Updated: February 28, 2025

Published: October 22, 2021

Fintech applications prevail in the financial sphere, but the process of their development doesn’t look easy at the first glance. So, how to build a fintech app to deliver the best quality to end-users and beat the competition? What tech stack to choose to implement the trending functionality, and how to estimate the final development price? Keep reading to find out.

Before asking “How to build a fintech app,” it’s worth knowing why one should do it. Statista shows that compared to 12,131 fintech startups in 2018, there are 25,045 of them in 2021. So, what is the driving force behind it? Why is fintech so demanded nowadays?

First of all, we live in the digital age, and technology aims to simplify and speed up everyday operations. Finances are far from the only sphere that is affected by digital transformation. Studying, shopping, talking, and many more usual activities are going online.

People are accustomed to the fact that they can access everything necessary via their mobile devices. That’s why businesses have to adapt and develop mobile applications for the services they provide.

We quickly get used to what’s simpler. So, it’s no wonder that 64.5% of Americans use digital banking instead of going to traditional financial institutions. Digital banking is only one of all possible types of fintech apps. And how many other kinds are there? Investment apps, lending apps, personal finance management, etc. It’s difficult to imagine the number of people benefiting from different types of fintech applications.

Though it takes significant resources to create a fintech app, it helps save many in the long run. Firstly, financial business owners don’t have to hire substantial staff to regulate some processes. For example, if you come to a banking house to take credit, it requires about an hour of someone’s work. At the same time, you can do it yourself through your phone in a couple of minutes. Plus, consider the time savings on getting to and from the bank if you decide to do things more conservatively. In addition, the commissions are much lower in mobile apps. Budget savings concern not only digital banking apps but all other types.

If we’re speaking about personal finance apps, they also have considerable advantages for the users. In this regard, we should mention financial illiteracy that today seems to be on the rise. Taking care of personal finances seems necessary and self-evident, but in fact, this field requires more attention. Personal budgeting apps provide only a couple of features, but they are sufficient to keep track of the numbers and not get lost in them. It makes people more aware of their finances and by this increasing the overall financial literacy.

Other pros can definitely supplement the list of advantages, but we’ve got the main idea and now can proceed to the trends that prevail in the fintech industry.

List of the Content

- Types of fintech applications

- How to stand out from the competition

- Important things to consider

- Best technologies for a fintech app

- Cost to build a fintech app

- Industry trends in 2024

- In conclusion

TYPES OF FINTECH APPS

There are many types of fintech applications, and each of them includes different functionality. So, to answer the question of “how to build a fintech app,” it’s necessary to understand what features must be implemented for each app type. We’ll discover the most common ones. They are insurance, investment, lending, banking, and consumer finance apps.

Let’s dive into each of them deeper.

Mobile Banking Apps

Banking mobile apps are probably the first to come to mind when someone speaks about how to create a fintech app. This type is the most popular one and has proven itself a worthy competitor to the traditional banking system.

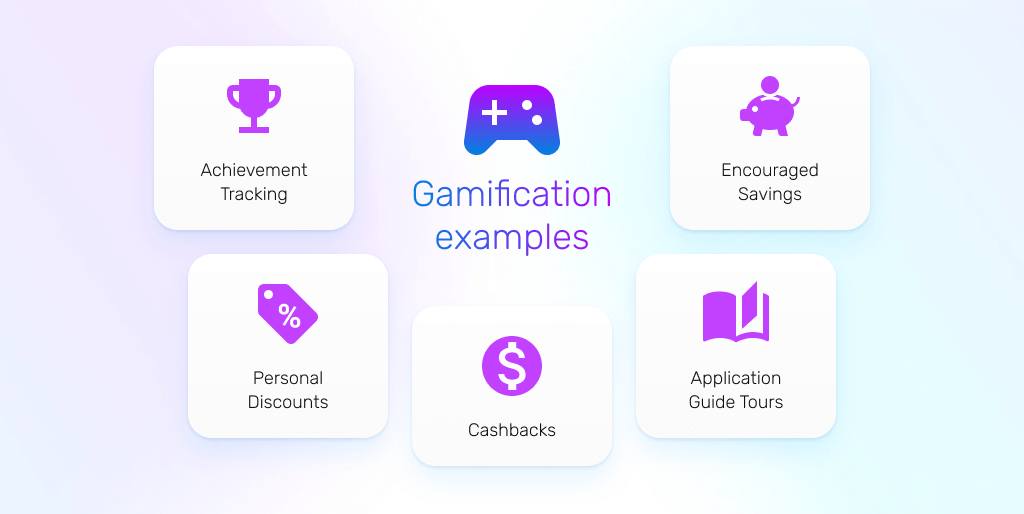

Banking apps include extensive functionality, such as integration with voice assistants, push notifications, card scanning, and other valuable features. We’ve already mentioned gamification as a way to make an app more attractive to users. So, it’s pretty standard in banking applications precisely. It can be rewarding for money transfers, invited users, etc.

