, it objects to the main incentives for companies to be encouraged with research and development activities.

At present, businesses are required to capitalize on and amortize their R&D expenses over a specified period. That impacts their financial statements, as they must account for these expenses over time rather than in the period they are incurred. This ended up with a surprisingly huge tax bill in 2022. Of course, it was more manageable for software companies with more extensive cash reserves. Small tech businesses and new market players needed more time to be ready for these changes and became the ones who felt the impact the most.

Tech companies can hardly call it an excellent incentive to encourage research and development activities. They must comply with the rules and regulations outlined in section 174 when reporting their R&D expenses. This requires them to keep detailed records of their R&D activities and costs, which can be complex and time-consuming. They feel the pressing need to revise their financial and business strategies to ensure their presence in the market. Besides, the growth of innovation might be badly hit among the US companies.

It’s worth noting that it becomes harder to find the software businesses that haven’t been impacted by these changes. According to annual reports, the world-known tech giants paid a considerable amount of additional tax in 2023. For instance, Netflix reported $368 million in additional tax due to the new sec. 174. Of course, it was quite manageable for this business as the stated annual profit numbered $4.4 billion.

However, we can’t say the same about small market representatives, where the multi-thousand dollar tax bill could turn out to be highly problematic. Some experts express concern about the fact that the tax change encourages software companies with limited cash reserves to reduce their investment in research and development or alternatively, relocate their operations overseas.

WHAT ARE THE SIDE EFFECTS OF SECTION 174 SOFTWARE DEVELOPMENT AMORTIZATION

Amortizing R&D expenses over the years can be logical, but it’s workable only in specific scenarios. For instance, businesses with already launched software and acquired customers can reasonably predict demand and invest developer hours to maintain the product. The software engineer could create a new feature for the product to generate revenue for an extended period. That really makes sense to win a valid argument for treating software development costs under section 174.

At the same time, software development amortization won’t be that beneficial in many other cases. Thus, the US tech market faces some logical consequences. This is explained by the fact that section 174 had an immediate effect on businesses, especially software companies.

- Decreased hiring of software developers

Regardless of size, tech companies tend to hire fewer developers due to increased tax bills. Some software developers stated that it was ten times harder to get a job offer in 2023 compared to 2022. The job market is undergoing significant change, and redundancies might occur as a measure to manage cash flow, leading to the replacement of in-house specialists with vendors.

- Increased firing of non-US developers

The tax change significantly impacts specialists employed outside the US as their salaries are subject to deduction over fifteen years. If the software company doesn’t have substantial cash reserves, hiring or contracting individual software developers remotely may no longer seem logical.

- More tech startups outside the US

If a company considers launching a startup in the US or some other country, opting for another country could become more sensible. During the initial years of a startup, it’s common to incur expenses while developing something that may fail to succeed. However, due to new amortization rules in the US, these expenses will likely become taxable profits.

- Fewer chances for innovation

It’s especially relevant for small software companies and startups, which once heavily depended on immediate deductions of R&D expenses. They might face significant challenges due to the great impact on their innovation strategies and growth. These companies need to revise planning approaches and stay without the extra resources to invest more.

- Broader perspectives for vendors and SaaS companies

Software companies based in the US now have a compelling incentive to purchase software instead of developing it in-house. Besides, the tax change motivates them to increase vendor spending. This potentially leads to a scenario where they either refrain from hiring more developers or even reduce their current workforce.

It isn’t surprising to observe some experts express concerns about the side effects of section 174 software development. Businesses find themselves in a difficult situation when they have some doubt about whether to invest more in their products. It gets extremely hard for someone new to enter the software market and compete with established players. Without large cash reserves, companies might think twice about the investment in research and development.

HOW DOES SECTION 174 INFLUENCE SOFTWARE COMPANIES AND STARTUPS

Given the urgency of the new section 174, all US companies are now required to amortize domestic R&D costs over five years and foreign R&D costs over fifteen years. The potential adjustments to section 174 are currently uncertain, making it even more crucial to grasp the existing law and the current compliance obligations.

