Updated: July 4, 2024

Published: March 5, 2024

Why is section 174 so widely discussed among U.S. tech companies? What are the major changes, and how do they prepare for them? Read the article to discuss more details on section 174 capitalization and outline the significant aspects for consideration.

List of the Content

- What is section 174?

- What are section 174 changes?

- Which businesses are required to adhere to section 174 capitalization?

- What R&D activities are qualified under 174 section?

- What are section 174 expenses?

- How to prepare for new sec. 174?

- Conclusion

WHAT IS SECTION 174 OF THE IRS?

For almost seven decades, U.S. businesses could deduct their research and development expenditures as an expense in the year they incurred them. It was under the IRS 174 section passed by Congress in 1953, allowing taxpayers to do that for expenses incurred after December 31, 1953.

The primary purpose of section 174 was to incentivize taxpayers to engage in research and experimental activities by removing uncertainty about how these expenses would be taxed. They encouraged research as a fundamental activity necessary for developing and advancing new technologies, techniques, products, and equipment.

However, the Tax Cuts and Jobs Act of 2017 brought significant section 174 changes in how R&D expenditures are treated for tax years starting after December 31, 2021. The sweeping changes were scheduled to take effect five years later, in 2022.

Initially, most experts anticipated that Congress would either postpone the amendment to a later date or eliminate it entirely. However, Congressional negotiations to repeal the changes broke down at the last minute in December 2022, resulting in its enactment into law. In 2023, companies monitored new guidance on research expenditures and expected additional modifications to it.

The revised section 174 requires businesses to capitalize on research and development expenditures instead of deducting them as expenses. These costs must be amortized over five years for domestic corporations and fifteen years for foreign ones. Furthermore, all software development costs are now treated as R&D expenditures, removing the option to amortize specific software over three years.

| Former section 174 (the same for domestic and foreign R&D) in 2021 | New section 174 (all domestic R&D) in 2022 | New section 174 (all foreign R&D) in 2022 | |

| Revenue | $150 000 | $150 000 | $150 000 |

|

R&D expenses |

$150 000 | $15 000 | $5 000 |

| Taxable income | $0 | $135 000 | $145 000 |

| Federal corporate tax rate | 21% | 21% | 21% |

| Corporate tax due | $0 (due in 2022) | $28 350 (due in 2023) | $30 450 (due in 2023) |

As the tax change was originally not intended to be enacted into law, section 174 changes have faced broad disapproval, resulting in several unsuccessful efforts to restore the law to its pre-2022 state. Besides, section 174 capitalization is under much discussion, and the market closely monitors new updates.

As for the latest news, the U.S. House of Representatives passed HR 7024, the Tax Relief for American Families and Workers Act of 2024, on January 31, 2024, aiming to address planned adjustments in business taxation as outlined in the Tax Cuts and Jobs Act, along with other provisions. The proposed legislation also suggests changes to section 174 to postpone the compulsory capitalization of domestic R&D expenses until tax years starting after December 31, 2025. However, foreign R&D expenses would still require mandatory capitalization and would be recovered over a 15-year period. Many assume that the chances of it being passed are slim.

Therefore, companies are keeping their finger on the pulse of section 174 news. The main thing is to be prepared for changing conditions and learn all the details regarding the possible changes.

WHAT ARE SECTION 174 CHANGES?

In this article, we aim to discover all the specifics of sec. 174 and how it can impact businesses shortly. As we’ve already reflected a bit on section 174 changes, we’d like to draw more attention to the most critical updates.

December 22, 2017 – The Tax Cuts and Jobs Act altered 174 section to increase revenues. One major change was the elimination of immediate deductions for section 174 expenses, requiring taxpayers to capitalize these costs and recover them through amortization over five or fifteen years, depending on the location of the expenditures.

December 2022 – The IRS released Rev. Proc. 2023-8 on December 12, 2022, detailing accounting method change procedures for companies required to capitalize and amortize these expenses. Rev. Proc. 2023-11, issued on December 29, 2022, amended these procedures for post-2022 changes related to audit protection.

June 15, 2023 – Rev. Proc. 2023-24 provided an updated list of changes to automatic accounting methods, including those from Rev. Proc. 2023-11 for section 174.

September 8, 2023 – Notice 2023-63 addressed issues surrounding section 174 post-TCJA amendments. This notice was particularly helpful for taxpayers preparing their current year tax returns, as it clarified areas that had been unclear in previous guidance.

