Updated: April 24, 2025

Published: February 7, 2024

How does mobile banking impact the future of the financial industry? Why do banks and financial institutions recognize the potential to offer mobile app services to their customers? Check this article on how to build a mobile banking app and discover the opportunities it opens for your business.

List of the Content

- The mobile banking app market

- Trends in mobile banking

- Benefits of mobile application development for banking

- Known mobile banking app examples

- Fundamental features of mobile banking applications

- Nice-to-have functionalities

- How to create a banking app: technology stack

- Core stages to build a mobile banking app

- How much does it cost to make a banking app

- Conclusion

MOBILE BANKING APP MARKET

In the dynamic landscape of modern finance, mobile banking has ushered in a transformative era, redefining how individuals manage their finances. The seamless integration of technology into banking has enhanced the accessibility of financial services. Besides, it has dramatically revolutionized the traditional banking experience.

Over the years, technological advancements and consumer demand led to a rapid evolution of mobile banking apps. It reflects the broader digital transformation within the financial industry, marking a shift towards a more interconnected and technologically-driven banking ecosystem.

Financial institutions invest heavily in user experience design and innovative feature introduction. Integrating various functionalities has transformed mobile banking from a mere extension of traditional banking to a comprehensive financial management tool accessible at users’ fingertips.

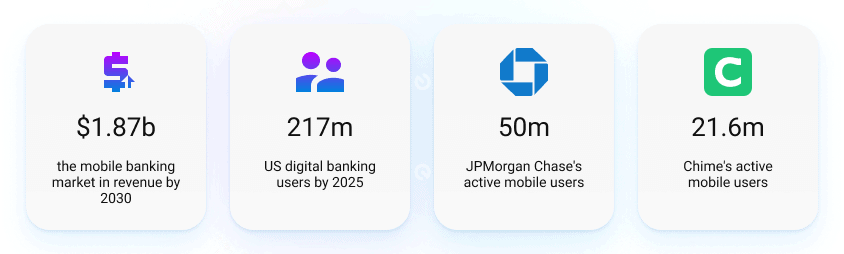

As consumers increasingly seek convenience in managing their finances, mobile banking apps offer a seamless and accessible solution. They allow users to access their accounts, make transactions, and manage finances anytime, anywhere, using their smartphones. Customers have gained the opportunity to perform various banking activities, all from the convenience of their smartphones. According to the statistics, the number of digital banking users in the USA is expected to reach almost 217 million by 2025.

Enhanced security features, user-friendly interfaces, and continuous innovation in mobile banking services further propel the market’s expansion. As a result, the mobile banking market continues to evolve, shaping the future of banking by offering customers unparalleled convenience and flexibility in managing their financial transactions.

Besides, the growing popularity of neobanks has impacted the conventional banking landscape, compelling traditional banks to enhance their mobile banking offerings. The seamless and user-friendly mobile banking experience provided by neobanks has prompted traditional banks to invest in their own mobile apps to stay competitive and retain customers. For example, Chime, the US leading mobile banking service provider, boasted 21.6 million active users in 2023.

At the same time, major US traditional banks such as Capital One, JPMorgan Chase, and Bank of America continue advancing their services. Being a part of the intensively competitive industry, they know how to follow the rising trends and introduce innovative tech solutions. They managed to maintain their dominance, gaining the most mobile customers. Out of the top banks based in the United States, JPMorgan Chase led in the number of active customers, with nearly 50 million users engaging in mobile banking.

The increasing demand for digital financial services, technological advancements, and evolving consumer preferences create opportunities for new entrants and established players. Open competition in this domain provides a heavy base for introducing new ideas on how to create a mobile banking app.

TRENDS IN MOBILE BANKING APP DEVELOPMENT

There is a widespread belief that the financial sector is quite conservative and slow to adopt changes. Of course, the industry’s reliance on established practices and proven methods is always considered. And banking service providers have to deal with a number of regulatory complexities, security concerns, and traditional approaches, prioritizing stability and compliance.

Mobile banking app development requires a careful balance between innovation and regulatory compliance, making the adoption of change a gradual process. However, the financial providers definitely know how to exercise these responsibilities and deliver advanced solutions. Moreover, they have always stayed among trendsetters and followed the latest market trends.