All banking apps allow users to view their transactions for a certain period. As an advanced feature, some applications suggest sorting them by a particular criterion or forming statistics and analytics of your spendings.

This type of fintech apps also eliminates the need to go to banking institutions to open a loan or set up a deposit.

Investing in the banking app development is also beneficial for the vendors because they save many resources that they would otherwise spend on numerous employees working 8 hours a day. With a banking app with an AI-powered chatbot, 50 consultants in a call center can be replaced by just five who answer the questions that a virtual assistant can’t handle.

Insurance Apps

Insurance has become a common practice long ago. The more processes and things people insure, the more difficult it gets to track all of these. Also, insurance contracts always need to be up-to-date, and it’s complicated for a human’s brain to keep it in mind. That’s why insurance apps are pretty helpful.

Once you register, you add all existing insurances that you use. Such apps are usually AI-powered, and they allow you to buy insurance just via your mobile device. All you need to do is choose what you need a policy for, and the app will provide you with the contracts presented conveniently and understandably. So that, you don’t need to spend much time asking for consultations from the banking employees – you have all warranties in the palm of your hand and can access them anytime and anywhere.

Besides, such applications remind users to update their insurance contracts in time, saving them from the exhausting paperwork later. One of the most successful examples of a company that offers its customers a fintech application is Lemonade. Their mobile app includes all features needed to make insurance understandable for everyone.

Investment Apps

Investment is not a simple process. To invest and reinvest money in the right way, one should do some digging. Fortunately, investment apps include not only the functionality to easily invest your resources but also the educational materials before you do that. People who are new to this sphere can find educational articles or videos very helpful. They may include instructions on how to invest via the app step by step and the basic principles of investing in general. Such applications often exclude third parties, which leads to a more significant profit for all sides involved in the investment process.

Lending Apps

Millions of people lend and borrow money daily. However, if both sides don’t control this process correctly, they can lose their money. If a person decides to keep all information in mind, such as your and other people’s interests, timing, etc., it’s easy to get lost in the numbers, and someone may take advantage of it. That’s why lending apps are a great way to avoid some problematic situations.

Such software includes the list of those who lend and borrow, all timeframes, percent interest, etc. In addition, lending apps often use push notifications to remind you about the payment due date, so you’ll never remain in debt.

Lending fintech applications are often integrated with some of your banking accounts and may even perform pre-planned payments regularly.

Consumer Finance Apps

People may often face some struggles while managing their budget manually. Writing down all revenues and expenditures is a tedious process, which is rather challenging to get used to. Even if someone has been doing it for the whole month, they won’t receive any valuable insights on their spending habits without the proper analysis. So, it would take only more time to go through your notes again and divide your expenses into some groups to make some conclusions in the end. Sounds rather tiresome, isn’t it?

Consumer finance apps can do it all for you. All you need is just add expenses or revenues, and the application will analyze it and present it to you in a visualized and understandable view. If some of your income or payments are regular, you can plan it only once, and the app will do the rest. For example, if your salary scale and the apartment rent are unchanging, you don’t have to enter them each month.

Personal budgeting apps also suggest users the pre-arranged categories, such as bills, food, entertainment, etc., to add your expenses to. You can also supplement the list with some specific sections if you’d like.

Such a simple process as adding your revenues and expenses several times a week can enhance your relationship with money and financial literacy in general.

HOW TO BUILD A FINTECH APP TO STAND OUT FROM THE COMPETITION

Though fintech is not the most occupied sphere on the market, it’s still worth thinking about how to stand out from the competition. What unique can you suggest to the audience, so people choose your app over the others?

When you, along with the software development company, start gathering app requirements and defining features, it may seem that all ideas have already been embodied, and there’s nothing new you can suggest. But it’s not true. No matter how many applications there are on the market, each has room for improvement, and all you need to do is detect it.