December 22, 2023 – Notice 2024-12 provided further clarification and adjustments to Notice 2023-63, which initially announced the Department of the Treasury and the IRS’s plans to propose regulations regarding the capitalization and amortization of expenditures under 174 section. Notably, this notice specifically elucidates the previously issued guidance concerning contract research providers and updating the procedures governing changes to accounting methods.

January 31, 2024 – HR 7024, passed by a vote of 357-70 of the U.S. House of Representatives, contains a provision for the repeal of section 174. However, it’s still uncertain whether this bill will be passed by the Senate.

So what’s next? This is understandably the question at the forefront of everyone’s minds and perhaps the most challenging one to address. Despite bipartisan support in Congress for restoring full R&D expensing, reaching a compromise on other tax issues and assembling a legislative package that includes a section 174 fix is proving to be difficult.

The recent legislation the House Ways and Means Committee put forth could be a step toward restoring full R&E expensing; however, there is still a lengthy legislative process ahead in Congress. The inclusion of a retroactive fix for tax year 2022 remains uncertain. The complexities of section 174 have been further compounded by new rules that require potential R&D expenditures to be assessed and often capitalized. Consequently, organizations must continue to adhere to the capitalization requirement for the time being.

Want to know how section 174 capitalization will impact the software development industry?

Read our article on the new tax conduct in the tech industry and how companies can overcome these new challenges.

WHICH BUSINESSES ARE REQUIRED TO ADHERE TO SECTION 174 CAPITALIZATION?

This question often arises as some may run into difficulties in identifying R&D activities and assigning associated costs, which cannot be easily linked to a specific entry in a company’s general ledger. Furthermore, taxpayers have to consider expenses related to software development, which may not have previously been considered as such type of activities.

As long as 174 section applies to any taxpayer involved in R&D activities, the latest regulations could substantially affect the company’s financial statements and cash flow. If the business operates in the technology or manufacturing sectors and engages in extensive research, it could generate taxable profits rather than incurring a tax loss. Furthermore, expenses they have previously deducted for research won’t be deductible in the upcoming years.

The point is that section 174 changes impact every taxpayer with R&D spending. It contains no exceptions to the imposed requirements on capitalization. It doesn’t make any difference whether the business has $15k or $10m in R&D, these expenses must be capitalized. Regardless of the industry specifications or the company’s size, here’s the list of businesses required to adhere to section 174 capitalization.

Corporations

Since many corporations accumulate eligible R&D expenses, sec. 174 requirements are the subject to be fulfilled. As they govern the treatment of certain costs related to research and development, corporations won’t be an exception to adhere to these rules. However, these tax changes are considered to remain manageable for large companies with stable incomes.

Small companies, including startups

Small businesses and startups usually heavily invest in R&D and, consequently, are the most impacted by new regulations. They must capitalize or amortize their research expenses, irrespective of their current profitability status. These companies express common concerns about paying much higher tax bills.

What is a stealth startup?

Explore the concept of the stealth startup, its unique characteristics, and strategies for effectively leveraging it to suit your specific business needs.

Sole proprietorships, partnerships, and LLCs

While the specific legal requirements for business structures may vary, the tax treatment of expenses under 174 section generally applies to all types of businesses subject to federal income tax. Therefore, sole proprietors, partnerships, and LLCs must follow new rules to fulfill their tax obligations.

Pass-through entities, including S-corporations

Pass-through entities, such as S-corporations, do not pay federal income tax at the entity level. Instead, income, deductions, and credits are passed to the shareholders and reported on their tax returns. Compliance with section 174 ensures that these entities appropriately capitalize expenses related to tangible property and report them accurately on the shareholders’ individual tax returns.

Failure to adhere to section 174 capitalization rules can lead to penalties and interest on underreported tax liabilities. Therefore, it’s crucial for corporations and other businesses to comply with these rules and to seek guidance from tax professionals if needed.