Bringing the question of how to create a banking application, it’s interesting to refer to the current market tendencies. It provides some useful ideas and required functionalities to include, as all companies still have opportunities to differentiate. The recent mobile banking trends cover the following:

Cardless transactions

The main point is that it caters to evolving consumer preferences for seamless, contactless payment experiences. Using biometric authentication methods, like fingerprint or facial recognition, further contributes to the appeal of cardless transactions as a convenient and secure alternative to traditional card-based payments. The prevalence of online payment options facilitates a transition towards a cashless and cardless approach.

Chatbots and virtual assistants

These intelligent tools enhance customer service, ensure round-the-clock support, and contribute to a more efficient and accessible banking experience. The integration of AI-driven chatbots is instrumental in delivering immediate responses to customer inquiries 24/7, offering guidance through various banking processes. They help handle a diverse range of tasks, from account inquiries to transaction assistance, significantly improving user satisfaction and excessive experiences.

Artificial intelligence and machine learning

Leveraging sophisticated AI algorithms and data analytics empowers mobile banking application development to provide customized financial guidance, identify and prevent fraudulent activities, and enhance overall customer service. These technologies enable financial institutions to analyze vast amounts of data efficiently, facilitating the delivery of personalized insights and recommendations to users. As technology advances, the integration of AI and ML in mobile banking is poised to optimize processes further and elevate the level of service provided to users.

Personal financial management tools

The widespread adoption and trendiness of financial management tools underscore a fundamental shift in how individuals approach and engage with their finances. Budgeting, expense tracking, and goal setting have become integral components of mobile banking applications. The trend is not just about the convenience of mobile banking; it signifies a change towards a more informed, engaged, and empowered approach to personal finance in the digital age. It helps users make better financial decisions on the go, ultimately promoting good financial health.

Voice control

Financial institutions often incorporate voice command functionalities into their mobile applications, enabling users to perform banking tasks seamlessly without manual input. With voice control in mobile banking, users can execute various transactions, check account balances, and even receive personalized financial insights using natural language commands. This strategic adoption of voice technology modernizes banking services and underscores the industry’s dedication to providing accessible, efficient, and user-centric financial solutions.

Enhanced privacy and security

Financial service providers allocate resources toward developing and implementing cutting-edge encryption and multifactor authentication technologies. They aim to safeguard users’ personal and financial information, ensuring robust security measures are in place to protect sensitive data during transactions and interactions with the mobile banking app. Additionally, a commitment to regular updates and advancements in security protocols is integral to maintaining the app’s resilience against emerging threats and vulnerabilities.

Blockchain

The traditional reliance on physical bank statements has become obsolete with the advent of blockchain networks, which now serve as the primary means for data storage. In the contemporary landscape, users can conveniently access their financial statements through online banking apps and platforms enabled by blockchain technology. This innovation ensures that bank account holders have the flexibility to review their statements at any given time, fostering a seamless and secure digital banking experience.

Cryptocurrency

Financial providers are delving deeper into cryptocurrencies, exploring the potential adoption beyond traditional transactions. Many actively engage in research and development initiatives to understand how digital currencies can seamlessly integrate into various financial processes, from cross-border transactions to investment portfolios. This trend reflects a growing recognition within the financial sector of the benefits of leveraging blockchain and digital assets for a more robust and efficient financial ecosystem.

Digital-only banks and neobanks

Digital banks and neobanks represent inventive alternatives to traditional physical banking institutions, operating exclusively through online platforms for convenient money management via smartphones or computers. The unique appeal lies in prioritizing a smooth user experience facilitated by intuitive mobile apps and advanced technology. Additionally, neobanks frequently form partnerships with established financial entities to provide a range of services, including checking and savings accounts, loan offerings, etc. This commitment to digital innovation and collaborative strategies underscores their disruptive impact on the financial industry.

Mobile banking app development is currently trending towards enhanced security features, seamless user experiences, and innovative technologies. The latest market trends emphasize a balance between security, convenience, and cutting-edge advantages to meet the evolving needs of users in the digital financial landscape.