Of course, this responsibility is not on your shoulders only. The business analyst will guide you through each stage of the discovery process and will do most of the work.

So, let’s see how to develop a fintech app that will beat its competitors.

Today, when every software provider wants to stand out, we see dozens of apps with numerous extraordinary features, but at the same time, they may miss something usual but necessary. When every second app has an online application tour, supplemented with a voiceover narrative, it may miss a card scanning feature, for example, or a possibility to add someone’s card number to a list of the regular transactions.

An app may have all the necessary features, but along with that, the overloaded design. Details and colors are essential to consider in terms of attracting users to your fintech app. Not many people would like to spend hours figuring out how to perform basic operations in the app because of too many options. We’ll discuss all details on how to develop a fintech app that will take the leading position on the market, and, on this note, let’s start with the user interface.

The user interface may not be the development team’s first consideration while planning a fintech application. However, it’s the first thing users notice when they download and open the app. It’s not a good move to add numerous buttons, text fields, or popup menus to highlight the app’s extensive functionality. In this situation, there’s a chance that users won’t get to it because of the overloaded interface — the simpler the UI, the better. A limited amount of buttons will make the app more understandable and easy to use. If the number of features is significant, it may be a great idea to leave them out of the main app screen and place them on an additional menu bar.

Colors shouldn’t be left out as well. They affect people’s state of mind and make them highly productive or relaxed. This work lies solely on the designers’ shoulders. However, describing your idea and requirements as clearly as possible remains your responsibility.

Still, on the subject of the app’s appearance, let’s proceed to the next point – visualized data. About 80% of people are visual learners meaning that the best way they perceive the information is presented visually. That’s why charts, diagrams, and tables are a great way to introduce the analyzed data. For example, the statistics of the user spendings would be better presented as a pie chart rather than plain text.

E-signatures are not the latest novelty, but still, many fintech apps don’t include this feature. Lending or banking apps can do without it, but it’s pretty necessary for insurance apps as they imply some paperwork. When a user wants to insure something, it requires signing a document, and one cannot argue that it’s much faster to do it right in the app without the need to print it first.

Let’s discuss how important the users’ trust is. No wonder that data safety and security are the first things that affect users’ trust, especially when it comes to fintech applications. Even if app users knew what technical details determine the level of security, they wouldn’t have the possibility to check the app code. So that the only way they can feel that their data is protected is a secure sign-in. Password authorization goes without saying. The next level of security is fingerprints. Two security levels may sound sufficient, but users will have more confidence in the app if it has the face ID as well. So, we see biometric authentication everywhere for a reason – it provides higher data safety and increases users’ trust.

We’ve mentioned the app tour in this paragraph. It’s quite a controversial point because sometimes virtual tours are a bit intrusive. Instructions on using an app are great, but if you can’t close them when you decide, they become a downside rather than an advantage. So, it may be a good idea to make app tours optional and include only the necessary features so that people can sooner start using the app instead of discovering some features they might never need.

As you can see, even if it seems that all features have already been implemented, you can always find something to improve and, therefore, suggest a unique product that will satisfy users.

Consider The Global Market

When you’re creating an app for an industry with high competition, it’s worth considering all possible ways to increase your chances to extinguish the competitors. Now, when we’ve discussed how it’s possible to do it by implementing the outstanding functionality, let’s look at another way – global expansion.