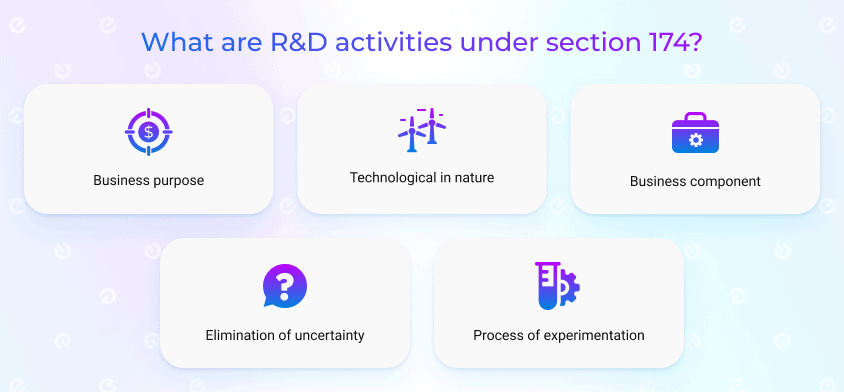

WHAT R&D ACTIVITIES ARE QUALIFIED UNDER SEC. 174?

In light of discussing the topic of the 174 section, it’s impossible to disregard the part defining R&D activities. It’s necessary for businesses of all sizes and structures to know what things are regarded as research and development.

According to IRC, these activities fall under specific criteria outlined in the tax code and related regulations. If they are classified into some of the following categories, they will qualify for the section 174 capitalization.

- Business purpose

The common purpose is about getting some product, process, software, technique, or invention to be held for sale, license, or use by the company in a trade or business. It includes but is not limited to products and services directly offered to customers, internal tools and processes, and intellectual property assets. The primary goal is to create value for the company by improving its offerings, operations, or competitive position in the market. This research should align with the company’s strategy and contribute to its growth and success.

- Technological in nature

Technology and software companies face a particularly daunting challenge as they navigate the complexities of realizing that they now amortize expenses related to software development. Section 174 changes lead to a significant rise in taxable income for many such businesses that can no longer deduct certain expenses. The transition may necessitate a thorough review of their financial strategies and operational models to ensure compliance and mitigate any adverse impacts.

- Business component

R&D activities include implementing a new function or advancing an existing software functionality. The company focuses on the product or service’s performance, increases reliability, and generally improves quality. This validation process often involves thorough testing, analysis, and possibly user feedback to ensure that the proposed changes deliver the intended benefits without compromising other product or service aspects.

- Elimination of uncertainty

Companies are required to thoroughly document and report the intended goal of their research related to product development or enhancement. That encompasses uncertainties regarding the optimal design of a product or process. It underscores the importance of clarity and precision in documenting the research’s purpose.

- Process of experimentation

The qualified activities encompass an experimental process, requiring an evaluation phase to explore and contemplate different approaches for achieving a desired outcome. The process should be rooted in technology and fundamentally grounded in the principles of physical or biological sciences, engineering, or computer science at its core.

If the activities meet these criteria, they will qualify as R&D and become subject to section 174 capitalization. Therefore, all the taxpayers engaged in these activities started to grasp the potential impact of the new regulations and specific calculations within other code sections. Due to these consequential impacts, taxpayers may find it necessary to precede the new tax section 174 requirement during tax preparation. The changes have raised a particular concern as many businesses find R&D vital to remain competitive, though not everyone is prepared to pay higher tax bills.

WHAT ARE SECTION 174 EXPENSES?

Due to the major section 174 changes, expenses incurred in the research and development process are no longer eligible for immediate deduction in the year they are incurred. According to the tax treatment, R&D expenses must be capitalized and amortized over the defined period.

At this point, we’ll need to outline the key difference within section 174 capitalization. The R&D expenses incurred for research and development conducted outside the United States must be amortized over a 15-year period instead of the standard five years.

Domestic vs foreign R&D expenses

| Total | $150 000 | $150 000 | $150 000 | $150 000 | ||

| Domestic R&D Expenses | Foreign R&D Expenses | |||||

| Capitalization | Amortization | Net Addback / Deduction | Capitalization | Amortization | Net Addback / Deduction | |

