Updated: June 27, 2024

Published: November 22, 2017

The new age of cryptocurrencies is booming more than most could imagine, and like every emergence of a succeeding development, many want to get involved with it. However, this can be difficult, especially if the aim is to get rid of you. Cryptocurrencies’ main agenda has been to exclude the middlemen, who, this time, are the central banks.

List of the Content

- How cryptocurrencies affect central banks

- How banks can adopt cryptocurrencies

- How official financial institutes may benefit from the digital currencies

- The future of cryptocurrencies in banking

- Conclusion

Even with the promised threats of the fall of digital coins made by the central banks while trying to protect their operations, online digital currencies have swiftly scaled up at the financial institutions’ watch. It has thus become impossible for them to ignore the new era of virtual money.

HOW THE EMERGENCE OF DIGITAL COINS HAS AFFECTED GUARDIANS OF OFFICIAL MONEY

Since the introduction of financial tech, central banks have perceived it as financial terrorism from the risks they pose to their operations as guardians of the official money. Central banks have acted as regulators over the money supply for years until the development of crypto money, which has attracted their clients, thus reducing their control as the overseer of the money supply. Digital money is overseen on a distributed ledger as opposed to the conventional banking system, where all operations are maintained within the banking systems.

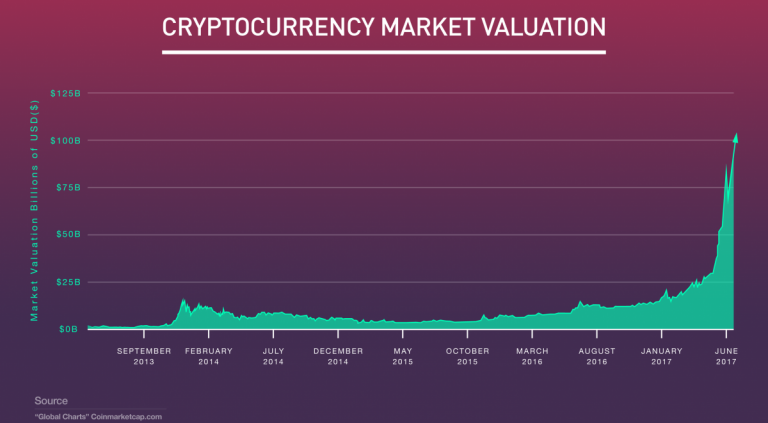

Though many most central banks take solace in it as a fad, cryptocurrencies have really accelerated in their prominence as of 2017, making these central banks concerned about their future. With central banks controlling the prices or the units of the quantity of the fiat currencies, the digital coins supersede this fact and are not in command of a certain entity. Being self-dependent, the worth of the currencies is what is dictated by their markets as stated on the distributed ledger and does not pose any instances of hacking.

The financial stability of digital coins is another factor that financial institutions are quite uncertain about whether to go all in or just watch from afar. They believe that these digital coins don’t have a longer lifespan as compared to the fiat currencies they deal with. Currently, financial institutions believe that the implications of lacking financial stability and lack of an overseer apart from Blockchain technology would be farfetched. The financial institutions believe that with the emergence of a bubble, like in 2008, the cryptocurrencies would be crumbling down. For the year 2017, Bitcoin has been very fluctuating, though by gaining value. This might be against all the worries of these financial institutions.

All these aside, financial institutions will still want a piece of where the money goes, and some banks have already started showing interest while others are actually running trials to achieve the use of these cryptocurrencies. The People’s Bank of China is a great example of banking that is adopting the new wave where it has created a virtual coin whereby it makes fake transactions with some financial institutions in the country to study their digital coin. The European Central Bank, together with the Bank of Japan, have launched joint research to try and assess the possible use of a distributed ledger in their transactions. The Dutch Central Bank has internalized the Blockchain technology and has created its own cryptocurrency but only for internal use within the bank so that they could better understand how the digital coins work.

WAYS IN WHICH BANKS CAN ADOPT CRYPTOCURRENCY

So the question of how banks can adopt cryptocurrencies begs. The guardians of official money have not only noted the momentum made by the digital currency but are now making efforts to penetrate this ecosystem. Some experts have expressed their concerns about the readiness of financial institutions to adopt and regulate cryptocurrencies claiming that they are not ready at all to be in such a position to regulate or even indulge in the currencies. But the need to level up to the financial trends is a thing financial institutions are in haste to achieve, and they are using two methods as described below.