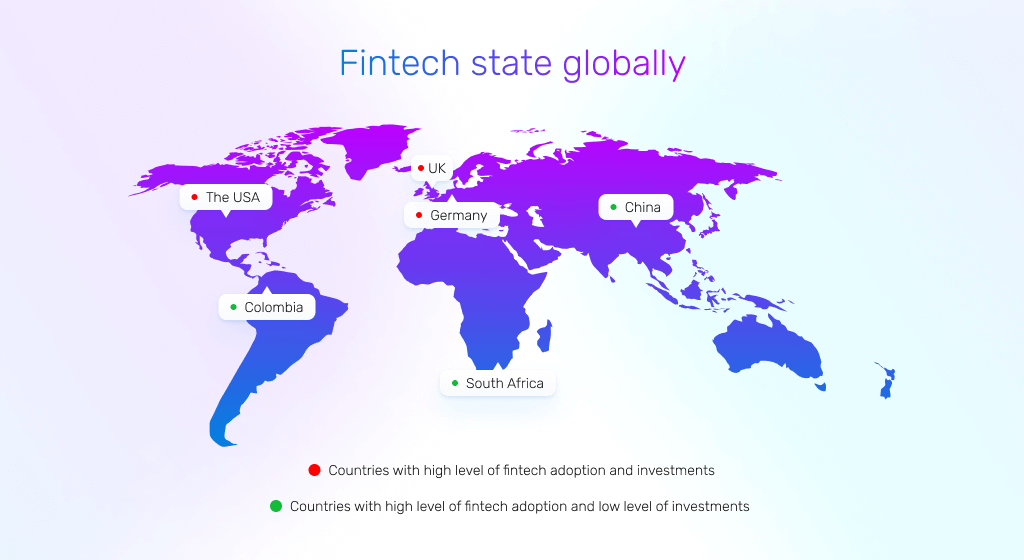

Findexable suggests an extensive study on the fintech industry in 2021. Among all numbers presented there, we can see that the adoption of fintech apps goes with the 120% increase in 2021, and for one year, about 50 new countries started actively investing in this field. So, fintech wasn’t that popular a couple of years ago, but now the market situation is changing, and the competition is snowballing.

This financial report presents the statistics on the investments in fintech around the world. The USA takes first place with $22 billion invested in the fintech industry. The UK takes second place by a wide margin with $4.1 billion, followed by Germany and Sweden. By the considerable difference in numbers between the first and second places, you can see that the US or UK wouldn’t be the best locations to provide your services from the start.

For example, China, South Africa, Colombia, or the Netherlands have high fintech adoption rates, but the investments in this sphere are not significant there. So, you may want to consider these options to deliver your services.

Global expansion isn’t the first thing to consider while creating a fintech app, but you should keep it in mind. It’s rather difficult to predict what will happen to the market in a couple of years, so it’s necessary to keep an eye on the ball to make the right decision while choosing a country to expand your business.

THINGS TO CONSIDER WHILE MAKING A FINTECH APP

Apart from the functionality, visual design, and documentation development, there are a few other essential things to consider when figuring out how to create a fintech app. They are legal compliance and possible risks. Of course, risks exist no matter what type of application you’re creating, but for fintech apps, it’s imperative. Such applications process very sensitive data, so developers should approach the question of security seriously. Let’s discuss each point in more detail.

How To Build A Fintech App And Avoid Risks

To understand how to avoid risks, we need to know what they can be and how they occur.

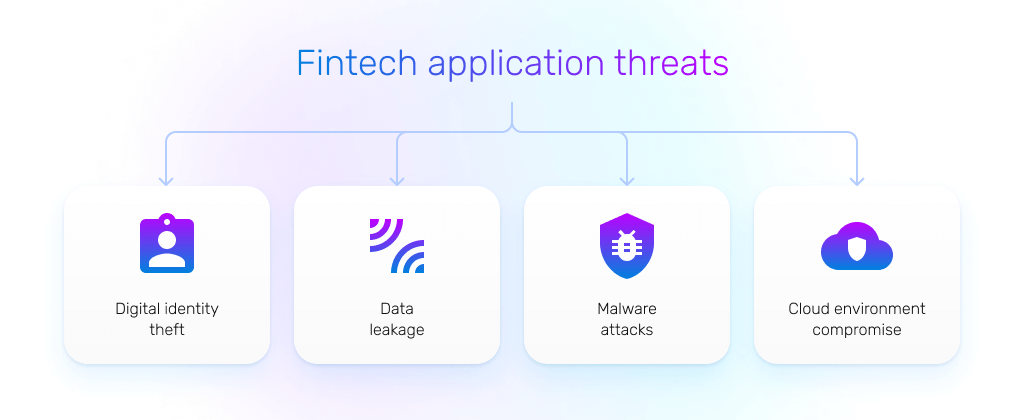

Among the most common threats, there are:

- Data leakage

- Digital identity theft

- Malware attacks

- Cloud environment compromise

The first thing the development team should do is to test the software thoroughly before launching it. There are a few types of testing that allow mitigating the risks. They can be:

- SAST (static application security testing)

- DAST (dynamic application security testing)

- Penetration testing

- Automated regression testing

Apart from these testing types, you may want to use innovative DevSecOps methodologies that provide the highest level of security in the process of product delivery.