| 1 year | $150 000 | $15 000 | $135 000 | $150 000 | $5 000 | $145 000 |

| 2 year | $30 000 | $30 000 | $10 000 | $10 000 | ||

| 3 year | $30 000 | $30 000 | $10 000 | $10 000 | ||

| 4 year | $30 000 | $30 000 | $10 000 | $10 000 | ||

| 5 year | $30 000 | $30 000 | $10 000 | $10 000 | ||

| 6 year | $15 000 | $15 000 | $10 000 | $10 000 | ||

| 7 year | $10 000 | $10 000 | ||||

| 8 year | $10 000 | $10 000 | ||||

| 9 year | $10 000 | $10 000 | ||||

| 10 year | $10 000 | $10 000 | ||||

| 11 year | $10 000 | $10 000 | ||||

| 12 year | $10 000 | $10 000 | ||||

| 13 year | $10 000 | $10 000 | ||||

| 14 year | $10 000 | $10 000 | ||||

| 15 year | $10 000 | $10 000 | ||||

| 16 year | $5 000 | $5 000 | ||||

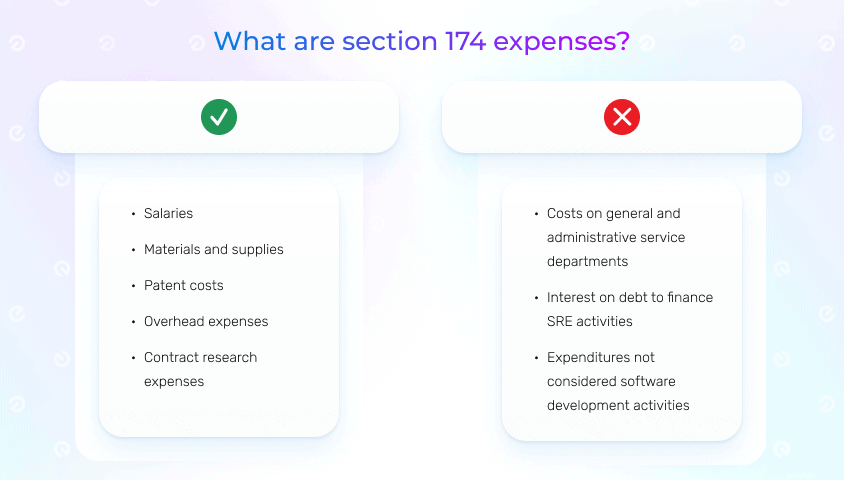

According to tax code 174, capitalized expenses encompass not only qualified expenses for calculating the tax credit but also indirect costs linked to research and development activities. These indirect costs comprise common overhead expenses like facility rent and utilities. Moreover, expenses related to software development are subject to capitalization. So, we’ve decided to address the next important question of how to help you define section 174 expenses.

What costs are subject to section 174 capitalization?

All research and development expenses can fit into specific categories. It’s necessary to check what costs are subject to capitalization and amortization after December 31, 2021.

- Salaries

That typically includes the payments made to employees in exchange for their work. It can encompass base salaries, wages, bonuses, commissions, and any other forms of compensation directly related to employment.

- Materials and supplies

It covers the costs associated with acquiring necessary goods for business operations, including equipment, software, maintenance supplies, etc.

- Patent costs

It generally refers to the expenses incurred in obtaining and protecting a patent, including attorney, filing, maintenance, and other related costs.

- Overhead expenses

These are the ongoing business costs that are not directly attributable to creating a product or service. They include rent, utilities, and other general expenses.

- Contract research expenses

Research costs conducted by a third party on behalf of a company can also be capitalized. That includes payments for services, materials, equipment, and other related expenses directly associated with the research project.

What costs can be excluded from R&D expenses?

Taking into account the above-mentioned expenses, companies should be aware of some other costs that are not classified as R&D expenditures. As a result, they aren’t subject to section 174 capitalization and typically include the following:

- Overall management and business administration costs

Expenses related to G&A service departments are generally not considered R&D expenses. They are necessary for the operation of a business but not directly related to the process of experimentation or research. For example, it covers costs associated with accounting and HR personnel.

- Interest payments on debt to finance SRE activities

The research tax credit under section 41 encourages businesses to invest in research and development by providing a tax incentive for these expenditures. This credit allows companies to claim a portion of their qualified research expenses, including supplies, wages, and contract research costs directly associated with R&D activities.

- Other expenditures that do not fall under 174 section

Certain expenses may not be considered software development activities under section 174 for various reasons. These typical examples include:

- Software installation

- Training stakeholders and employees in software usage

- Qaulity control testing

- Distribution, marketing, and customer support

- Promotions and advertising

- Consumer surveys

- Inputting content and website hosting

- Research for literary, historical, or similar projects

It’s essential for companies to accurately identify and account for all categories to ensure compliance with tax regulations and financial reporting requirements.