WHY BUILD A BANKING APP: CUSTOMER AND BUSINESS BENEFITS

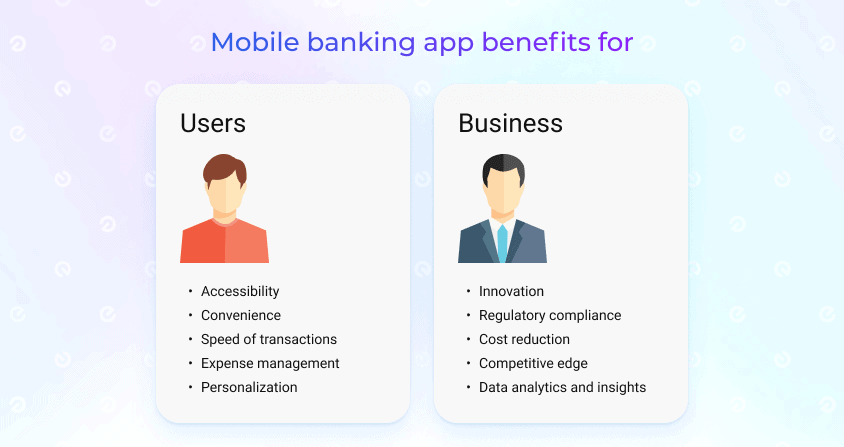

The statistics and trends point towards the growing importance of mobile banking apps in meeting customer expectations and staying competitive in the financial industry. Building a banking app has highlighted numerous advantages for your business and customers, whether you are an established banking service provider or a new market player. When figuring out how to make a mobile banking app, it’s essential to consider some of the following benefits.

Advantages for customers

Banking apps empower users with greater control over their finances, offering a range of features to enhance convenience, efficiency, and security in managing their money.

- Accessibility: The round-the-clock access to account information and services allows users to check balances, view transaction history, and perform transactions at any convenient time.

- Convenience: As long as customers have mobile devices and an internet connection, they can complete numerous financial transactions on the go. It eliminates the need to visit a physical branch, thus saving time and effort.

- Speed of transactions: Users favor transferring money, paying bills, and conducting various financial transactions with just a few taps. It definitely reduces the time it takes compared to traditional methods.

- Expense management: Mobile banking functionalities offer users the convenience of tracking and categorizing their expenditures in real time. It helps them understand financial habits better, set budgets, and support informed decisions.

- Personalization: Financial institutions have an opportunity to provide clients with a more engaging and relevant banking experience. It includes personalized insights, targeted offers, and customized interfaces based on individual preferences and behaviors.

Advantages for business

Mobile banking app development offers a variety of benefits to financial businesses, contributing to improved customer experiences, operational efficiency, and overall competitiveness.

- Innovation: Mobile solutions provide a platform for financial institutions to innovate and adapt to changing market trends. They can easily introduce new features, services, and technologies to stay ahead in a dynamic and evolving industry.

- Regulatory compliance: Teams always focus on how to create a banking app that complies with various financial regulations. It helps them ensure that transactions are secure and meet legal requirements to avoid regulatory issues and penalties.

- Cost reduction: By encouraging customers to use mobile banking, financial institutions can reduce costs associated with traditional brick-and-mortar branches, such as staffing, maintenance, and utilities. Besides, many providers can operate exclusively using only online banking services.

- Competitive edge: Financial service providers that embrace mobile banking stay competitive in the digital era. A user-friendly, feature-rich app can attract more customers and position the institution as forward-thinking and customer-centric.

- Data analytics and insights: The data generated by mobile banking apps can be leveraged for analytics, allowing financial businesses to gain insights into customer behavior, preferences, and trends. This information can inform strategic decisions and improve service offerings.

Mobile banking is highly beneficial and popular among customers and financial institutions. It offers a comprehensive set of features to enhance accessibility, efficiency, and convenience for financial activities.

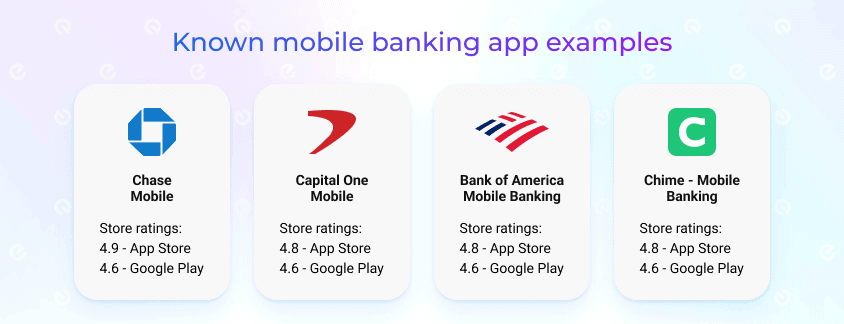

SUCCESSFUL MOBILE BANKING APP EXAMPLES

The success of banking applications is often measured by their ability to meet user needs, provide a secure environment, and adapt to evolving advancements. When discovering how to create a banking app, it is worth referring to the known representatives and learning more about their project success and distinctive functionality.