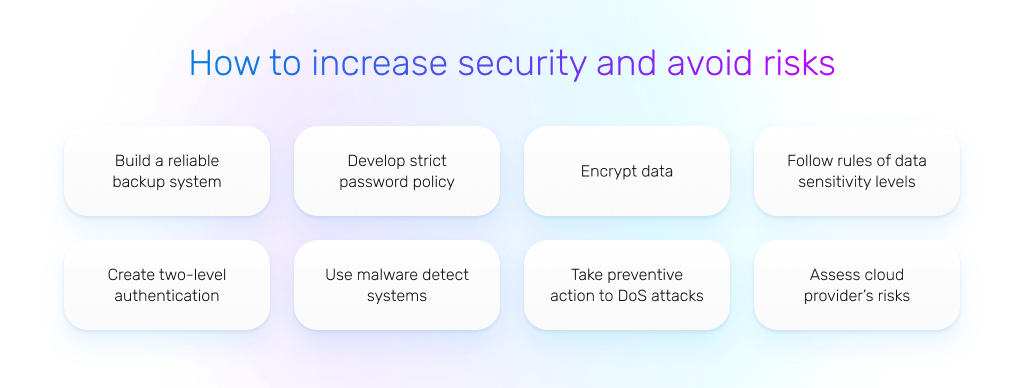

Let’s approach the question of how to develop a fintech app to avoid risks from the technical perspective and see what aspects developers should consider:

- Encrypt data

- Follow the data sensitivity levels (private, public, restricted) closely

- Create a reliable backup

- Develop two-factor authentication and a strict password policy

- Use firewalls and malware detection systems

- Prevent distributed denial-of-service attacks

- Thoroughly assess the risks of a particular cloud provider

The responsibility for the application’s security isn’t on your shoulders, so we’ll stop at this point and won’t go any more technical. With a trusted software development company, you can be sure that the specialists will implement the best practices to keep the users’ data safe and secure.

How To Deal With Compliance

With the growth of fintech’s popularity, the amount of fraudulence in this sphere grows as well. The financial field is very vulnerable, and all data it processes is too. That’s why fintech startups need to pass respective tests to meet all security standards. All fintech applications need to conform to the AML compliance policy (Anti Money Laundering). The AML policy includes specific procedures, which include:

- KYC (Know Your Customer/Client). Most of the listed procedures include that the user information should be thoroughly checked, but the KYC approach means only initial verification. So, when a person registers in an app, the provider should verify all essential information about him, such as identity or address. For this, the app may require a photo of a passport or a driver’s license to prove identity, and a proof of residence, for example, to confirm the address. Suppose some hesitations about a particular person appear. In that case, they might be asked to provide some information about their business or need to describe why they chose the specific provider, as an example. Knowing who is the client of your investment, banking, or lending app significantly reduces the risk of fraud, money laundering, and other illicit activities.

- CDD (Customer Due Diligence) and EDD (Enhanced Due Diligence). These processes are an integral part of the previous one – KYC. Compliance with the customer due diligence standards can be checked only after performing the KYC procedure. While KYC is mainly the process of gathering customer information, CDD and EDD are more of the result. If someone matches particular criteria, they are marked identified as diligent. While CDD includes quite a short list of requirements to the clients, EDD is designed to check those who’s been caught in some suspicious activity.

There are many more standards and procedures, but they’re not appropriate for fintech apps because they require qualified staff. For example, there are:

- SAR (Suspicious Activity Reports)

- Transaction monitoring

- Sanctions screening

- Adverse media screening

These procedures are proven to be effective for reducing financial fraud levels, but for now, they can’t be automated enough to imply them in fintech applications. For instance, if we’re speaking of the SAR, the reports are formed by qualified banking workers based on a significant amount of data. This process includes a human factor, so at the moment, this is not an option for fintech apps, though it is great for financial institutions in general.