WHAT IS THE REACTION OF BUSINESSES AND HOW TO PREPARE TO NEW SEC. 174?

Navigating the ever-changing landscape of tax law has always been a challenging task. The revisions to IRC sec. 174 are poised to impact a broad spectrum of businesses and industries. Organizations that heavily invest in research and development experience the most pronounced effects of these changes. They are among companies that end up with taxable profits instead of tax losses. Additionally, research expenses that were previously deductible are no longer deductible in future years.

Tax code 174 modifications have raised considerable concern. Many companies realize that it can negatively impact their ability to grow and innovate their business operations. Especially for startups and small organizations, when income is low in their initial years, they frequently rely on immediately expensing their R&D costs to offset expenses. This approach helps them sustain a more robust cash flow to support ongoing operations.

As for big tech companies, it is more manageable to undergo changes with large cash reserves. They have many more opportunities to adapt their operations and continue research and development activities. At the same time, like any other company, they’ve already been affected by sec 174 changes. For example, Microsoft stated it would pay $4.8B in additional taxes in 2023.

It isn’t surprising that the question “Will section 174 be repealed?” is still under discussion. Some may even maintain hope for positive changes. Businesses continue to express their concerns even though the new regulations are under active legislation. Large enterprises like Microsoft, Intel, Amazon, and others tend to address this type of question through coalitions, trade groups, and lobbyists. They established the US R&D Coalition in 2018 to push for a reversal of this particular change, but it has succeeded so far.

Since Congress is in the process of navigating a complex tax package, there is new hope for congressional action on sec 174. Businesses are encouraged to write or call their representatives and senators in Congress to express support. Not many hope for section 174 repeal. Whereas they commonly request to retroactively extend the effective date to include amounts paid or incurred in tax years starting after December 31, 2025. The extension would enable businesses to continue expensing R&D costs for several additional years. It would simplify tax compliance and reduce confusion regarding R&D cost identification.

As a result, all these modifications started to alter how businesses approach their R&D investments. That may necessitate strategic adjustments not only to their financial planning but also to keep their business on track. They need to prepare for all the possible outcomes, whether section 174 changes or remains unchanged.

- The first thing is that the company needs to stay informed about the latest legislation and learn all the related details.

- Next, they have to review R&D activities and how they are impacted by sec. 174.

- Planning is an inevitable part of examining financial implications and reducing the final impact.

- Last but not least, a review of applied business models might be needed. Actually, it is not excluded that finding contractors and service providers or even starting a company outside the US could become a reasonable solution.

As for now, both large and small companies have to be prepared for any outcome. It’s essential to find a strategic approach to undergo the significant changes and make their impact as negligible as possible.

CONCLUSION

Considering all the aforementioned changes, new sec. 174 definitely makes a significant impact on businesses. In the current scenario, companies need to transition from incurring a tax loss to generating a taxable profit. Additionally, expenses that they have historically deducted for research are no longer deductible in the upcoming years. It’s crucial to carefully assess these potential impacts, adjust financial planning accordingly, and consider new research and development strategies.

Looking for a business partner outside the US to apply for software development services?

Existek is an established provider with extensive experience in developing custom solutions to meet customers’ needs across different domains. Get in touch to have a professional consultation and discuss your business-specific needs.

Frequently asked questions

What has changed in the tax code 174?

Expenses from research and development activities are no longer immediately deductible in the year they occur. Instead, R&D costs must be capitalized and spread out over a specified period for tax purposes.

Do companies have to comply with section 174 changes?

Yes, new sec. 174 applies to all taxpayers engaged in R&D activities.

Does state conformity impact the 174 section?

State conformity to the federal tax code requires a state-by-state review. Some states automatically conform to changes in the federal tax code for state income tax purposes, while many others adhere to fixed-date conformity or only conform to explicitly listed provisions. For instance, Tennessee has passed legislation to separate from the federal capitalization rules outlined in section 174, permitting immediate expensing at the state level. It’s only up to the state to consider or implement similar measures to detach from federal capitalization rules in the 2024 legislative sessions.

How does section 174 impact software companies?

With the current changes, sec.174 now specifically includes software development as a qualifying R&D expense. Therefore, these companies have to be ready for substantial R&D costs and, consequently, higher tax bills.