Chase Mobile

Store ratings: 4.9 – App Store, 4.6 – Google Play

Fees: $12 monthly service fee

Minimum deposit amount: $0

JPMorgan Chase, a leading financial institution in the U.S., has delivered an advanced mobile application. They enable users to conveniently manage accounts, make payments, manage investments, deposit checks, monitor credit scores, and receive other online banking services. Its success stems from a user-friendly interface, strong security measures, and the convenience it offers for diverse financial transactions. Regular updates and enhancements contribute to a positive overall customer experience.

Capital One Mobile

Store ratings: 4.8 – App Store, 4.6 – Google Play

Fees: no monthly service fee

Minimum deposit amount: $0

That is the official mobile banking app of Capital One, a known financial institution. The product covers essential functionalities such as account management, money transfers, bill payments, investment management, check deposits, and other services on the go. They consistently update the solution to guarantee a superior mobile banking experience. Each successive app version incorporates enhancements to enhance speed and reliability,

Bank of America Mobile Banking

Store ratings: 4.8 – App Store, 4.6 – Google Play

Fees: $12 monthly service fee

Minimum deposit amount: $100

Another comprehensive product provided by Bank of America helps users to perform various banking tasks online. Its success lies in its intuitive design, offering features such as account monitoring, fund transfers, bill payments, and check deposits. The solution incorporates advanced security measures like fingerprint and facial recognition, providing a secure and convenient user experience. Regular updates and responsiveness to user feedback contribute to its continued success in meeting evolving customer needs.

Chime – Mobile Banking

Store ratings: 4.8 – App Store, 4.6 – Google Play

Fees: no monthly service fee

Minimum deposit amount: $0

This is an innovative banking app delivered by a financial technology company, not a bank. They offer online banking services without traditional brick-and-mortar branches. It succeeds by providing fee-free checking and savings accounts, early direct deposit, a user-friendly mobile app, and features like round-up savings. Chime’s success is rooted in its emphasis on customer-friendly policies, accessibility, and innovative financial tools.

With the increasing popularity of banking apps, the market has experienced advancement in delivering financial operations. Moreover, it has definitely transformed the way we provide and receive services using mobile functionality. Finding out how to create a banking app refers to the commitment to providing a user-friendly and secure banking experience coupled with innovative features to increase your customer base.

Have your vision for a revolutionary banking app?

Share your ideas, and our team will help you bring your concept to life.

FUNDAMENTAL FEATURES FOR BANKING MOBILE APP DEVELOPMENT

As long as the provider focuses on developing a mobile banking application, they always place emphasis on implementing the critical app features at first. The diverse variety of available functionalities enables it to furnish a resilient and user-centric platform. Besides, it helps to cater to the requirements of the customer base and evolve into successful market products.

Banking app functionalities are getting more and more sophisticated. Financial service providers have always stayed attuned to emerging trends and ever-evolving user expectations. Analyzing the commonly implemented features, we received the following list of core functionalities for mobile banking apps.

Authentication and authorization

Financial service providers have to safeguard customer information and comply with evolving security standards in the dynamic landscape of digital banking. Many apps incorporate biometric authentication data, such as face ID or fingerprint scanning, as a security option for account access. In addition, teams have other alternatives accessible within digital banking solutions to address diverse security needs.

Account management

It evolves into an essential function added within every banking application. The account management feature goes beyond mere balance inquiries, providing users with a comprehensive suite of tools to manage their finances on the go actively. It allows customers to review account activities, replace or activate debit/credit cards, configure alerts, etc.

Transactions

Checking balances, making digital payments, transferring money, and depositing funds via mobile cover the regular tasks that users would like to perform on their smartphones. Providers come up with more advanced abilities like paying bills, taking care of loans, scheduling payments, etc. Besides, customers have access to the entire history of transactions, covering even the smallest details.