BEST TECHNOLOGIES TO BUILD A FINTECH APP

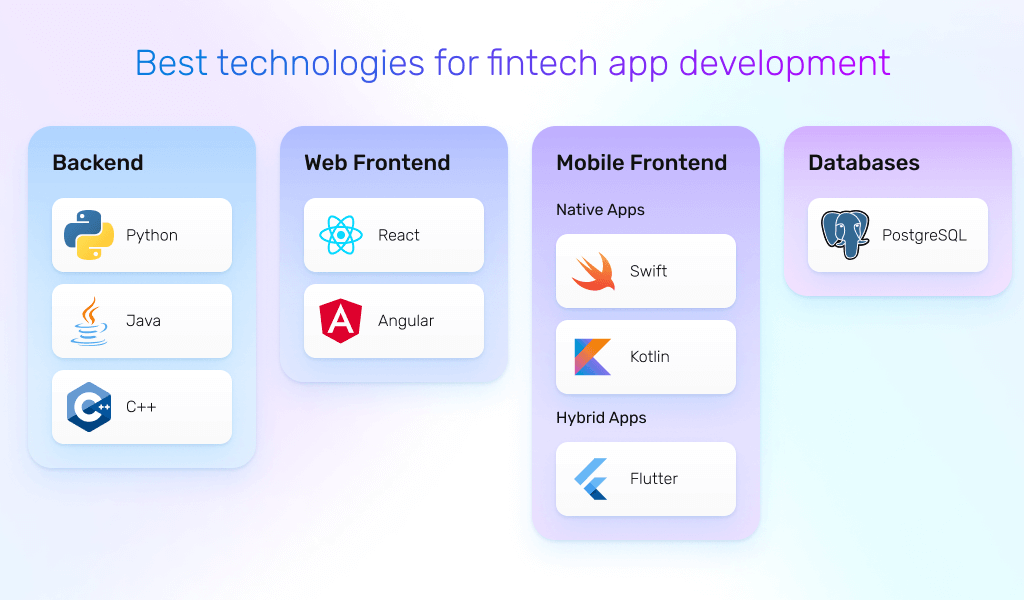

The technology stack sets particular restrictions on the way you implement the software. Answering the question of “How to build a fintech app,” the tech stack should also be thoroughly considered. We’ve already described what innovative trends fintech software includes, and now we need to find out what languages can handle this purpose on the highest level.

Backend Development

Java is great for processing big data and handling high loads. Also, Java has a reputation as a very secure language due to the OOP approach and static typing. However, one may face problematic performance because of the garbage collector used for managing the memory. In addition, Java is quite remarkable in its complex code.

Python is perfect for working with AI and machine learning. It has numerous libraries explicitly designed for it, such as PyAlgoTrade, ffn, PyRisk, etc. Also, its simple and understandable code saves a lot of time while writing it. The extensive Python documentation can also be of great help while programmers run into some issues. A significant downside that may affect the development is that Python might not be the best candidate in terms of memory-intensive tasks.

C++ provides high-performance and swift app execution. It has a reliable memory backup and is highly portable. The portability of C++ allows developers to reuse the same code for different platforms, sometimes with only minor adjustments. QuantLib and Armadillo are among the most potent C++ libraries for financial operations. They include numerous methods for scientific and quantitative computing.

Web Development

React is a stable web front-end framework. It has been on the market for almost a decade, and has proven itself as a reliable technology, and at the same time, very fast. It provides instant rendering and real-time code changes. Its reusable components save lots of time for developers owing to the isolated components. Programmers don’t have to make even minor changes in code to reuse them. This can be very useful for fintech apps because while working with the extensive systems, there often appears the necessity to make adjustments to some parts of the app without affecting the others.

Angular is the next generation of a well-known AngularJS. Angular v2 is based on TypeScript instead of JavaScript, which is highly suitable for fintech applications. TypeScript provides great support of OOP features and static typing leading to higher security and data protection. Angular is suitable for large projects due to the list of its peculiarities. First off, the module system allows devs to work only on their part of the project without worrying about disrupting something in someone else’s code. Secondly, the significant amount of libraries and other tools that Angular includes, allows specialists to really focus on coding instead of looking for some third-party solutions to achieve some tasks.

Mobile App Development

Swift/Kotlin is a classic option for native mobile development. Recently, Objective-C was considered a more stable technology, but with the rapid development of Swift, it probably has already replaced it. Developers admire fast performance and smooth learning curve speaking about Swift. As for Kotlin, its main competitor is Java, but due to the shorter and clearer code, it beats the competition. What else proves its quality is the number of companies using it for large mobile apps. They are Netflix, Pinterest, Uber, and others.