The new tax code rules have an immediate effect on software companies. They are obliged to comply with all the introduced changes and find ways to efficiently continue research and development activities. Considering the overall situation, the high tax bills are not the only thing that businesses have to be prepared for. A common concern is raised about the fall in value when investing in software development. Early-stage and small software companies have already found it extremely difficult to enter the software market and develop new products.

One key aspect that proponents of revised section 174 emphasize is that the business will recover costs over the outlined period. In the first year of expenditure, only 10% of domestic R&D costs and 3.3% of foreign ones are amortized into taxable income. This means that the negative impact is spread over six years instead of five and sixteen years instead of fifteen.

Furthermore, if the business continues to grow its revenue, the expenses associated with R&D activities will also increase. Although the incremental amount capitalized would decrease, the amount recorded on the balance sheet as capitalized would continue to rise rather than fall over time.

| 1 year | 2 year | 3 year | 4 year | 5 year | 6 year | Total | |

| Domestic R&D costs | $150k | $150k | $150k | $150k | $150k | $150k | $900k |

| Amortization (1 year) | ($15k) | ($15k) | |||||

| Amortization (2 year) | ($30k) | ($15k) | ($45k) | ||||

| Amortization (3 year) | ($30k) | ($30k) | ($15k) | ($75k) | |||

| Amortization (4 year) | ($30k) | ($30k) | ($30k) | ($15k) | ($105k) | ||

| Amortization (5 year) | ($30k) | ($30k) | ($30k) | ($30k) | ($15k) | ($135k) | |

| Amortization (6 year) | ($15k) | ($30k) | ($30k) | ($30k) | ($30k) | ($15k) | ($165k) |

The company will not have a chance to “catch up” until it ceases its R&D activities. That poses a situation where businesses face a no-win scenario. This provision seems to become more challenging as businesses have to plan their R&D investments more strategically and ensure long-term sustainability. They are no longer in a situation where the capital can be spent on enhancing, innovating, or developing new products and software. This is a concern that all companies, especially software companies, should take seriously and consider in their strategic planning.

Everyone involved in software development knows that creating software is an ongoing process that considerably depends on constant advancements and reviews. For many businesses, especially startups, it is almost impossible to overlook the outcomes and estimate their revenues even in one year. It isn’t a good idea to view section 174 software development through the lens of amortization applied to physical goods. It does not accurately reflect the nature of software products or their maintenance. It is even without mentioning that the spent R&D costs are subject to amortization over the required period, even if the startup doesn’t succeed and the company decides to stop the development.

The important point remains that the new tax code rules might have a significant negative impact. Many worry that software businesses are now less encouraged to invest in R&D activities as most attention is now taken by tax obligations and strategic planning. This basically makes companies take financial and business risks when creating new software. At the same time, it also prevents US businesses from competing globally.

WILL CHANGES TO SECTION 174 SOFTWARE DEVELOPMENT WEAKEN THE US TECH MARKET’S POSITION?