Adoption or introduction of a digital currency

Banks have opted to take digital currency head-on by adopting Blockchain technology in their operations. Having digital currencies in their transactions keeps them relevant and in the trend, ensuring that most of their customers would definitely stick with them. Depending on their choice of operations, banks have two ways around this.

To begin with, some financial institutions have opted to add cryptocurrencies as another payment method. Banks can choose a digital coin they want to use, though most would prefer Bitcoin due to its popularity among many customers. For example, The Norwegian Skandianbanken, the largest online bank in Norway, has formulated a means by which its customers can now add their Bitcoin wallet.

With this, banks can use these wallets as payment methods but will not transact with this reserve at this time. Their customers could receive payments in Bitcoins but can’t send or pay with Bitcoin from their accounts. Although, Skandianbanken officials say that they evaluate the option to give their account holders this functionality from legal and technical perspectives. Still, this approach ensures that these financial institutions still maintain being the custodians of money.

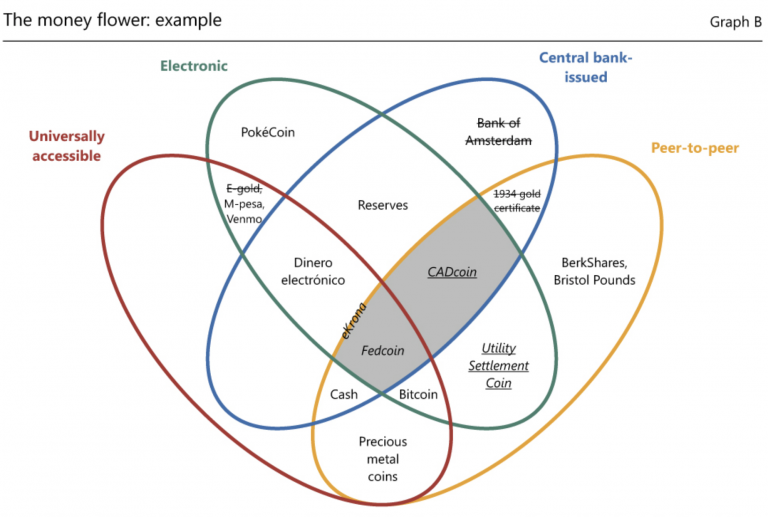

Secondly, banks can opt to introduce their own crypto coins. Being on an openly distributed ledger, banks use Blockchain technology to introduce their own coin that they would offer their customers, either under Bitcoin, Litecoin, Ethereum, or whatever digital wallet of their choice that their customers would use. This would streamline the payment mechanisms for institutional purposes, ensuring that it is in the same currency.

Recently joined by Barclays, Canadian Imperial Bank of Commerce, Credit Suisse, MUFG, HSBC, and State Street USC is a digital cash instrument that is asset-backed that was designed to be used by global institutional financial markets. It comes with major currency variants of the Euro, British Pound, US Dollar, Swiss franc, etc., where it is convertible upon the corresponding fiat currency upon request. If one wishes to spend their wealth in USC, the expenditure will be paired with its equivalent in the fiat currency.

Improvement of existing banking and payment systems

Faster or real-time payments, ease of sending money, minimal transaction charges, convenient and ideal online portals, convenient mobile wallets, you name it, these are the factors that the digital coins have the upper hand over banks. They, on the other hand, are forced to level up by these factors in order to ensure that it maintains their customers.

“Using blockchain technology–which employs a form of DLT–and an open architecture, Bitcoin allows for the transfer of value (bitcoins) between participants connected to its ecosystem without reliance on banks or other trusted intermediaries.”

Jerome Hayden Powell, member of the Federal Reserve Board for the “Innovation, Technology, and the Payments System” Speech

Customers are always looking for ease of doing business or transactions, and the digital currency world is really attracting them. Banks could opt to reduce their transaction costs while improving the timeliness of their transactions while also cutting charges of transactions but still failing to match up to the digital currencies. The idea behind most digital coins was the elimination of an intermediary, that is, the banks, but if banks would achieve reducing these impediments, they have an upper hand of being experienced and known as the money handlers and would stand a better chance too.

How to create a cryptocurrency exchange?

Find out more details about creating a cryptocurrency exchange and how much it could cost.

HOW DO BANKS BENEFIT FROM FACILITATING THEMSELVES IN WORKING WITH CRYPTOCURRENCIES?