Flutter is a relatively new framework designed for hybrid mobile development. It has been on the market for only 4 years, but it has already proven itself a worthy competitor. Flutter provides an extensive set of customization opportunities, especially in terms of UI/UX design. It has no restrictions at all, unlike React Native, for example. It uses a Skia graphic engine that results in smooth and fast animations. Among its other advantages, there are a HotReload feature, access to the source code, and guaranteed high security and performance.

Databases

There are SQL and NoSQL databases. The first type is a relational database that uses the SQL language for queries, and the second one is in a non-relational database. It means that NoSQL databases easily store unstructured data and don’t have some predefined schemas. Though, the main difference we can distinguish to make a choice between an SQL and NoSQL database for a fintech app is that SQL is better when the data is well-structured and can be stored in a table view. NoSQL, in turn, stores data in separate documents or wide-column stores. Non-relational databases allow storing significant amounts of non-structured information. Though there is no right answer on what’s best for a fintech app, it’s probably better to consider an SQL option because of strict data structuring, and therefore, higher security.

PostgreSQL is most often used for fintech apps because it shows exemplary results in terms of speed of response to queries. It is a crucial aspect for financial services because when the software processes someone’s sensitive data, users tend to expect a fast response to their actions. In addition, PostgreSQL implies numerous solutions for enhanced security. They may be TDE (transparent data encryption), Data Masking, etc.

COST TO BUILD A FINTECH APP

When we’ve discussed how to build a fintech app, let’s try estimating how much it would cost. First off, fintech apps require a mobile component and an admin panel, so we’ll keep that in mind while calculating the price. We should highlight the next point: a native and a hybrid app would somehow differ in price. The thing is that during the hybrid development, developers use frameworks that allow using about 80% of written code to launch the app on both platforms: iOS and Android. If we’re speaking about native development, the development time doubles because programmers must write a hundred percent of code twice.

How are hybrid and native apps different?

Find out how both native and hybrid development are arranged, the difference between them, and the pros and cons of each option.

What is the difference between a native app and a hybrid app?

Let’s start the cost estimation by defining the approximate development rates. We’ll take the Ukrainian developers as an example because they provide excellent value for money. The rates of a back-end developer will differ from those of a UI/UX designer, but to not dive deep into the details, let’s take $60/hour as an average rate for each specialist.

The team usually includes about 6-7 people. They are:

- Project manager

- Business analyst

- UI/UX designer

- Front-end developer

- Back-end developer

- QA engineer

- DevOps engineer

If the timeframes are tight, you may decide to engage a couple of front and back-end developers.

The development process takes about nine months, depending on the system complexity and the number of advanced features implemented. In one of our articles, we’ve described how we got the number of 9 months.

Want to know a bit more about the price estimation?

In the article, you’ll find out about the development process, how long it takes, and see the price estimation based on the duration of the development stages.

So, with a nine-month timeframe and an average development rate of $60/hour, we receive about $190,000 for a hybrid fintech application of medium complexity. If you want to build two native applications, the development time may constitute about a year, and the price may increase by $30-40k and account for $220k-$230k.

HOW TO BUILD A FINTECH APP: INDUSTRY TRENDS IN 2024

While answering the question of “How to build a fintech app,” it’s necessary to understand what other software vendors suggest because it usually represents the situation on the market. Keeping up to date with the industry trends is essential for a reason. Supplying demands, and by knowing the trends, we know what people want. So, let’s see what features and technologies are on the cutting edge now.

Among the most groundbreaking fintech app technologies and features, there are:

- Artificial intelligence and machine learning

- Voice integration

- Blockchain

- Gamification

Let’s dive deeper into each of them.

Artificial Intelligence And Machine Learning

Artificial intelligence and machine learning are almost non-existent without each other, so these technologies always go side by side. AI requires big data to provide expected results, and ML helps to gather and process it. While speaking of how to develop a fintech app, we should know that today, AI and ML are more of a necessity rather than an example of advanced functionality.

First of all, AI helps to provide more personalized customer service. It gathers and analyzes the information about people while they’re using the app, and on its basis, suggests customized operations. As you see, with properly integrated AI components, manual data analysis is no longer necessary.

What technologies are most suitable for AI development?

In the article, we’ve described the five best languages for artificial intelligence and machine learning and discover their pros and cons.

One more advantage of artificial intelligence is that it can process unstructured data like pictures or human speech. As for the last one, chatbots are a great example of it. Chatbots have become an integral part of fintech apps. They save precious time and money. Unfortunately, AI assistants cannot solve all users’ problems and answer all questions, but they discharge employees from answering recurring questions that appear every day. In addition, AI has grown to understand the natural language, so chatbots don’t need to contain pre-arranged questions.