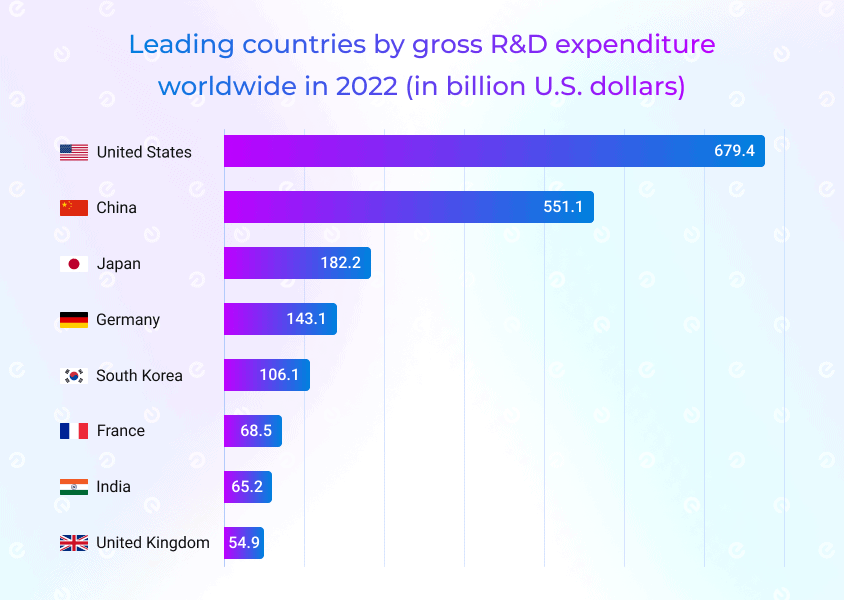

For many years, section 174 has been a crucial tool for numerous software companies, reducing their tax burden and fostering innovation. The US tech market, renowned for its ability to maximize benefits for its players, now faces an uncertain future. What if the revised changes to section 174 remain? The potential impact is alarming.

Besides the impact on individual business opportunities, many forget about the devastating impact on the US tech market. Software companies are trying to get Congress’s attention to look at the situation from their point of view. The main point is that investing in research and development is no longer valued on the market. They feel that it’s related to their small chances to experiment and introduce something new to the market.

At the same time, it could influence the competitiveness of the US market. Established players and early-stage companies are worried about their real opportunities to succeed under strict regulations. Besides, some businesses are no longer provided with a clear perspective on why to continue software advancements or launch their startups in the US.

Others could significantly benefit when the US market becomes less competitive due to changes in section 174 software development. This potential shift in market dynamics should serve as a wake-up call for the tech industry, urging it to take action to protect its interests.

As the global innovation hub, the US tech market is deeply concerned about potentially missing out on significant opportunities. While they recognize that the revised section 174 potentially benefits businesses and startups outside the US, they also fear the loss of business investments in innovation.

Have you ever thought why even the biggest market players invest in software development hubs outside the US? It is easy to come to the conclusion that their decisions have some logical reasons. For example, Google has made significant investments in its Swiss software development hub and continues to employ a substantial number of developers in Switzerland. It’s easily explained by the fact that this European country offers a compelling incentive for research and development. Companies can expense 135% of R&D-related salaries in the year they are incurred. As a result, the tax systems of some other countries, including Switzerland, can become a viable alternative, particularly with regard to current section 174 software development. If it remains unchanged, it would not be surprising if more US companies followed Google’s example and explored the possibility of establishing software development offices and startups outside the US.

One of the world’s biggest tech markets is undergoing significant changes. Of course, the US government encourages and advances research and development in diverse industries like healthcare, biotechnology, and energy. They offer funding, grants, and collaborative programs to foster innovation in these areas. At the same time, many other companies find it necessary to be ready for quite different outcomes and build their new strategy to stay in business.

HOW CAN SOFTWARE COMPANIES PREPARE FOR SECTION 174 CHANGES?

As time passes, there is no point in waiting just to see whether or not section 174 will be reversed. Businesses don’t have an opportunity to waste time and resources. They had better prepare themselves for new tax rules to minimize future risks. It’s crucial to stay informed and strategize to safeguard your business. As a result, it helps your company to innovate under favorable conditions.

The first thing to remember is that the current changes notably affect a business’s tax liability, making it crucial to comprehend them before filing your taxes. This has already led to a decrease in federal tax benefits because businesses aren’t able to deduct R&D costs at the 21% corporate tax rate. Some companies apply to utilize the R&D tax credit available under section 41 as it can partially mitigate the loss of deductions. A clear decision is to consult with your tax professionals to see how to benefit from it. Besides, they can take responsibility for documenting R&D activities and filing taxes in compliance with new regulations. Starting from the tax year 2023, all research and development expenses within the year must adhere to these rules.