Privacy and security

Learning how to create a banking application always goes with a primary focus on security. Businesses have to ensure that the solution incorporates robust security measures, sensitive data protection, secure storage, and transaction processing within its framework. Privacy and security considerations always come first, as mobile banking is subject to the latest regulations, including GDPR, PCI DSS, PSD2, etc.

Customer support

Some of the popular features for customer support in mobile apps include in-app chat support, real-time transaction assistance, alerts and purchase notifications, and seamless integration with other communication channels. What’s more, it’s important to allow users to set preferences and customize their profiles, enabling a more personalized customer support experience based on individual needs.

Turning special attention to implementing the core functionalities of a banking app is crucial for security, compliance, user experience, reliability, and convenience. They also serve as the foundation for adding nice-to-have features by establishing an advancing service platform. Once the essential functions are robustly implemented, developers can build upon this foundation to introduce additional ones.

VALUE-ADDED FEATURES FOR BUILDING BANKING APPS

The fintech industry is highly competitive, and offering unique and attractive features can differentiate your banking app from another. Value-added functionalities can be a contributing factor in attracting and retaining customers. The decision to add something extra can lead to exploring and utilizing additional services.

Chatbot and voice assistants

These features contribute to the evolution of digital banking towards more user-friendly and inclusive interfaces. Chatbots handle a large volume of queries simultaneously, providing quick responses and solutions for customers. On the other hand, voice assistants cater to users with varying technological proficiency and accessibility needs. It helps to make banking services more inclusive and reach a broader user base.

Expense trackers

One of the great functionalities is to provide your customers with a comprehensive overview of their financial behavior. It helps users manage and monitor spending habits to promote better financial control and planning. Customers favor the ability to categorize transactions, set spending limits, and generate insightful reports. This feature enhances financial literacy, encourages responsible spending, and contributes to economic well-being.

Cashback services

It’s an obvious example that allows businesses to create a sense of loyalty and engagement. It gets easier to encourage users to consistently use the mobile banking app for their transactions. The appeal lies in the opportunity to save money on regular purchases, turning the application into a more comprehensive and rewarding financial tool. Overall, users prefer them because they offer a tangible benefit by giving them a percentage of their spending back, enhancing the overall value and attractiveness of the mobile banking experience.

Personalized offers

It’s always worth considering a win-win scenario that supports the personalized experience of your customers. Banking apps can generate targeted discounts, cashback rewards, or exclusive deals on products and services covering the user’s interests. These services leverage user data to understand spending patterns, preferences, and financial goals. Powered by AI and ML, it’s efficient at analyzing transaction history and behavior, so later, it can offer exclusive deals. It helps to evolve the user’suser’s behavior model to get ideas for further app advancement.

Bill-splitting

This functionality provides a convenient and collaborative way to manage finances in social settings. It greatly simplifies the process of dividing expenses among friends and family. Bill-splitting features often allow users to send payment reminders, view individual contributions, and settle debts directly within the app. This functionality is favored for seamless group transactions, eliminating the need for manual calculations and promoting easy settlement of shared bills.

Integration with wearables

Integration with wearable devices enhances the convenience and accessibility of mobile banking apps, allowing users to quickly and effortlessly access financial information, make transactions, and receive alerts directly from their wearable devices. It is always worth developing a specialized application for them to facilitate users in receiving push notifications, checking their banking details, and even facilitating payments through NFC technology.

Adopting cutting-edge solutions and technologies transforms mobile banking into a more intuitive, adaptive, and value-added experience. Financial service providers can come up with a number of great ideas to foster innovation and keep up with the growing demand.

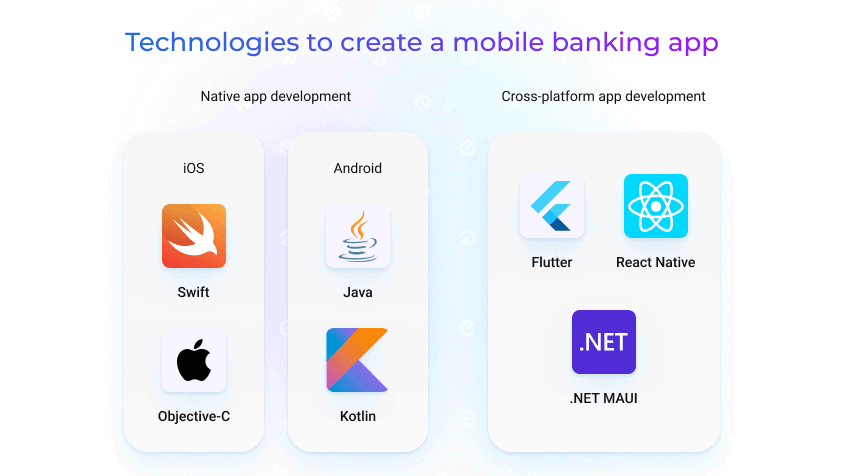

HOW TO BUILD A BANKING APP WITH A ROBUST TECH STACK?