Definitely, there is a great pool of advantages that the banks will derive by working with digital currencies. Since the invention of Bitcoin, it has never been hacked or cracked, and if banks used such a technology in their business model, it would be a real tool for the trade to them.

So what benefits do the banks accrue for adopting digital currencies in their day-to-day operations?

- Adopting digital currencies will ensure their longevity in the financial scene. Banks now realize that the future is in digital currencies, and that’s where they should be.

- The adoption and inclusion of cryptocurrencies reduce the costs of operations as well as minimize the labor costs the banks incur.

- With the numerous cases of insecurity, scheming, and laundering that conventional banks face, cryptocurrencies will offer a stable and uncracked currency. This guarantees the security of the banks and their investments too.

- Banks will get to retain the trust of their customers. Since banks heavily rely on the customers’ transactions, having a digital currency that their customers could transact in that would be internationally acknowledged greatly boosts the trust of the customers in the bank.

- Banks get to broaden their market base to an international scale since a wider scope can now access their digital currency, and this aids in the bank’s expansion.

THE FUTURE OF CRYPTOCURRENCIES IN BANKING

The future of cryptocurrencies in banking is a topic of significant interest and debate among industry experts. While some predict that cryptocurrencies will become a mainstream payment method, replacing traditional currencies altogether, others believe that their future will be more limited.

One of the main challenges that cryptocurrencies face in the banking industry is regulatory compliance. As cryptocurrencies are not yet fully regulated, banks are hesitant to adopt them fully, and it remains to be seen how regulators will approach them. Governments around the world are currently grappling with the issue of how to regulate cryptocurrencies, and it is uncertain how these regulations will affect the adoption of cryptocurrencies in the banking industry.

Another challenge for cryptocurrencies is their security concerns. Cryptocurrencies are prone to hacking and fraud, and banks need to ensure the security of their customers’ funds. While there have been several high-profile hacks of cryptocurrency exchanges, it is important to note that banks are also vulnerable to cyberattacks. Therefore, banks need to invest in robust security measures to protect their customers’ funds and transactions.

Despite these challenges, there are several potential benefits of cryptocurrencies in the banking industry. One of the most significant benefits is their ability to facilitate cross-border transactions quickly and at a lower cost than traditional banking methods. Cryptocurrencies can also increase financial inclusion by enabling financial service access for the unbanked population. This is particularly relevant in developing countries, where traditional banking infrastructure is often lacking.

Another potential benefit of cryptocurrencies in banking is their ability to reduce transaction costs. Banks currently charge significant fees for cross-border transactions, and cryptocurrencies have the potential to reduce these costs significantly. Furthermore, cryptocurrencies can provide greater transparency and accountability in financial transactions, which can help to prevent fraud and money laundering.

Overall, the future of cryptocurrencies in banking remains uncertain. While there are several potential benefits to their adoption, significant challenges also need to be addressed. As such, it is important for the banking industry to continue exploring cryptocurrencies and finding ways to overcome the challenges associated with their adoption. Only then can we begin to see the potential benefits of cryptocurrencies realized in the banking industry.

CONCLUSION

Since banks know they have very little control over the cryptocurrency world and know they can do very little to regulate the cryptocurrencies, central banks are now warning about the risks of using these currencies. This is in order to achieve an upper advantage over their conventional ways of doing business as opposed to distributed-ledger technology. The inclusion and adoption of cryptocurrencies by banks have been rather slow, but some banks are actually actualizing it, and it is still in baby steps. Banks have as well expressed their confidence in Blockchain technology, with most having prospects of either creating their own currency or adopting existing cryptocurrencies as a payment method. Cryptocurrency technology is rather new in the banking scene, with most banks still opposed to the concept of digital currencies, so the banks willing to take on this risk should capitalize at the moment rather than when they are out of business.

What do you think about blockchain and cryptocurrencies in regard to central banks?

Leave your comments or questions below, and our team will be happy to start a conversation.

Frequently asked questions

What is cryptocurrency?

Cryptocurrency is a type of digital currency that uses encryption techniques to regulate the generation of units of currency and verify the transfer of funds, independent of a central bank or government.

How do cryptocurrencies affect central banks?

Cryptocurrencies have the potential to challenge the traditional roles and functions of central banks, including monetary policy, financial regulation, and currency issuance. However, the extent of this impact remains to be seen and is a subject of ongoing debate and research.

How can banks benefit from working with cryptocurrencies?

Banks can benefit from working with cryptocurrencies by generating new revenue streams, increasing efficiency, diversifying their offerings, and potentially attracting new customers.