The other thing is that companies still have the possibility to open up new opportunities. It mainly refers to situations where the revised business strategies could shed light on something that hasn’t been considered before. Software companies can go for some of the following options:

- Lean startup methodology

In many cases, starting software development from scratch will be considered an R&D activity. It entails building a new, innovative asset amid significant uncertainty. At the same time, there are alternative approaches to consider. Rather than investing years in R&D to launch the startup only when it has all the advanced functionalities, it’s recommended to adopt the lean startup approach. This method involves concentrating on a basic version of the product (MVP) with minimal initial investment. Subsequently, the team has the ability to refine and expand the app based on user feedback, our strategies, and market dynamics, as well as manage their resources properly.

- Outsourcing

It’s a common practice to reduce initial R&D expenses by outsourcing some processes to another company. This allows businesses to cut costs on the in-house workforce as they engage developers at more reasonable rates, especially outside the US. The rates are typically 40-60% lower compared to hiring in-house developers in the USA. The only thing is that outsourcing still necessitates amortizing costs over 15 years. Therefore, the service provider can initiate R & D as part of its own project, and then the provider can claim it, but your company has no claim.

- Foreign subsidiary with IP rights

Some businesses choose to have a subsidiary company overseas. Thus, they can avoid US amortization requirements under section 174 software development with the most straightforward approach to transfer the IP to a foreign subsidiary. The US company no longer possesses the asset and thus is not subject to amortization requirements. However, it can continue its operations and R&D activities and earn revenue from the asset. When a foreign subsidiary acquires IP rights, it should amortize the costs of the acquired IP rights based on the laws of the host country. This strategy is already being adopted by newly established VC-funded startups.

- Tech startups outside the US

Another approach is to assess whether the business might be more successful starting in another country. Additionally, backing a startup and observing its ability to dominate its domestic market before increasing investment can validate its concept and lead to significant cost savings. This practice aims to demonstrate that non-US startups possess distinct advantages and can present a feasible investment prospect as they expand. And it’s apparent that the startup doesn’t fall under the US tax rules.

The amendments to the tax code pose some challenges, especially for small businesses, early-stage companies, and tech startups. Moreover, experts started to raise concerns that it also significantly hinders innovation processes in the US. Nevertheless, businesses find ways to enhance tax planning, implement reasonable strategies, and bolster innovation in response to the revised regulations.

CONCLUSION

The revised section 174 requires many companies to carefully examine their balance between fiscal responsibility and innovation. As a result, it has significantly impacted these players’ business strategies and financial paths. Since they face limitations or specific regulations concerning Section 174 software development, they need to carefully plan their R&D activities. It’s time to realize there’s little chance to expect other tax code regulation updates soon. Moreover, a clear understanding of the new legislation and meticulous planning will help your team optimize tax liabilities and continue innovation.

Are you interested in partnering with a professional provider of custom software development services?

We are an experienced offshore software development company with a proven track record in creating tailored solutions for diverse industries. Contact our team for a consultation to address your unique business requirements.

Frequently asked questions

What is the revised section 174 software development?

After December 31, 2021, any US company is required to categorize all software development costs as R&D expenditures and can no longer deduct them in the year they incur them.

What R&D expenses are subject to the new 174 section?

Due to section 174, R&D expenses now include salaries, materials, supplies, patent costs, overhead expenses, and contract research expenses.

What are the side effects of section 174 software development?

The experts emphasize the following effects, including

Less hiring

Firing of non-US specialists

More non-US startups

Less innovation within the US tech market

Higher demand for SaaS companies and vendors

What are some alternative options to prepare for changes in section 174 software development?

Businesses can consider the following options:

Lean startup methodology

Outsourcing

Foreign subsidiary with IP rights

Tech startups outside the US