A well-suited tech stack ensures that banking app development efforts are successful and tailored to unique business needs. One of the primary considerations lies in aligning the chosen technology with the specific goals and requirements. Besides, it forms the backbone of a software project and significantly influences its advancements.

Figuring out how to create mobile banking apps involves defining a comprehensive technology stack. It has to cater to diverse aspects like performance, security, scalability, and user experience. Moreover, the financial sector must adhere to industry regulations and security standards.

We’ve compiled the list of technologies commonly leveraged in mobile banking app development.

Programming languages

- Swift, Objective-C for native iOS app development

- Java, Kotlin for native Android app development

- Dart for cross-platform development with Flutter

- Javascript for cross-platform development with React Native

- С# for cross-platform development with .NET MAUI

Mobile app frameworks

- Flutter

- React Native

- .NET MAUI

Databases

- MySQL

- MS SQL

- MongoDB

- Firebase

Cloud services

- AWS

- Azure

- Google Cloud

Integrations

- Mobile wallet APIs

- Payment gateways

- Google Analytics

- Firebase Analytics

- Third-party APIs

Other technologies

- AI and ML

- Blockchain

- RPA

The technology stack varies from project to project. However, it’s always important to consider the most recent best practices and security measures to guarantee the protection of users’ data. Continuing with the question of how to make a banking app, consider a few more critical aspects when choosing efficient and reliable technologies.

Scalability: As projects grow regarding users, data, and features, a scalable tech stack facilitates smooth expansion without causing disruptions.

Development speed and efficiency: The right set of tools and technologies can accelerate the development process, allowing teams to iterate quickly, respond promptly to market demands, and stay competitive.

Cost efficiency: Beyond the direct costs associated with licensing fees, the tech stack influences resource allocation, maintenance costs, and the overall cost of the project. An informed choice can lead to a streamlined budget, preventing unforeseen expenses and resource drain.

The available talent pool: A widely adopted stack attracts a larger pool of skilled developers, ensuring the project benefits from expertise and experience. Less popular or outdated technologies pose challenges in terms of recruitment and limit the available talent pool.

Community support: A vibrant and active community ensures a wealth of resources, documentation, and collaborative problem-solving.

Security considerations: The chosen tech stack should have robust security features to protect against potential vulnerabilities and ensure the integrity of sensitive data. A lapse in security measures can have severe consequences, making this aspect non-negotiable in decision-making.

Interoperability: Compatibility with other systems, services, or third-party APIs becomes crucial, as seamless integration can impact the application’s overall functionality and user experience.

A tech stack is a multifaceted decision reverberating throughout the project’s lifecycle. It influences development dynamics, scalability, cost, security, talent acquisition, and overall project success. Therefore, a thoughtful and strategic approach to selecting the right tech stack is fundamental to the prosperity and longevity of any software solution.

Need assistance in selecting the appropriate technology stack for our project?

We’ll gladly share our extensive experience in mobile app development and help you deliver robust solutions powered by the latest technology.

CORE PHASES TO CREATE A MOBILE BANKING APP

Banking apps development involves several stages, each essential for ensuring a successful and secure implementation. The team has to undertake substantial planning and expertise along with introducing the latest technologies and varied functionalities.

In crafting a proficient mobile banking app, the team has to set up a smooth development process. Let’s proceed with a comprehensive, step-by-step guide to mark the crucial stages.

1. Undertake research

When conducting research to develop a banking app, the business should initiate the process by gaining a comprehensive understanding of the market and the target audience. It’s essential to analyze existing banking apps to identify features and user experiences that are well-received. This stage also helps Investigate user preferences, pain points, and expectations through surveys, interviews, and usability testing.