As for the pictures, AI can be involved in face recognition. In apps that contain personal documents, this feature is essential. AI component usually asks for a user’s selfie to identify the personality. It is beneficial in terms of the KYC (Know Your Customer) policy. We’ll talk about it and other security standards of the financial field later in the article.

Voice Technology

The faster users can access the feature, the more likely they will use it a lot. What can be simpler than saying a command in voice instead of opening an app and choosing the appropriate option? That’s why integration with voice assistants can be very useful.

We’re used to multitasking all day long, and when we suddenly remember something important that we need to find out right away, we may already be busy. So, taking a phone to look up what we need is not always an option. Thus, while figuring out how to build a fintech app, don’t forget about including voice technology on the list of must-have features.

There are many ways to employ speech recognition, but the most common one is integration with voice assistants. Usually, when there’s enough data gathered to say that a person uses a command quite often, the app suggests adding it to Siri, Alexa, Bixby, or others.

Apart from that, developers can also use speech recognition for creating NLP-powered chatbots (Natural Language Processing). Chatbots noticeably speed up the problem-solving process, but when you don’t even need to type your questions, the efficiency becomes sky-high.

Blockchain

The first question that comes to mind after “How to build a fintech app” is “How to make it secure?” Blockchain was recently associated exceptionally with cryptocurrency, but now it’s used in many spheres, including fintech, insurance, healthcare, etc. This technology has become so popular that even in 2018, it was already among the IT outsourcing trends.

Blockchain is helpful for the financial industry in many ways, but first of all, it provides strengthened security. In short, blockchain is a ledger organized as blocks. It allows storing up to 1MB of information in 1 block.

To put it simply, each block has a unique hashcode and can be called on by it anytime later. The operations set out in one block can access other blocks. Blockchain is associated with high security because once the new data is recorded and added to the chain, it cannot be changed later.

What are the pros and cons of a blockchain database?

Find out how the database is based on blockchain technology, what types of such DBs are, and how it affects the application security level.

Also, blockchain technology increases business efficiency because it triggers some processes automatically. Invoices would be a great example. They are automatically matched with purchase orders, which results in faster money transfers.

Gamification

As odd as it may sound, gamification can be successfully integrated into fintech applications. Apps can be gamified in numerous ways, so you should consider it while you’re thinking of how to build a fintech app.

People like to interact with an application and see some entertaining content. It can be cashback, personal discounts, achievements tracking. Apart from that, educational videos may be right on point regarding some complex operations in fintech apps. For example, if someone isn’t sure how to set up a deposit, he may use video instruction. The more topics such videos cover, the more it attracts potential users because the app instantly looks more understandable and easy to use.

Personal achievements are also a nice feature to consider when you create a fintech app. Users may get rewards for a particular number of online payments or transfers from card to card. It maintains a light competitive spirit and makes people return to the app over and over again.

CONCLUSION

The adoption of technology evolves, and today, we can’t imagine a successful business without a mobile app. That’s why fintech apps have become a necessity in the modern world. In the article, we’ve learned how to build a fintech app, what technologies are best for it, what challenges you may face, and how much it would cost. Though it seems like tons of information, the development process isn’t that complicated if you have enlisted the support of a reliable software development company.

Want to build a fintech app?

Contact EXISTEK if you have further questions on how to build a fintech app. We’re ready to start from scratch to transform your idea into a market sensation.

Frequently asked questions

What are the types of fintech applications?

Fintech apps can be divided into the following categories:

Insurance apps

Consumer finance

Lending apps

Investment apps

Mobile banking

How to build a fintech application?

Building a fintech application involves defining its purpose and target audience, designing the user interface and experience, developing the app with suitable technologies, ensuring security and regulatory compliance, rigorous testing, and continuous improvement based on user feedback.

What are the best technologies to build a fintech app?

There is a great technology choice, and teams have the opportunity to choose based on their business-specific needs. The common options include:

Backend: Python, Java, C++

Web frontend: React, Angular

Mobile frontend: Swift, Kotlin, Flutter

What are the latest fintech industry trends?

In order to deliver cutting-edge solutions, teams often leverage

Artificial intelligence and machine learning

Blockchain

Gamification

Voice integration