2. Build and test a prototype

Prototypes enable teams to visualize the app’s interface, flow, and features, facilitating effective communication among team members and stakeholders. By testing the prototype, you can validate the technical feasibility of the design choices, assess performance, and address any performance bottlenecks or integration challenges early on. It reduces the likelihood of significant issues during the later stages of development.

3. Provide security

This stage focuses on examining regulatory requirements and security standards for governing financial apps to ensure compliance. The provider has to collaborate with legal experts to navigate around financial regulations and data protection laws. It’s imperative to verify that the intended functionality aligns with such policies as GDPR, PSD2, PCI DSS, or others before commencing work on a product.

4. Design a user-friendly app

It’s recommended to leverage a holistic approach to UI/UX considerations. The app should feature simplified navigation with clear menus and an intuitive design, ensuring users can easily access essential services. Consistent branding, effective feedback mechanisms, and accessibility features for all users, including those with disabilities, further contribute to the app’s overall success. Performance optimization, emphasizing fast and responsive interactions, is critical for a well-designed banking app that prioritizes usability, security, and customer satisfaction.

5. Develop a mobile application

Studying technological trends, including advancements in mobile app development, security protocols, and payment systems, allows the team to stay innovative and productive. The stage involves translating the conceptualized design and outlined requirements into a functional application. Developers start with building the server-side logic, business rules, and APIs that enable the app’s functionality. The next focus is creating an engaging user interface and ensuring a seamless user experience. Besides, this stage covers thorough testing to identify and address bugs, usability issues, and security vulnerabilities.

6. Enhance the app through integrations

The business can also establish strong partnerships with financial institutions, payment processors, and other relevant stakeholders to integrate seamless and secure financial functionalities. Regular research allows you to stay ahead of evolving market trends and technology, ensuring your banking app remains competitive and aligns with user expectations. Collaborations with third-party fintech companies can introduce innovative features like peer-to-peer payment systems, investment platforms, or digital wallets. By staying attuned to new tendencies and user preferences, you can leverage third-party integrations to position your app as a comprehensive financial hub.

7. Release and maintain

As the banking app enters the market, a new phase starts. Users begin interacting with it, leading to the emergence of new requirements and the need for the implementation of additional features. The team has to be prepared for the potential transformation of the initial mobile banking app, sometimes in substantial ways. Regular updates, user engagement, and a commitment to security will contribute to long-term success in the competitive mobile app landscape.

As a result, the decision to build your own banking app requires a comprehensive approach that encompasses meticulous planning, rigorous testing, and continuous adaptation.

Existek’s experience

Our team of skilled experts specializes in various mobile technologies, including native iOS and Android development and cross-platform frameworks like React Native and Flutter. Leveraging our deep technical knowledge and commitment to quality, we have developed a diverse portfolio of mobile applications across various industries.

Want to see the impact of our mobile development solutions?

From the initial concept stage to the launch and maintenance, we work closely with our clients, fostering open communication and transparency to deliver successful mobile products.

HOW MUCH DOES IT COST TO MAKE A MOBILE BANKING APP?

The cost of banking app development can vary as there is always a combination of factors impacting the complexity and scope of the project. Besides, teams realize that estimating requires careful planning and thorough product understanding. It remains important to consider the following aspects that influence the project expenses.

Complexity: The more functionality you add to your mobile banking app, the more complex it becomes, and consequently, the development cost increases. It could be a great idea to start with MVP development to learn from customer feedback. They help you prioritize the list of nice-to-have features to be added to basic ones.

Security and compliance: Given the sensitive nature of banking apps, security is a top priority. Implementing robust security measures will add to the development cost. Moreover, financial apps must comply with various regulations and standards, which may vary by region.

Design: A well-designed mobile application is crucial for user experience. Investing in a user-friendly and visually appealing design can increase the cost, but it is often worth it for customer satisfaction and retention.

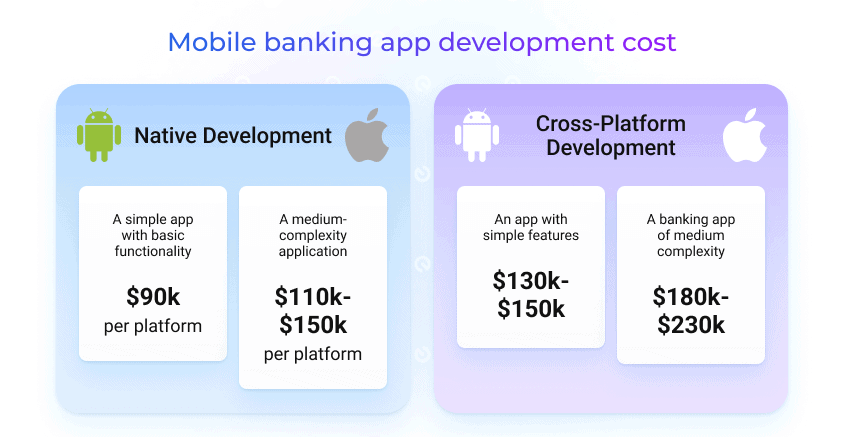

Development approach: It’s obvious that financial service providers need to reach a wider user base and thus develop apps for both iOS and Android. However, they need to choose between native and cross-platform app development. Native apps for each platform are typically more expensive than cross-platform or hybrid solutions.

Integrations: If you plan to integrate the application with third-party services or APIs (e.g., payment gateways, financial institutions), the complexity and the variety of these integrations often impact the final costs.

Team composition: The engagement model defines how the development team is structured, managed, and compensated. Each model has its advantages and considerations, and the made decision can impact cost, flexibility, and project outcomes. Effective communication and a clear understanding of project requirements are crucial for successful engagement under any model.

Maintenance and updates: Ongoing maintenance, updates, and support are essential for the long-term success of a mobile banking app. Considering these expenses as part of the overall project is vital, whereas it commonly takes 15% of the development costs.

Would you like to get your project estimate?

Feel free to consult our software development company. We’ll provide you with a more tailored cost estimate based on the specific requirements of the banking app.igma.

It’s essential to have a well-coordinated and skilled team to deliver a successful mobile banking app. Besides, increasing the development team size allows you to cooperate with experts with specific skills or expertise. It can be beneficial when certain features or components require specialized knowledge like regulations and compliance in the banking industry. Moreover, more developers can lead to an increase in overall development speed. Tasks and features can be divided among team members, allowing parallel work on different aspects of the project.

Continuing how to create a bank app and estimate its cost, we need to refer to the list of specialists required for app implementation. The cross-functional team commonly consists of

- Project manager

- Business analyst

- UI/UX designers

- Back-end developers

- Mobile developers

- QA engineers

Last but not least, development rates vary significantly based on the region. For instance, a developer from Asia might charge $30 per hour, while in the United States, the hourly rate can go up to $120. And European specialists could charge approximately $60-70 per hour.

As for the provided estimates, we used the average rates of European developers and calculated expenses for the nine-month collaboration to deliver a banking app of medium complexity. As a result, the average development cost of medium-complexity banking apps starts from $190k.

CONCLUSION

A banking app offers a safe and convenient way to access different financial services, helping businesses enhance user experience and improve their market offerings.

It’s essential for long-term success to adjust to changing trends, technologies, and customer needs. Facing competition helps you improve continuously and makes sure your app stays successful. We hope this article enables you to use your app to drive innovation, satisfy customers, and grow in the market.

Have you thought about creating a banking application?

So why wait? If you’d like to learn more about our services and how we can help you take your business to the next level.

Frequently asked questions

How to start a banking app?

The critical decision is to balance innovation with reliability, security, and customer satisfaction to withstand market competition. With the fast-changing requirements, financial service providers have to put considerable effort into developing a resilient banking application with a user-centric design and distinguishing features. It’s also essential to implement effective marketing strategies to raise the product awareness.

What are the main requirements for a mobile banking application?

Considering the specification of financial services, businesses have to focus on:

- Security

- Compatibility

- User-friendly interface

- Offline functionality

- Compliance

- Smooth integrations

How much does it cost to develop a banking app?

The development cost for a banking application can vary significantly, typically ranging from $190,000 and more. The total expense depends on factors like the app's complexity, features, applied tech stack, design requirements, and the hourly rates of the development team, which can vary based on their location.

How can a reliable software vendor streamline your banking app implementation?

Professional providers help to set up an efficient development process, secure compliance, offer technical support, facilitate integrations, and ensure regular updates. Therefore, partnering with a reliable vendor comes with several benefits, including access to specialized expertise, accelerated development cycles, reduced costs, and ongoing support.